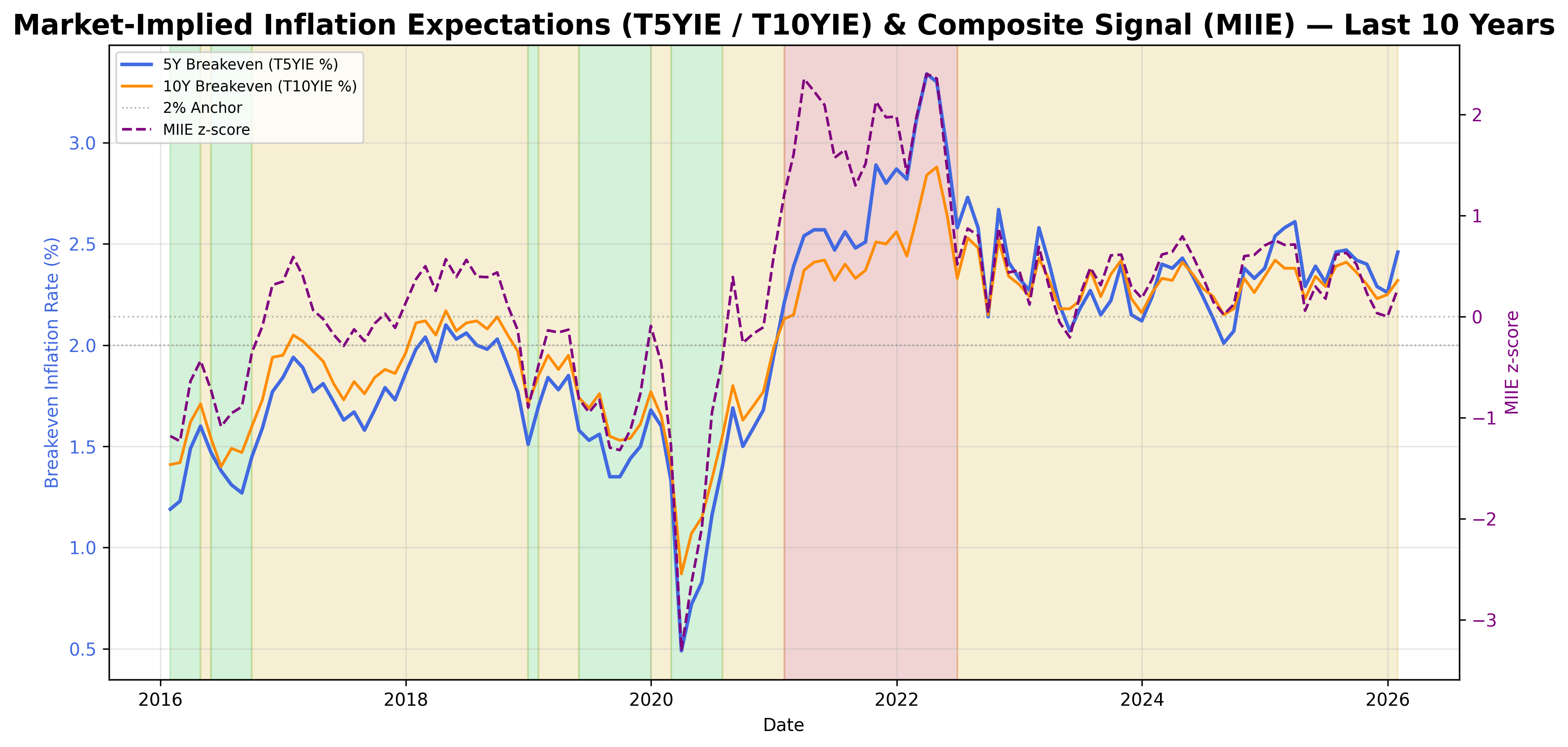

Market Implied Inflation Signal

Market-implied inflation signal: tracking investor expectations for future inflation.

Gemini Summary

Signal Summary:

- Market-Implied Inflation Expectations (MIIE) currently remain in a STABLE regime as of 2026-01-31.

- This indicates market expectations for medium-term inflation are neither strongly rising nor falling.

- Conviction Band: Medium, Interpretation Confidence: High Confidence, Internal Conflict Flag: No.

Key Dynamics:

- The MIIE composite z-score is 0.27 (1), well within the STABLE regime's -0.5 to 1.0 threshold (1).

- Both 5-year forward and 10-year breakeven inflation rates show subdued momentum, with their 3-month annualized z-scores near zero (1).

- Conditional Invalidation: A sustained move of the MIIE composite z-score below -0.5 (FALLING) or above 1.0 (RISING) (1).

Scenario Balance:

- Base Case dominant: Market-implied inflation expectations will likely continue in a STABLE regime, supported by current levels and momentum.

- Upside secondary: Expectations could shift to RISING if economic activity significantly outperforms, pushing breakevens higher.

- Downside residual: A notable economic slowdown or disinflationary event could cause expectations to enter a FALLING regime.

Time Horizon & Aggregation:

- Time Horizon: Structural (quarters+), reflecting longer-term market views inherent in 5-year and 10-year breakevens (1).

- Aggregation Weight Hint: Medium, given the high confidence in the current stability but a lack of strong directional conviction.

Macro Relevance:

- This signal primarily informs the Pricing dimension, specifically market-based inflation expectations.

- It provides a forward-looking perspective relevant across economic cycles, especially when assessing policy implications.

- The signal complements realised inflation measures (2)(3) and producer price dynamics (4).

Data & References:

Market Implied Inflation Chart

Market-implied inflation: investor expectations for future price changes.