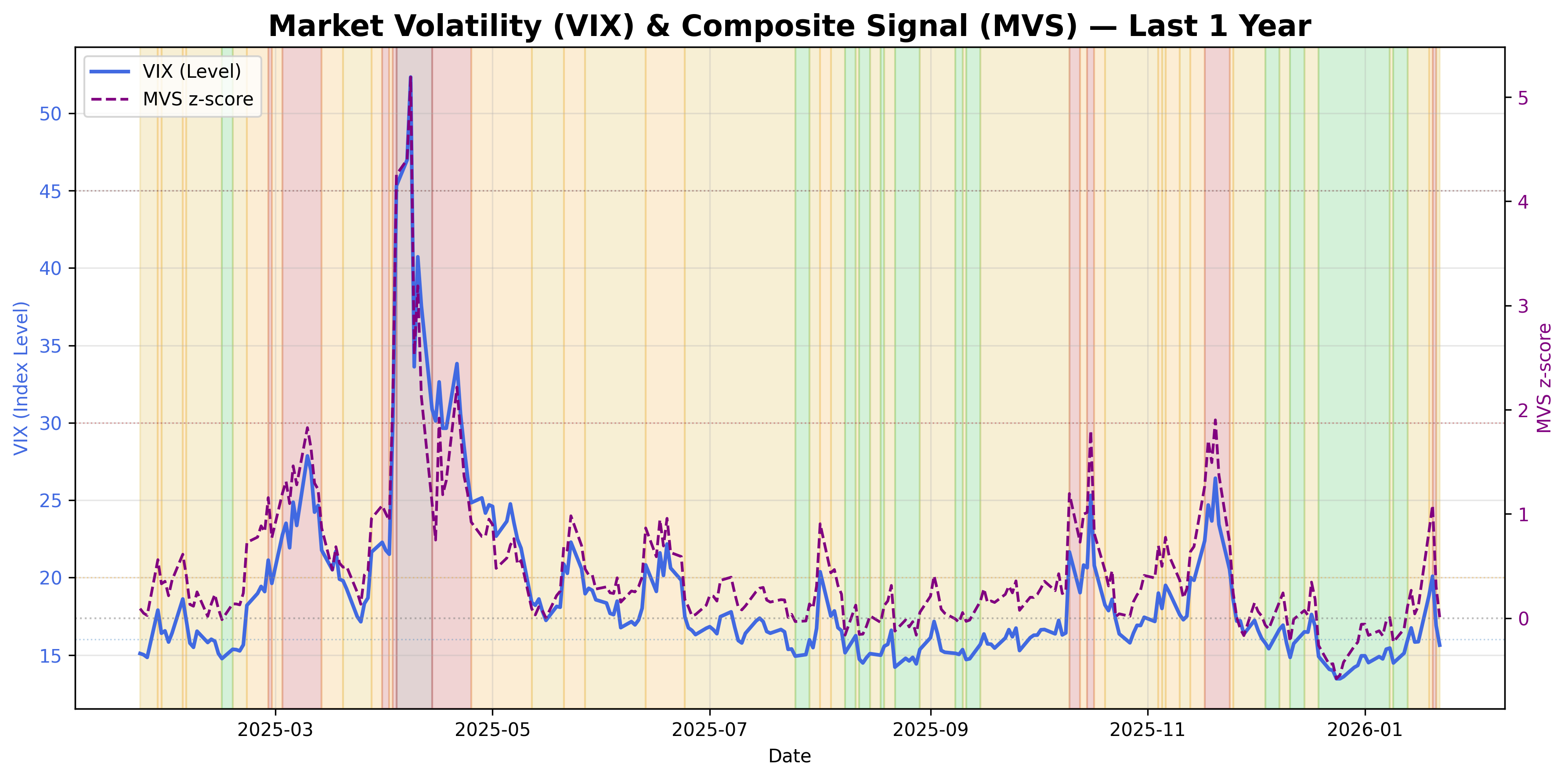

Market Volatility (VIX) Signal

VIX market volatility signal: tracking investor fear and uncertainty.

Gemini Summary

Signal Summary:

- The Market Volatility Signal is currently in a "NORMAL" regime, with the VIX at 15.64 on 2026-01-22, following a brief "STRESSED" period (1). The composite z-score (MVS_z) is near zero at 0.009689, indicating a de-escalation of market risk sentiment (1).

- This state reflects a transition towards stability after recent heightened volatility.

- Conviction Band: Medium, Interpretation Confidence: High Confidence, Internal Conflict Flag: No.

Key Dynamics:

- The primary drivers are the VIX level at 15.64, a stabilizing short-term momentum (d5_z: -0.004331), and medium-term momentum (d20_z: 0.748175) (1). The percentile rank is 0.376984, indicating VIX is below its historical median for the last two years (1).

- There is observable momentum towards de-escalation, as the regime shifted from "STRESSED" (VIX 20.09 on 2026-01-20) to "NORMAL" (VIX 15.64 on 2026-01-22) (1).

- No internal offsets are present; all components are coherently signaling reduced, but not absent, market risk.

- Conditional Invalidation: A sustained return of the VIX above 20.0 or its composite z-score (MVS_z) exceeding +0.5 would invalidate the "NORMAL" regime (1).

Scenario Balance:

- Base case dominant: Market volatility continues to settle in the "NORMAL" range (VIX 16-20 or MVS z in [0, +0.5)), as recent stresses ease (1).

- Upside secondary: A return to "CALM" conditions (VIX < 16 and MVS z < 0), driven by sustained positive risk sentiment.

- Downside plausible: A swift re-escalation to "ELEVATED" or "STRESSED" conditions, triggered by unexpected macro or geopolitical events.

Time Horizon & Aggregation:

- Time Horizon: Tactical (weeks). The VIX is a prompt indicator of short-term implied volatility and market sentiment (1).

- Aggregation Weight Hint: Medium. It provides timely risk assessment but should be integrated with other signals for broader macro and longer-term perspectives.

Macro Relevance:

- This signal primarily informs on market sentiment, risk-on/risk-off dynamics, and indirectly on liquidity and credit conditions.

- It is relevant across all cycle positions as a real-time gauge of market stress.

- High VIX readings typically correlate with tightening credit conditions (2), reduced liquidity (3), and a strengthening USD (4), signaling risk aversion (1).

Data & References:

- CBOE VIX Index (VIXCLS), latest observation 2026-01-22 (1).

- The MVS_regime, MVS_z, and the VIX level were the most influential datapoints for the current assessment.

- The Real Interest Rate Trend Signal (5) and the Financial Stress Index Signal (6) would provide additional depth on financial conditions.

VIX Volatility Chart

VIX index: market volatility and investor sentiment.