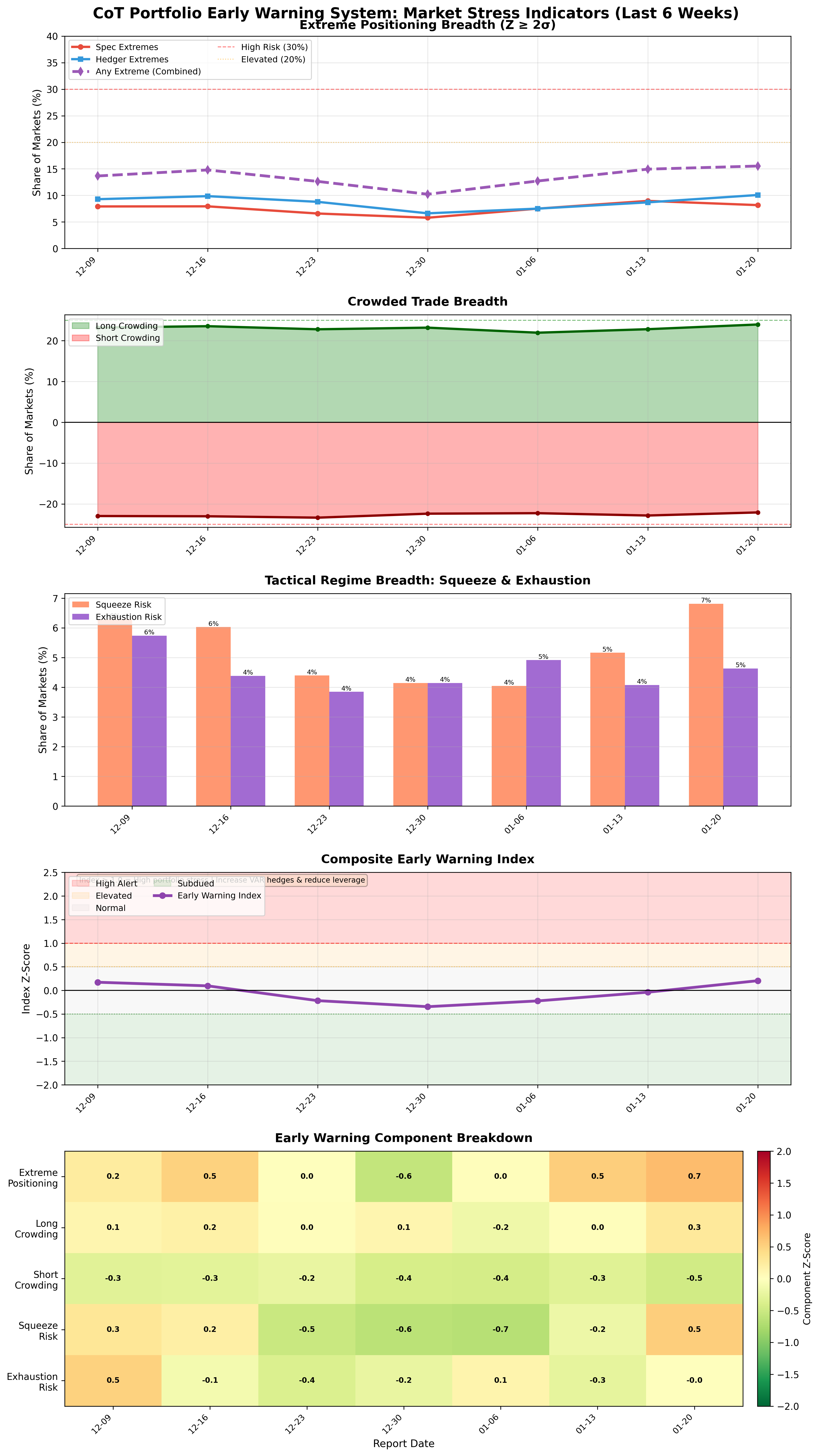

Portfolio-Level Early Warning System

CoT portfolio-level early warning: extremes, crowding, squeeze/exhaustion, composite stress index.

Gemini Summary

Signal Summary:

- The CoT Early Warning Index is currently in a "Normal" regime, with a composite value of 0.205901 as of 2026-01-20 (1). This indicates stability, reflecting typical market functioning.

- Conviction Band: Medium | Interpretation Confidence: High Confidence | Internal Conflict Flag: No.

Key Dynamics:

- The signal has stabilised within the normal range after recently being "Elevated" (0.643468 on 2025-11-04) (1).

- Current positive contributors to the index include the z-score of any extreme positioning share (0.684428) and squeeze risk share (0.535634) (1).

- Conditional Invalidation: The index rising to 0.5 or above would shift the regime to "Elevated", signalling increasing risk of volatility or unwinds (1).

Scenario Balance:

- Base Case dominant: The index remains in the "Normal" regime, supported by its current value well within the -0.5 to 0.5 range (1).

- Upside secondary: A decline below -0.5 (Subdued regime), triggered by a broad unwinding of speculative extremes and tactical reversal risks (1).

- Downside residual: An increase to 0.5 or higher (Elevated/High Alert regime), prompted by a surge in speculative crowding or squeeze/exhaustion pressures (1).

Time Horizon & Aggregation:

- Time Horizon: Tactical (weeks). Rationale: It uses weekly CoT data to identify short-term instability and potential reversals (1).

- Aggregation Weight Hint: High. Justification: This signal provides critical cross-asset instability insights for tactical risk management and portfolio adjustments (1).

Macro Relevance:

- This signal primarily informs macro dimensions of sentiment and risk, indirectly impacting liquidity through potential forced unwinds (1).

- It is relevant across all cycle positions, particularly as an early warning for potential inflection points.

- It often precedes VAR spikes and deleveraging cycles, complementing other macro signals like credit conditions (2) or financial stress (3) by providing critical positioning context.

Data & References:

- Enriched unified CoT dataset (`df_cot_signals`) (1), latest observation: 2026-01-20.

- Datapoints most influential for current state: `any_extreme_share_z` (0.684428) and `squeeze_share_z` (0.535634).

- Additional public datasets that would improve depth or reliability: Market Volatility (VIX) Signal (4) and Credit Spreads Signal (5).

Early Warning System Chart

Portfolio-level stress indicators: extremes, crowding, squeeze/exhaustion, composite index.