Cross-Sector Positioning

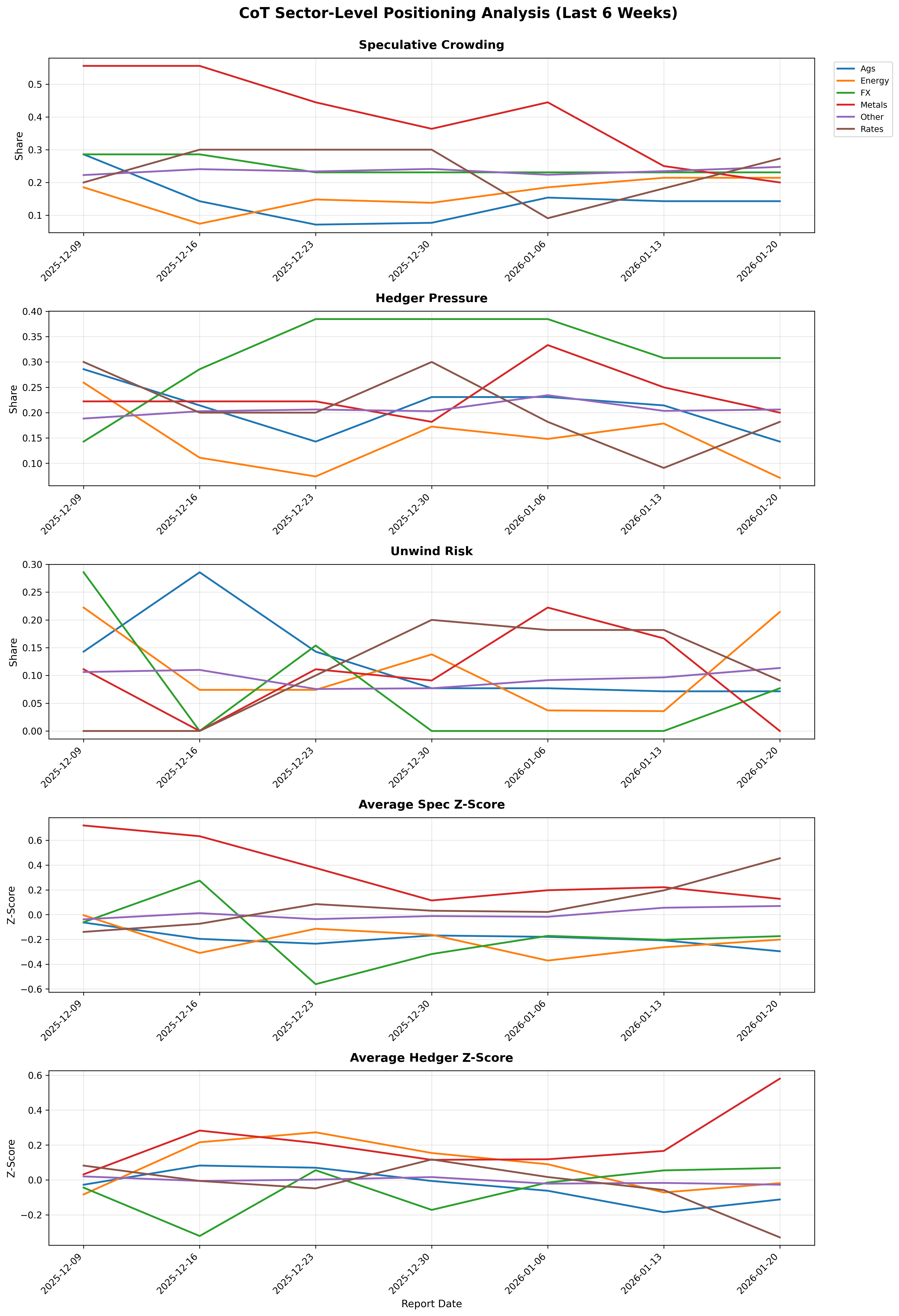

CoT sector positioning vs history.

Gemini Summary

Signal Summary:

- As of 2026-01-20, the Sector Positioning signal indicates a stable environment, with no broad speculative crowding, hedger pressure, or unwind risk across major macro sectors. The signal is in a neutral state.

- Conviction Band: Low, Interpretation Confidence: High Confidence, Internal Conflict Flag: No.

Key Dynamics:

- For the latest observation on 2026-01-20, all reported sectors (Ags, Energy, FX, Metals, Rates) show `spec_crowded_long_share` below 0.40, `hedger_pressure_share` below 0.40, and `unwind_risk_share` below 0.30 (1). This implies a lack of systemic positioning imbalances.

- The signal currently indicates stabilisation, reflecting a period without significant stress triggers.

- No internal offsets or tensions are observed, as all broad flags are consistently `False` for the latest period.

- Conditional Invalidation: The interpretation would be invalidated if any sector's `spec_crowded_long_share` or `hedger_pressure_share` exceeds 0.40, or `unwind_risk_share` exceeds 0.30 (1).

Scenario Balance:

- Base Case dominant: A continuation of the neutral positioning environment, with no systemic crowding or stress across futures sectors, supported by the current `False` readings for all broad flags.

- Upside secondary: A sudden, broad speculative crowding in cyclically sensitive sectors could signal a strong directional consensus.

- Downside residual: Increased broad hedger pressure or unwind risk across multiple sectors would point to rising market instability or potential reversals.

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months). This signal captures medium-term positioning dynamics by aggregating weekly CoT data and 4-week flows (1).

- Aggregation Weight Hint: Low. The signal's current neutral state provides minimal active directional input, mainly confirming stable market conditions.

Macro Relevance:

- Macro dimension informed: Sentiment, liquidity (speculative positioning), and supply/demand dynamics (hedger pressure) (1).

- Cycle position: Suggests a neutral phase in the positioning cycle, not indicating extreme risk-on or risk-off sentiment.

- Typical interaction with other macro signals: Complements aggregate sentiment indicators like the Global Risk-On / Risk-Off Positioning Tone (2) and broader instability measures like the Portfolio-Level Early Warning System (3).

Data & References:

- Commitment of Traders (CoT) data, latest observation 2026-01-20.

- The `spec_crowded_long_share`, `hedger_pressure_share`, and `unwind_risk_share` across all sectors on 2026-01-20 are most influential (1).

- Additional public datasets that would improve depth or reliability: VIX Market Volatility (4) for broader sentiment context, and Forward Indicators of Economic Cycles (Momentum of Flows) (5) for confirming cyclical shifts.

Sector Positioning Chart

Net speculative positioning by sector vs 5-year history.