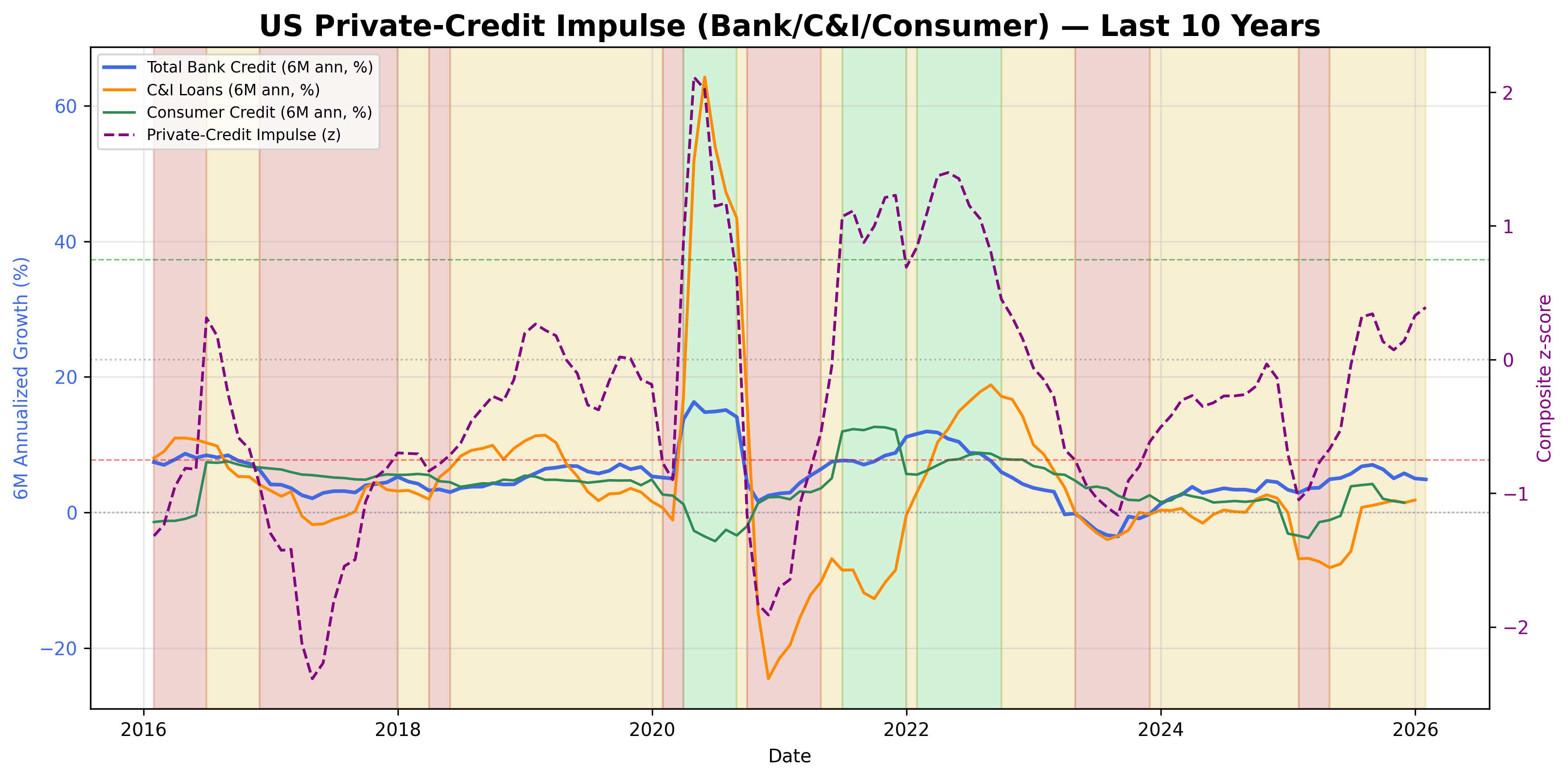

Private Credit Impulse Signal

Private credit impulse: momentum in bank and consumer credit growth.

Gemini Summary

Signal Summary:

- The Private‑Credit Impulse signal is currently classified as `Stable` (1) as of 2025-12-31. Its composite z-score of -0.706972 is critically close to the `Decelerating` threshold of -0.75, indicating a significant deceleration in private credit momentum (1).

- Conviction: Low, Interpretation Confidence: Mixed Signals, Internal Conflict Flag: Yes.

Key Dynamics:

- The current deceleration is predominantly driven by a sharp fall in Total Consumer Loans (TOTALSL_ann6), with a z-score of -1.952265 as of 2025-12-31 (1).

- Conversely, Total Bank Credit (TOTBKCR_ann6) and Commercial & Industrial Loans (BUSLOANS_ann6) show positive, albeit moderating, z-scores of 0.386765 and 0.272290, respectively (1). This creates internal tension.

- Conditional Invalidation: A sustained rebound in consumer loan growth or a significant re-acceleration in total bank credit and business loans would reverse the signal's decelerating bias.

Scenario Balance:

- Base Case dominant: The credit impulse remains `Stable` but continues to trend towards `Decelerating`, sustained by ongoing softening in consumer loan growth.

- Most plausible upside risk and trigger: A surprising rebound in household consumption and business investment could boost demand for bank and business loans, pushing the composite back towards positive momentum.

- Most plausible downside risk and trigger: Continued contraction in consumer credit, coupled with further deceleration in business and bank credit, would push the signal firmly into a `Decelerating` regime.

Time Horizon & Aggregation:

- This signal is classified as Cyclical (months) (1) as it primarily captures short-to-medium term shifts using 6-month annualized growth rates.

- Aggregation Weight Hint: Medium, due to its proximity to a regime shift and its leading indicator properties for economic activity, warranting close monitoring despite internal component divergence.

Macro Relevance:

- This signal directly informs the liquidity and demand dimensions of the macro backdrop (1). It suggests the economy is in a mid-to-late cycle phase, characterized by moderating credit conditions.

- It typically interacts with macro signals such as Industrial Production (2), Policy-Relevant Inflation (PCE) (3), and Credit Spreads (4).

Data & References:

- Total Bank Credit (FRED: TOTBKCR), latest observation 2025-12-31 (1).

- Commercial & Industrial Loans, All Commercial Banks (FRED: BUSLOANS), latest observation 2025-12-31 (1).

- Total Consumer Loans Owned by Banks (FRED: TOTALSL), latest observation 2025-12-31 (1).

- The 6-month annualized growth and robust z-score of Total Consumer Loans were most influential for the current state of the composite.

- Additional public datasets that would improve depth or reliability include the Senior Loan Officer Opinion Survey (SLOOS) for qualitative credit conditions and Consumer Credit Outstanding (FRED: TOTALSLOAN) for broader consumer debt trends.

Private Credit Impulse Chart

Momentum in U.S. bank credit, business lending, and consumer loans.