| 192 |

2025-10-14 |

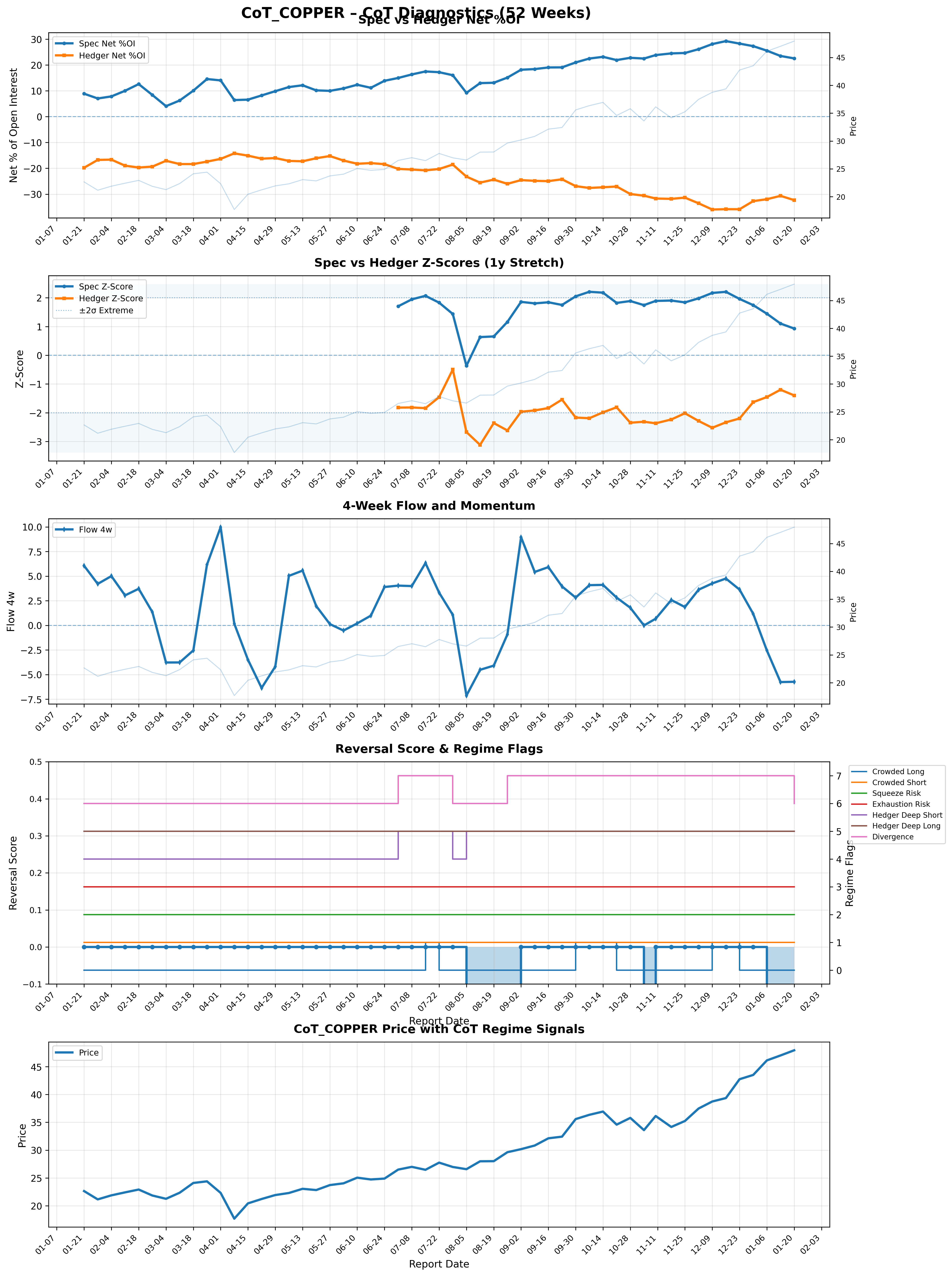

COPPER- #1 - COMMODITY EXCHANGE INC. |

23.160074 |

-27.336774 |

2.179435 |

-1.987615 |

4.112606 |

Balanced |

-4.176699 |

True |

False |

True |

Spec_Extreme_Long |

Long_Build |

4.112606 |

True |

False |

False |

False |

Hedgers_Deep_Short |

False |

False |

No_Clear_Reversal |

Balanced_Long_Bias |

4.167050 |

2 |

Elevated_Risk |

085692 |

CMX |

1.0 |

85.0 |

Other |

Unknown |

Other / Unknown |

100.000000 |

58384 |

-68913 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

0 |

36.932270 |

| 193 |

2025-10-21 |

COPPER- #1 - COMMODITY EXCHANGE INC. |

21.909695 |

-27.044611 |

1.823070 |

-1.811131 |

2.822338 |

Hedgers |

-5.134916 |

False |

False |

False |

None |

Long_Build |

2.822338 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

False |

No_Clear_Reversal |

Hedger_Covering |

3.634201 |

0 |

High_Tension_Low_Flags |

085692 |

CMX |

1.0 |

85.0 |

Other |

Unknown |

Other / Unknown |

93.849734 |

56676 |

-69959 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

0 |

34.584042 |

| 194 |

2025-10-28 |

COPPER- #1 - COMMODITY EXCHANGE INC. |

22.786215 |

-29.950233 |

1.887368 |

-2.348494 |

1.791929 |

Hedgers |

-7.164018 |

False |

True |

True |

Hedger_Extreme_Short |

Long_Build |

1.791929 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

False |

No_Clear_Reversal |

Hedger_Covering |

4.235862 |

1 |

High_Tension_Low_Flags |

085692 |

CMX |

1.0 |

85.0 |

Other |

Unknown |

Other / Unknown |

98.161091 |

61994 |

-81485 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

0 |

35.795902 |

| 195 |

2025-11-04 |

COPPER- #1 - COMMODITY EXCHANGE INC. |

22.498388 |

-30.589124 |

1.745995 |

-2.313942 |

-0.004701 |

Hedgers |

-8.090736 |

False |

True |

True |

Hedger_Extreme_Short |

Long_Reduction |

-0.004701 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

True |

Bearish_Reversal_Risk |

Hedger_Adding_Short |

4.059937 |

2 |

Elevated_Risk |

085692 |

CMX |

1.0 |

85.0 |

Other |

Unknown |

Other / Unknown |

96.745351 |

60729 |

-82568 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

-1 |

33.598682 |

| 196 |

2025-11-10 |

COPPER- #1 - COMMODITY EXCHANGE INC. |

23.838116 |

-31.692369 |

1.891558 |

-2.368426 |

0.678042 |

Hedgers |

-7.854253 |

False |

True |

True |

Hedger_Extreme_Short |

Long_Build |

0.678042 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

False |

No_Clear_Reversal |

Hedger_Covering |

4.259984 |

1 |

High_Tension_Low_Flags |

085692 |

CMX |

1.0 |

85.0 |

Other |

Unknown |

Other / Unknown |

100.000000 |

63284 |

-84135 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

