Yield Curve Slope Signal

Yield curve slope signal: tracking recession risk and monetary stance via curve shape.

Gemini Summary

Signal Summary:

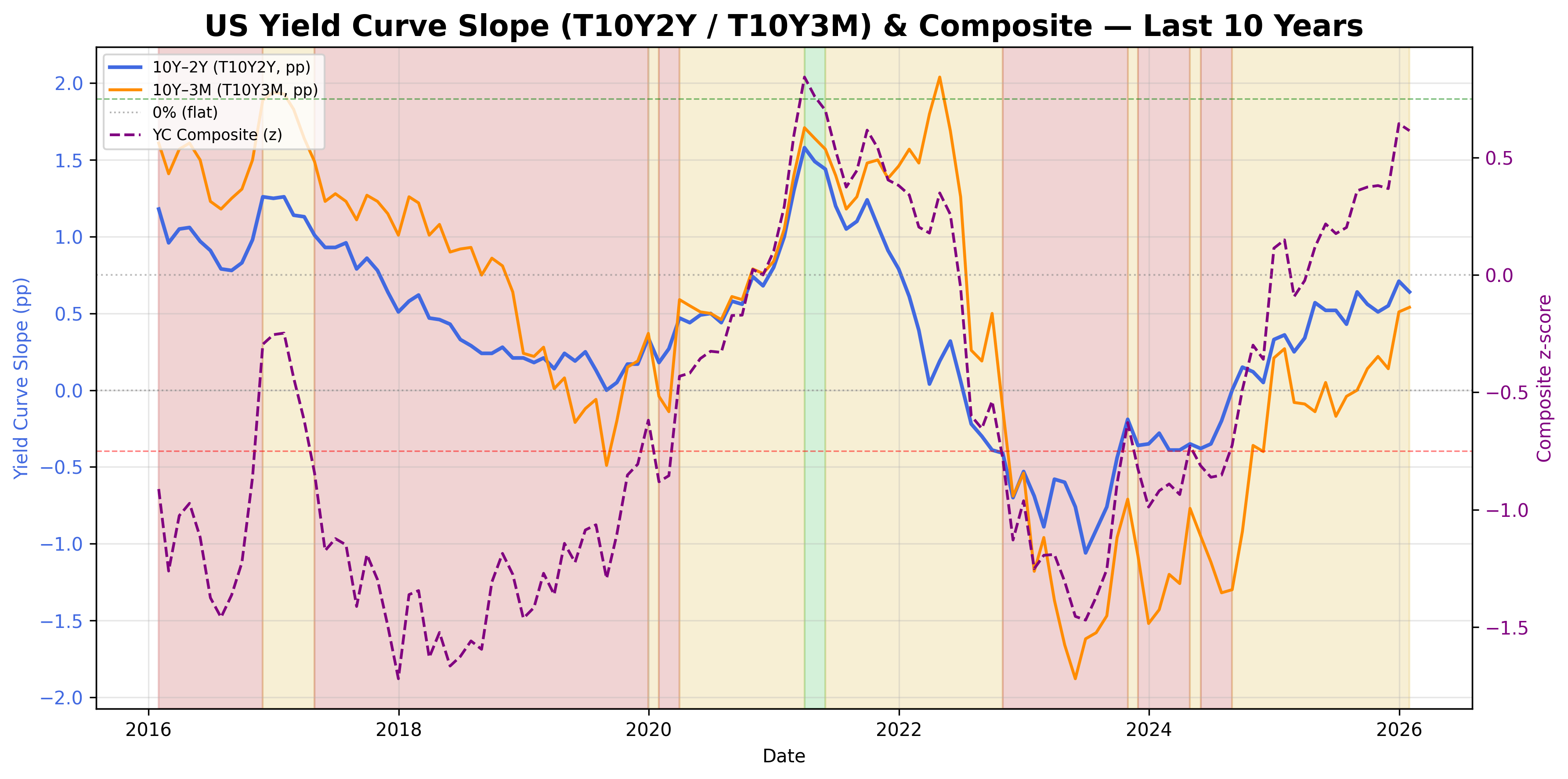

- The U.S. Treasury Yield Curve signal (1) is currently in a "Flat/Neutral" regime, with the composite value at 0.614008 as of 2026-01-31.

- This indicates a stable, neither excessively steep nor inverted, market expectation for interest rates and growth.

- Conviction Band: Medium | Interpretation Confidence: High Confidence | Internal Conflict Flag: No.

Key Dynamics:

- The T10Y2Y spread z-score (0.645721) and the T10Y3M spread z-score (0.582294) are the primary drivers (1).

- The composite has steadily trended upward from inverted territory, stabilizing within the Flat/Neutral range.

- There are no material internal offsets between the two spread components.

- Conditional Invalidation: A sustained move of the YC_Composite above 0.75 (Steepening) or below -0.75 (Inverted) would invalidate the current Flat/Neutral interpretation (1).

Scenario Balance:

- Base Case dominant: The yield curve will likely remain in a Flat/Neutral regime, with the composite well within the ±0.75 thresholds (1).

- Upside secondary: A transition to a Steepening regime is plausible if the composite crosses above 0.75, suggesting improving risk sentiment or recovery expectations (1).

- Downside residual: Reversion to an Inverted regime (composite below -0.75) seems less likely, given the current upward momentum in spreads (1).

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months). This signal captures medium-term economic cycle phases, with inversions historically preceding recessions by 6-18 months (1).

- Aggregation Weight Hint: High. The yield curve is a fundamental indicator for macro-financial regimes and forward growth expectations (1).

Macro Relevance:

- This signal primarily informs demand, liquidity, and market sentiment, reflecting expectations for future growth and monetary policy.

- A Flat/Neutral curve often signifies a late-cycle balance between growth and inflation pressures, or a transition out of a restrictive phase (1).

- It typically interacts with monetary conditions (2), growth indicators (3), and inflation expectations (4) to confirm business cycle shifts.

Data & References:

- T10Y2Y (10-Year Treasury Constant Maturity minus 2-Year Treasury Constant Maturity) from FRED, latest 2026-01-31 (1).

- T10Y3M (10-Year Treasury Constant Maturity minus 3-Month Treasury Bill) from FRED, latest 2026-01-31 (1).

- The YC_Composite value of 0.614008 and its "Flat/Neutral" regime classification are most influential for the current state (1).

- Additional public datasets that would improve depth: Effective Federal Funds Rate (5) and 5-year/5-year Forward Inflation Expectation Rate (4).

Yield Curve Slope Chart

U.S. yield curve slope across 10Y–2Y and 10Y–3M indicators.