USD Index Signal

USD Index signal: tracking the strength of the US Dollar against major currencies.

Gemini Summary

Signal Summary:

- The USD Index Signal remains in a Bearish regime as of 2026-01-01, indicating a weakening U.S. dollar (1). The current state reflects a continued transition from previous bullish phases.

- Conviction Band: High | Interpretation Confidence: High Confidence | Internal Conflict Flag: No

Key Dynamics:

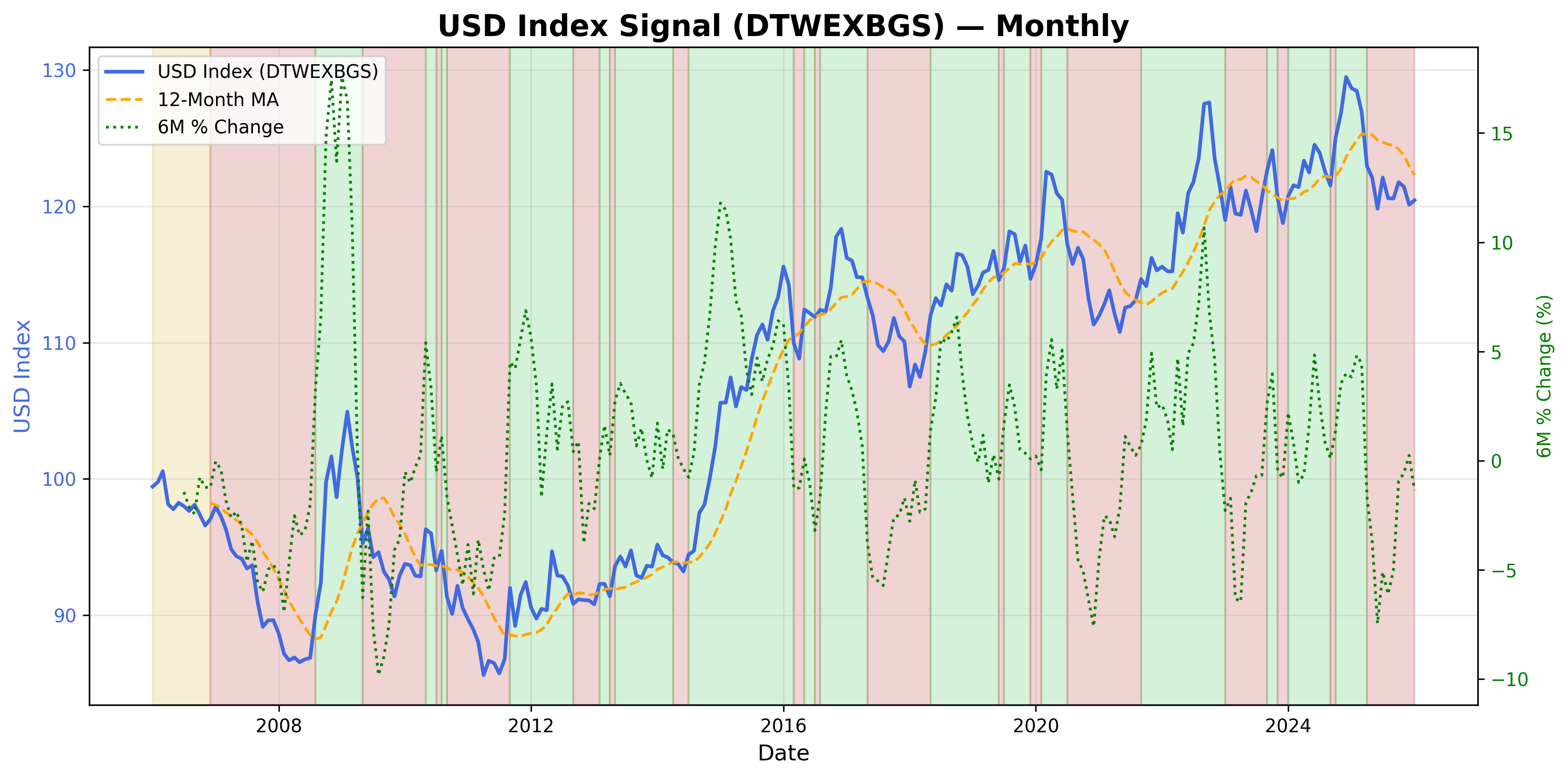

- The primary driver for the Bearish signal is the Broad U.S. Dollar Index (Value_Monthly: 120.4478) remaining below its 12-month moving average (122.277133) (1).

- The 6-month change in the USD Index is -1.36%, which, while negative, is not below the -5% threshold for a more aggressive Bearish classification (1).

- Conditional Invalidation: The signal would reverse to Bullish if the Broad U.S. Dollar Index rises above its 12-month moving average, or if its 6-month change exceeds +5% (1).

Scenario Balance:

- Base Case dominant: Continued USD weakness is expected as the index consistently trades below its long-term average.

- Upside secondary: A sustained rebound in the USD Index, pushing it above its 12-month MA, could shift the signal to Bullish.

- Downside residual: Further significant negative momentum (e.g., 6-month change falling below -5%) would confirm deeper USD depreciation.

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months). The signal relies on 6-month momentum and a 12-month moving average for its classification (1).

- Aggregation Weight Hint: High. The U.S. dollar's direction is a critical macro input influencing global financial conditions and asset prices.

Macro Relevance:

- Macro dimension informed: Liquidity, pricing, sentiment. A weakening USD typically suggests easing financial conditions globally (1).

- Cycle position: Mid-cycle, as the signal oscillates between bullish and bearish within a broader trend.

- Typical interaction with other macro signals: Often inversely correlated with commodity prices and emerging market assets, and influences inflation dynamics (1).

Data & References:

- FRED DTWEXBGS (Broad U.S. Dollar Index), latest observation 2026-01-01.

- The `Value_Monthly` (120.4478) relative to `USD_12Month_MA` (122.277133) are most influential for the current state.

- Additional public datasets that would improve depth or reliability: Real Interest Rate Trend Signal (2), Federal Reserve Liquidity Composite Signal (3).

USD Index Chart

USD Index: tracking the strength of the US Dollar.