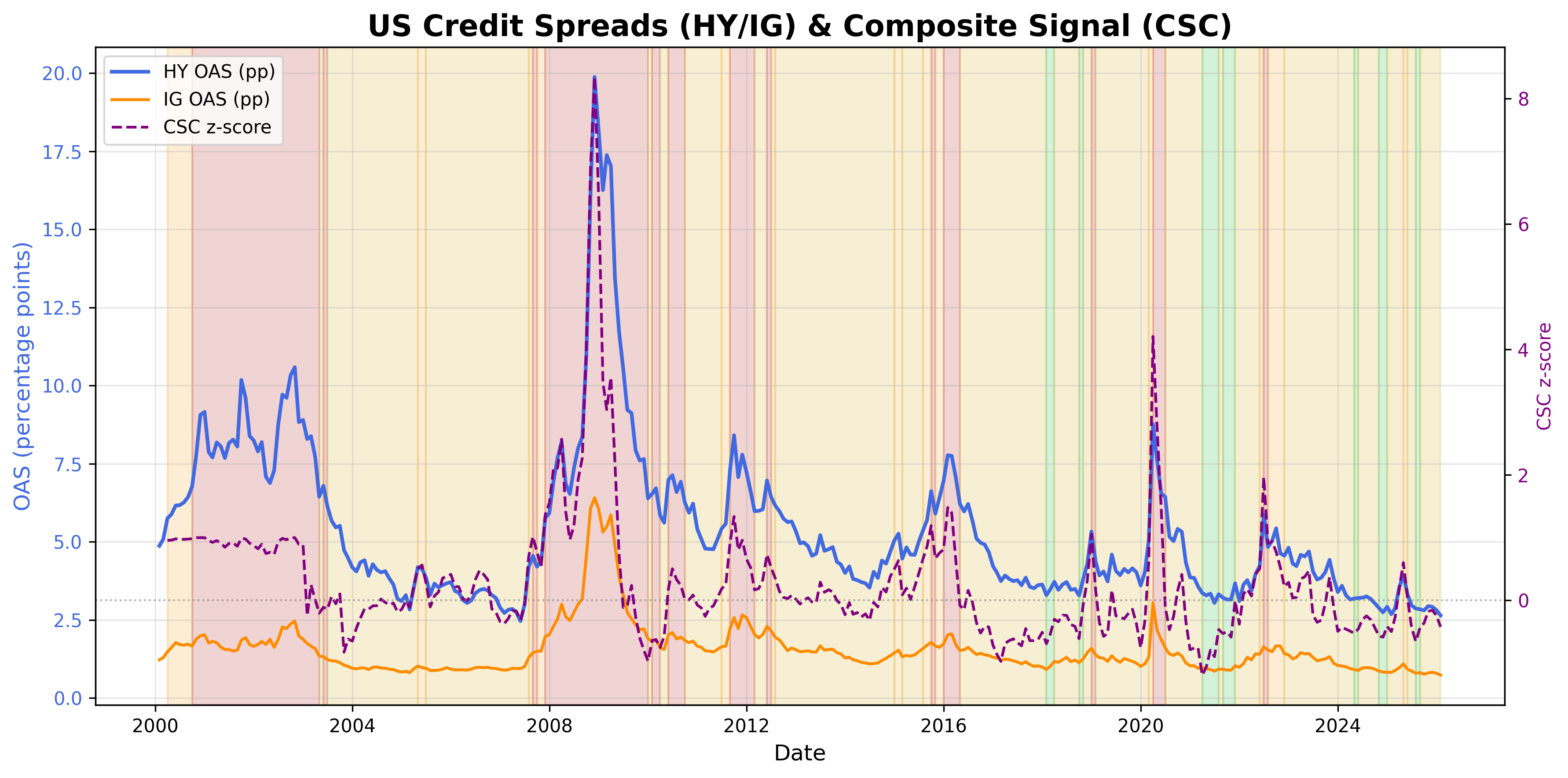

Credit Spreads Signal

Corporate credit spreads as a funding-stress and risk appetite indicator.

Gemini Summary

Signal Summary:

- The 1 Credit Spreads Signal is currently in a "NORMAL" regime as of 2025-12-31. This reflects stable corporate funding conditions, easing from a previous "EASY" regime. Conviction Band: Medium, Interpretation Confidence: High Confidence, Internal Conflict Flag: No.

Key Dynamics:

- The High Yield Option-Adjusted Spread (HY OAS) is 2.92%, below the 3.5% threshold for "NORMAL" (1). The composite z-score (CSC_z) is -0.416, falling within the [-0.5, +0.5) range for "NORMAL" (1). This marks a transition from "EASY" in the prior two months.

- Conditional Invalidation: The signal would transition to "TIGHTENING" if the composite z-score (CSC_z) rises above +0.5 (1).

Scenario Balance:

- Base Case dominant: Credit spreads remain in the "NORMAL" regime, indicating a stable corporate funding environment.

- Upside secondary: Spreads could revert to an "EASY" regime if risk appetite improves further, leading to additional tightening.

- Downside residual: Spreads may widen into a "TIGHTENING" regime if financial stress or economic uncertainty increases.

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months). Credit spreads reflect business cycle dynamics and systemic liquidity shifts over a multi-month horizon (1).

- Aggregation Weight Hint: Medium. The signal provides a coherent view, but its position near the "EASY" boundary suggests ongoing monitoring.

Macro Relevance:

- Macro dimension informed: This signal primarily informs liquidity and financial stress conditions (1). It also gauges broader risk sentiment.

- Cycle position: The "NORMAL" regime suggests mid-cycle financial conditions, where funding is neither excessively loose nor tight.

- Typical interaction with other macro signals: The signal feeds into the 2 Financial Stress Index, interacting with 3 volatility and 4 liquidity to assess overall risk appetite (1).

Data & References:

- ICE BofA US High Yield Index Option-Adjusted Spread (BAMLH0A0HYM2), latest as of 2025-12-31 (1).

- ICE BofA US Corporate Master Option-Adjusted Spread (BAMLC0A0CM), latest as of 2025-12-31 (1).

- The `HY_OAS` level and `CSC_z` for 2025-12-31 were most influential for the current state.

- Additional public datasets: The `Market Volatility (VIX) Signal` (3) and `Federal Reserve Liquidity Composite Signal` (4) would improve depth.

Credit Spreads Chart

U.S. corporate credit spread dynamics.