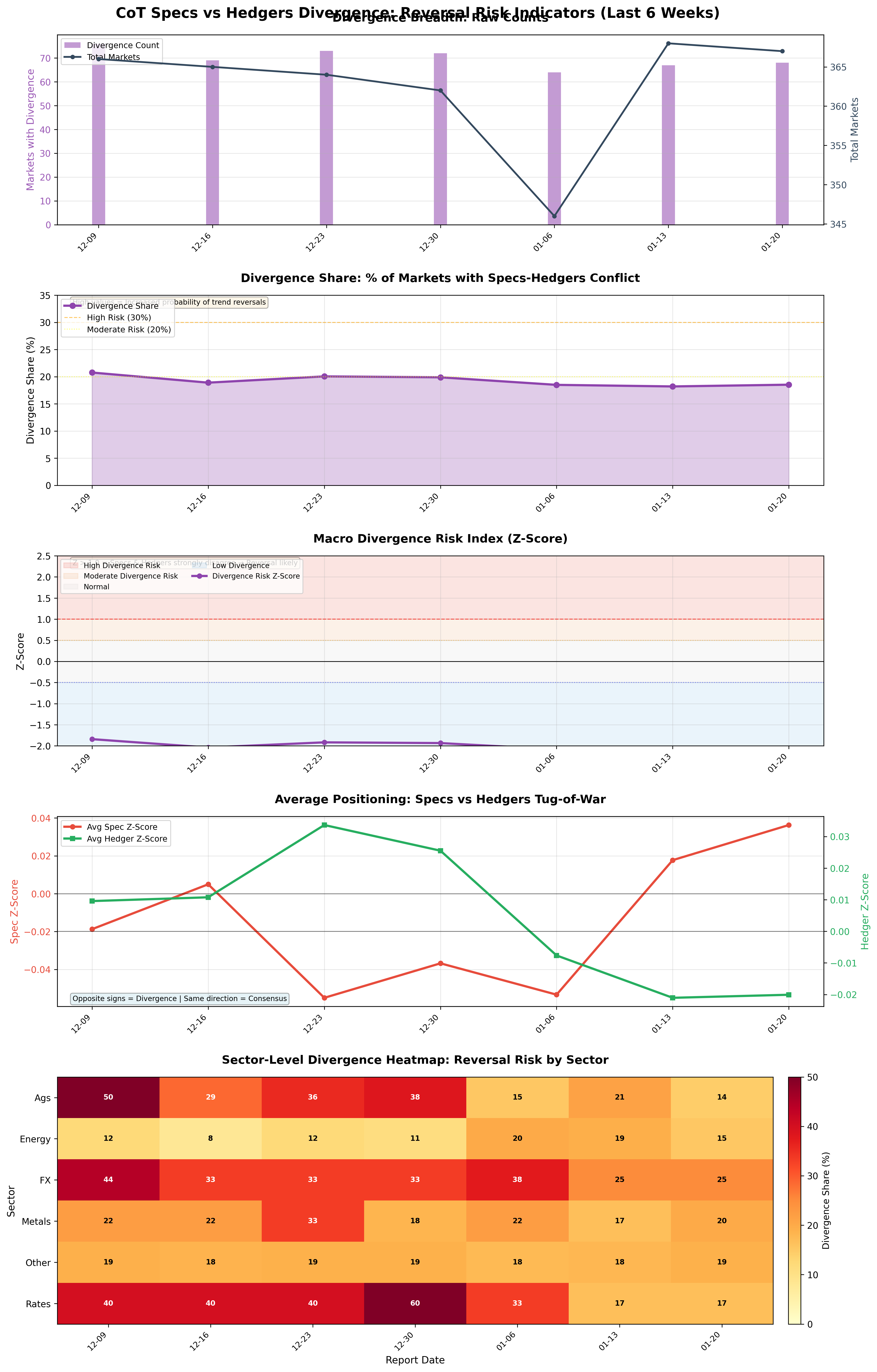

Specs vs Hedgers Divergence: Reversal Risk

Specs vs hedgers divergence: macro reversal risk indicator.

Gemini Summary

Signal Summary:

- The Macro Divergence Risk signal is currently in a "Low Divergence" regime as of 2026-01-20.

- This indicates unusually aligned market positioning between speculators and hedgers across futures markets (1).

- Conviction Band: High | Interpretation Confidence: High Confidence | Internal Conflict Flag: No.

Key Dynamics:

- The `Macro_Divergence_Risk_z` score is -2.078747, well below the -0.5 threshold for "Low Divergence" (1).

- The `divergence_share` is 0.185286, meaning only 18.5% of markets show strong divergence (1).

- This regime has been stable for recent months, indicating consistent market alignment.

- Conditional Invalidation: The signal would reverse if `Macro_Divergence_Risk_z` rises above -0.5, moving out of "Low Divergence" (1).

Scenario Balance:

- Base Case dominant: Continued "Low Divergence" due to persistent market alignment and low speculative-hedger tension.

- Upside secondary: An increase in opposing speculative and hedger convictions, pushing the `divergence_share` higher.

- Downside residual: Deepening "Low Divergence," implying an even stronger market consensus.

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months), as the signal captures market structure and potential macro inflection points (1).

- Aggregation Weight Hint: High, given the strong, stable regime and its relevance for overall market stability assessment.

Macro Relevance:

- This signal primarily informs market sentiment and structural stability.

- It suggests a mid-to-late cycle position characterized by strong market consensus (1).

- When combined with Global Risk-On / Risk-Off Positioning Tone (2), Hedger Pressure Indicator (3), and Sector Flow signals (4), it helps detect macro inflection points (1).

Data & References:

Specs vs Hedgers Divergence Chart

Specs vs hedgers divergence and reversal risk by market breadth.