| 197 |

2025-10-14 |

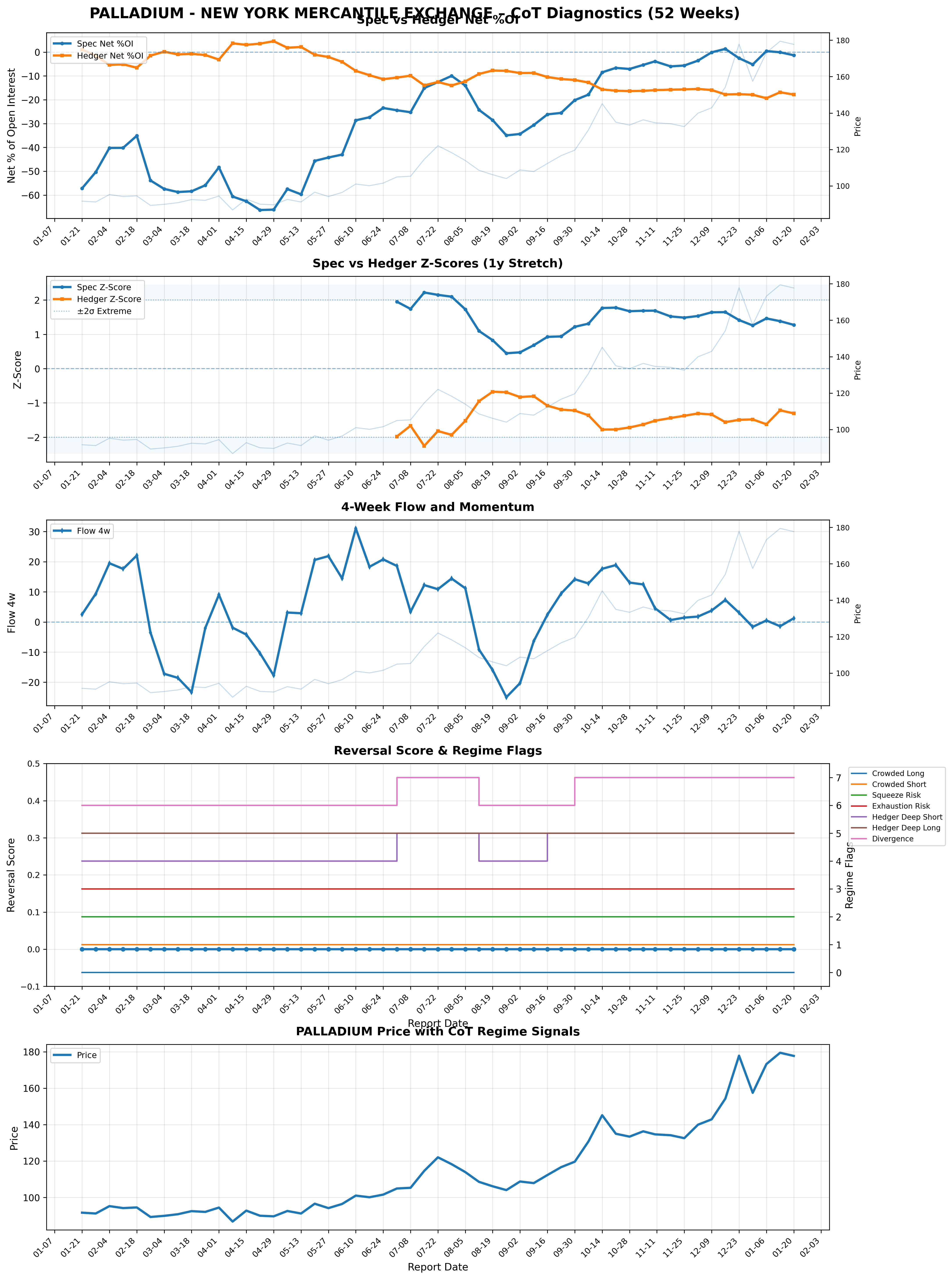

PALLADIUM - NEW YORK MERCANTILE EXCHANGE |

-8.485212 |

-15.669266 |

1.767225 |

-1.777543 |

17.652754 |

Hedgers |

-7.184054 |

False |

False |

False |

None |

Long_Build |

17.652754 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

False |

No_Clear_Reversal |

Hedger_Covering |

3.544768 |

0 |

High_Tension_Low_Flags |

075651 |

NYME |

1.0 |

75.0 |

Other |

Unknown |

Other / Unknown |

100.000000 |

-1839 |

-3396 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

0 |

145.139999 |

| 198 |

2025-10-21 |

PALLADIUM - NEW YORK MERCANTILE EXCHANGE |

-6.630061 |

-16.205676 |

1.778396 |

-1.774727 |

18.890105 |

Hedgers |

-9.575615 |

False |

False |

False |

None |

Long_Build |

18.890105 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

False |

No_Clear_Reversal |

Hedger_Covering |

3.553122 |

0 |

High_Tension_Low_Flags |

075651 |

NYME |

1.0 |

75.0 |

Other |

Unknown |

Other / Unknown |

100.000000 |

-1292 |

-3158 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

0 |

134.964996 |

| 199 |

2025-10-28 |

PALLADIUM - NEW YORK MERCANTILE EXCHANGE |

-7.088866 |

-16.368744 |

1.673543 |

-1.717180 |

13.079046 |

Hedgers |

-9.279877 |

False |

False |

False |

None |

Long_Build |

13.079046 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

False |

No_Clear_Reversal |

Hedger_Covering |

3.390723 |

0 |

High_Tension_Low_Flags |

075651 |

NYME |

1.0 |

75.0 |

Other |

Unknown |

Other / Unknown |

99.230697 |

-1388 |

-3205 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

0 |

133.389999 |

| 200 |

2025-11-04 |

PALLADIUM - NEW YORK MERCANTILE EXCHANGE |

-5.382781 |

-16.270103 |

1.687570 |

-1.628980 |

12.460089 |

Hedgers |

-10.887322 |

False |

False |

False |

None |

Long_Build |

12.460089 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

False |

No_Clear_Reversal |

Hedger_Covering |

3.316551 |

0 |

High_Tension_Low_Flags |

075651 |

NYME |

1.0 |

75.0 |

Other |

Unknown |

Other / Unknown |

100.000000 |

-1061 |

-3207 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

0 |

136.300003 |

| 201 |

2025-11-10 |

PALLADIUM - NEW YORK MERCANTILE EXCHANGE |

-3.893145 |

-15.960438 |

1.689603 |

-1.520402 |

4.592067 |

Hedgers |

-12.067294 |

False |

False |

False |

None |

Long_Build |

4.592067 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

False |

No_Clear_Reversal |

Hedger_Covering |

3.210005 |

0 |

High_Tension_Low_Flags |

075651 |

NYME |

1.0 |

75.0 |

Other |

Unknown |

Other / Unknown |

100.000000 |

-803 |

-3292 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