0 |

36.135189 |

| 197 |

2025-11-18 |

COPPER- #1 - COMMODITY EXCHANGE INC. |

24.490632 |

-31.826332 |

1.905646 |

-2.235419 |

2.580936 |

Hedgers |

-7.335700 |

False |

True |

True |

Hedger_Extreme_Short |

Long_Build |

2.580936 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

False |

No_Clear_Reversal |

Hedger_Covering |

4.141065 |

1 |

High_Tension_Low_Flags |

085692 |

CMX |

1.0 |

85.0 |

Other |

Unknown |

Other / Unknown |

100.000000 |

61603 |

-80055 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

0 |

34.167343 |

| 198 |

2025-11-25 |

COPPER- #1 - COMMODITY EXCHANGE INC. |

24.649513 |

-31.350847 |

1.840988 |

-2.019469 |

1.863298 |

Hedgers |

-6.701333 |

False |

True |

True |

Hedger_Extreme_Short |

Long_Build |

1.863298 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

False |

No_Clear_Reversal |

Hedger_Covering |

3.860458 |

1 |

High_Tension_Low_Flags |

085692 |

CMX |

1.0 |

85.0 |

Other |

Unknown |

Other / Unknown |

100.000000 |

57547 |

-73192 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

0 |

35.239674 |

| 199 |

2025-12-02 |

COPPER- #1 - COMMODITY EXCHANGE INC. |

26.122232 |

-33.542858 |

1.981734 |

-2.286930 |

3.623844 |

Hedgers |

-7.420626 |

False |

True |

True |

Hedger_Extreme_Short |

Long_Build |

3.623844 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

False |

No_Clear_Reversal |

Hedger_Covering |

4.268663 |

1 |

High_Tension_Low_Flags |

085692 |

CMX |

1.0 |

85.0 |

Other |

Unknown |

Other / Unknown |

100.000000 |

63459 |

-81486 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

0 |

37.477989 |

| 200 |

2025-12-09 |

COPPER- #1 - COMMODITY EXCHANGE INC. |

28.101315 |

-35.945555 |

2.169520 |

-2.523842 |

4.263199 |

Hedgers |

-7.844240 |

True |

True |

True |

Hedger_Extreme_Short |

Long_Build |

4.263199 |

True |

False |

False |

False |

Hedgers_Deep_Short |

False |

False |

No_Clear_Reversal |

Hedger_Covering |

4.693362 |

2 |

Elevated_Risk |

085692 |

CMX |

1.0 |

85.0 |

Other |

Unknown |

Other / Unknown |

100.000000 |

70484 |

-90159 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

0 |

38.739555 |

| 201 |

2025-12-16 |

COPPER- #1 - COMMODITY EXCHANGE INC. |

29.247879 |

-35.818083 |

2.208452 |

-2.334426 |

4.757248 |

Hedgers |

-6.570204 |

True |

True |

True |

Hedger_Extreme_Short |

Long_Build |

4.757248 |

True |

False |

False |

False |

Hedgers_Deep_Short |

False |

False |

No_Clear_Reversal |

Hedger_Covering |

4.542878 |

2 |

Elevated_Risk |

085692 |

CMX |

1.0 |

85.0 |

Other |

Unknown |

Other / Unknown |

100.000000 |

75134 |

-92012 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

0 |

39.356956 |

| 202 |

2025-12-23 |

COPPER- #1 - COMMODITY EXCHANGE INC. |

28.285386 |

-35.840849 |

1.961964 |

-2.200281 |

3.635873 |

Hedgers |

-7.555462 |

False |

True |

True |

Hedger_Extreme_Short |

Long_Build |

3.635873 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

False |

No_Clear_Reversal |

Hedger_Covering |

4.162245 |

1 |

High_Tension_Low_Flags |

085692 |

CMX |

1.0 |

85.0 |

Other |

Unknown |

Other / Unknown |

96.356717 |

75619 |

-95818 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

0 |

42.742001 |

| 203 |

2025-12-30 |

COPPER- #1 - COMMODITY EXCHANGE INC. |

27.300405 |

-32.697519 |

1.744910 |

-1.631882 |

1.178173 |

Hedgers |

-5.397115 |

False |

False |

False |

None |

Long_Build |

1.178173 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

False |

No_Clear_Reversal |

Hedger_Covering |

3.376792 |

0 |

High_Tension_Low_Flags |

085692 |

CMX |

1.0 |

85.0 |

Other |

Unknown |

Other / Unknown |

92.628310 |

71019 |

-85059 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

0 |

43.509998 |

| 204 |

2026-01-06 |

COPPER- #1 - COMMODITY EXCHANGE INC. |

25.556217 |

-31.964932 |

1.446661 |

-1.455206 |

-2.545098 |

Hedgers |

-6.408715 |

False |

False |

False |

None |

Long_Reduction |

-2.545098 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

True |

Bearish_Reversal_Risk |

Hedger_Adding_Short |

2.901867 |

1 |

High_Tension_Low_Flags |

085692 |

CMX |

1.0 |

85.0 |

Other |

Unknown |

Other / Unknown |

85.338300 |

68242 |

-85355 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

-1 |

46.119999 |

| 205 |

2026-01-13 |

COPPER- #1 - COMMODITY EXCHANGE INC. |

23.494420 |

-30.659383 |

1.104061 |

-1.199744 |

-5.753459 |

Hedgers |

-7.164962 |

False |

False |

False |

None |

Long_Reduction |

-5.753459 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

True |

Bearish_Reversal_Risk |

Hedger_Adding_Short |

2.303805 |

1 |

High_Tension_Low_Flags |

085692 |

CMX |

1.0 |

85.0 |

Other |

Unknown |

Other / Unknown |

77.149727 |

63391 |

-82723 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

-1 |

47.009998 |

| 206 |

2026-01-20 |

COPPER- #1 - COMMODITY EXCHANGE INC. |

22.557115 |

-32.310698 |

0.930373 |

-1.396972 |

-5.728272 |

Hedgers |

-9.753583 |

False |

False |

False |

None |

Long_Reduction |

-5.728272 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

True |

Bearish_Reversal_Risk |

Hedger_Adding_Short |

2.327345 |

1 |

High_Tension_Low_Flags |

085692 |

CMX |

1.0 |

85.0 |

Other |

Unknown |

Other / Unknown |

73.427151 |

62806 |

-89963 |

True |

False |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

-1 |

47.938999 |