0 |

134.645004 |

| 202 |

2025-11-18 |

PALLADIUM - NEW YORK MERCANTILE EXCHANGE |

-5.993231 |

-15.779825 |

1.522092 |

-1.441299 |

0.636830 |

Hedgers |

-9.786594 |

False |

False |

False |

None |

Long_Build |

0.636830 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

False |

No_Clear_Reversal |

Hedger_Covering |

2.963391 |

0 |

High_Tension_Low_Flags |

075651 |

NYME |

1.0 |

75.0 |

Other |

Unknown |

Other / Unknown |

96.633181 |

-1275 |

-3357 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

0 |

134.154999 |

| 203 |

2025-11-25 |

PALLADIUM - NEW YORK MERCANTILE EXCHANGE |

-5.641860 |

-15.639761 |

1.486605 |

-1.375247 |

1.447006 |

Hedgers |

-9.997901 |

False |

False |

False |

None |

Long_Build |

1.447006 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

False |

No_Clear_Reversal |

Hedger_Covering |

2.861852 |

0 |

High_Tension_Low_Flags |

075651 |

NYME |

1.0 |

75.0 |

Other |

Unknown |

Other / Unknown |

97.196492 |

-1075 |

-2980 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

0 |

132.550003 |

| 204 |

2025-12-02 |

PALLADIUM - NEW YORK MERCANTILE EXCHANGE |

-3.585597 |

-15.457239 |

1.534130 |

-1.308643 |

1.797184 |

Hedgers |

-11.871642 |

False |

False |

False |

None |

Long_Build |

1.797184 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

False |

No_Clear_Reversal |

Hedger_Covering |

2.842773 |

0 |

High_Tension_Low_Flags |

075651 |

NYME |

1.0 |

75.0 |

Other |

Unknown |

Other / Unknown |

100.000000 |

-714 |

-3078 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

0 |

139.929993 |

| 205 |

2025-12-09 |

PALLADIUM - NEW YORK MERCANTILE EXCHANGE |

-0.091465 |

-15.919703 |

1.642627 |

-1.339096 |

3.801680 |

Hedgers |

-15.828239 |

False |

False |

False |

None |

Long_Build |

3.801680 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

False |

No_Clear_Reversal |

Hedger_Covering |

2.981722 |

0 |

High_Tension_Low_Flags |

075651 |

NYME |

1.0 |

75.0 |

Other |

Unknown |

Other / Unknown |

100.000000 |

-19 |

-3307 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

0 |

142.884995 |

| 206 |

2025-12-16 |

PALLADIUM - NEW YORK MERCANTILE EXCHANGE |

1.328136 |

-17.773446 |

1.647300 |

-1.561903 |

7.321367 |

Hedgers |

-16.445311 |

False |

False |

False |

None |

Long_Build |

7.321367 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

False |

No_Clear_Reversal |

Hedger_Covering |

3.209203 |

0 |

High_Tension_Low_Flags |

075651 |

NYME |

1.0 |

75.0 |

Other |

Unknown |

Other / Unknown |

100.000000 |

293 |

-3921 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

0 |

154.255005 |

| 207 |

2025-12-23 |

PALLADIUM - NEW YORK MERCANTILE EXCHANGE |

-2.567264 |

-17.644987 |

1.416429 |

-1.493184 |

3.074596 |

Hedgers |

-15.077722 |

False |

False |

False |

None |

Long_Build |

3.074596 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

False |

No_Clear_Reversal |

Hedger_Covering |

2.909614 |

0 |

High_Tension_Low_Flags |

075651 |

NYME |

1.0 |

75.0 |

Other |

Unknown |

Other / Unknown |

94.237341 |

-583 |

-4007 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

0 |

177.824997 |

| 208 |

2025-12-30 |

PALLADIUM - NEW YORK MERCANTILE EXCHANGE |

-5.200796 |

-17.894430 |

1.258718 |

-1.481980 |

-1.615199 |

Hedgers |

-12.693634 |

False |

False |

False |

None |

Long_Reduction |

-1.615199 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

False |

No_Clear_Reversal |

Hedger_Adding_Short |

2.740698 |

0 |

High_Tension_Low_Flags |

075651 |

NYME |

1.0 |

75.0 |

Other |

Unknown |

Other / Unknown |

90.341425 |

-1071 |

-3685 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

0 |

157.455002 |

| 209 |

2026-01-06 |

PALLADIUM - NEW YORK MERCANTILE EXCHANGE |

0.413458 |

-19.355005 |

1.463340 |

-1.622598 |

0.504923 |

Hedgers |

-18.941547 |

False |

False |

False |

None |

Long_Build |

0.504923 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

False |

No_Clear_Reversal |

Hedger_Covering |

3.085938 |

0 |

High_Tension_Low_Flags |

075651 |

NYME |

1.0 |

75.0 |

Other |

Unknown |

Other / Unknown |

98.646872 |

80 |

-3745 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

0 |

173.214996 |

| 210 |

2026-01-13 |

PALLADIUM - NEW YORK MERCANTILE EXCHANGE |

-0.082123 |

-16.855720 |

1.383766 |

-1.216003 |

-1.410259 |

Hedgers |

-16.773597 |

False |

False |

False |

None |

Long_Reduction |

-1.410259 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

False |

No_Clear_Reversal |

Hedger_Adding_Short |

2.599769 |

0 |

High_Tension_Low_Flags |

075651 |

NYME |

1.0 |

75.0 |

Other |

Unknown |

Other / Unknown |

97.913734 |

-16 |

-3284 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

0 |

179.440002 |

| 211 |

2026-01-20 |

PALLADIUM - NEW YORK MERCANTILE EXCHANGE |

-1.330412 |

-17.827516 |

1.275465 |

-1.305532 |

1.236852 |

Hedgers |

-16.497104 |

False |

False |

False |

None |

Long_Build |

1.236852 |

False |

False |

False |

False |

Hedgers_Deep_Short |

False |

False |

No_Clear_Reversal |

Hedger_Covering |

2.580997 |

0 |

High_Tension_Low_Flags |

075651 |

NYME |

1.0 |

75.0 |

Other |

Unknown |

Other / Unknown |

96.067078 |

-255 |

-3417 |

True |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

True |

False |

0 |

177.705002 |