Industrial Production Signal

Industrial production growth as a real-economy activity signal.

Gemini Summary

Signal Summary:

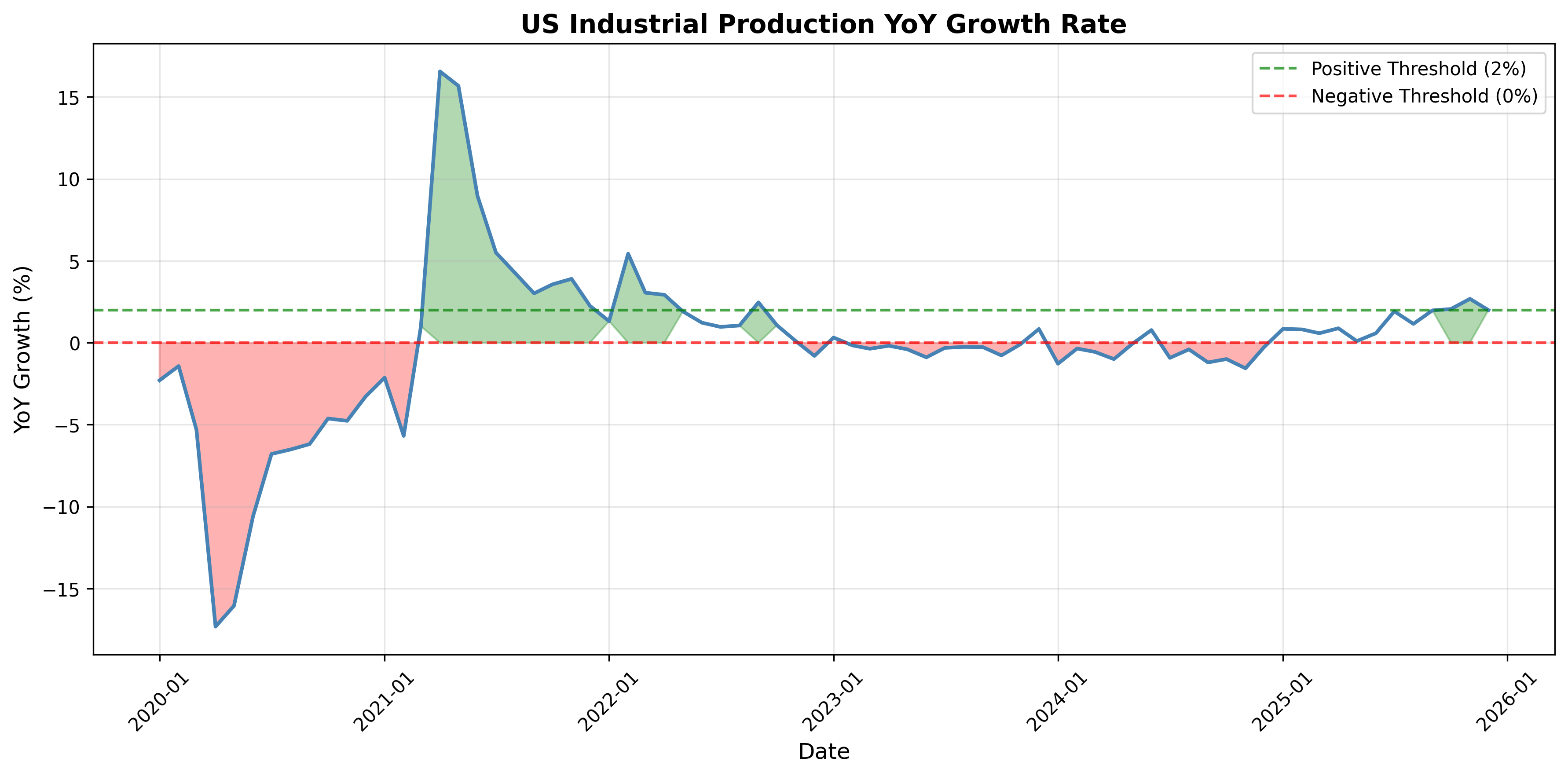

- The Industrial Production Signal is currently Neutral, indicating a balanced demand-supply environment for cyclical and metals exposures as of 2025-12-01 1.

- This state reflects a stable transition, not meeting the criteria for strong expansion or contraction.

- Conviction Band: Medium, Interpretation Confidence: High Confidence, Internal Conflict Flag: No.

Key Dynamics:

- Industrial Production (INDPRO) year-over-year growth is 1.99%, below the +3% threshold for a Bullish signal 1.

- Value Added by Industry: Mining as a Share of GDP (RIWG21222S) year-over-year growth is 20.88%, remaining positive and thus preventing a Bullish classification 1.

- The signal has consistently been Neutral across all observed future data (January to December 2025), indicating stability.

- Conditional Invalidation: A sustained drop in Industrial Production YoY below 0% while the Mining share of GDP YoY remains positive would reverse the signal to Bearish.

Scenario Balance:

- Base Case dominant: The signal remains Neutral, supported by moderate industrial growth and continued expansion in the mining sector.

- Upside secondary: A Bullish shift could occur if industrial production growth accelerates above 3% and mining sector growth slows or turns negative.

- Downside residual: A Bearish outcome is plausible if industrial production contracts (below 0%) while the mining share of GDP continues to expand.

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months), given its reliance on year-over-year growth rates that reflect broader business cycle trends.

- Aggregation Weight Hint: High, due to its clear, deterministic classification and direct relevance to industrial activity and commodity demand-supply dynamics.

Macro Relevance:

- This signal primarily informs macro dimensions of demand, supply, and growth, particularly for industrial sectors and commodities like metals 1.

- It indicates a steady expansion phase within the business cycle, without showing signs of overheating or contraction.

- It typically interacts with other macro signals like liquidity 2 and real yields 3, contributing to a comprehensive regime triangulation for assets such as gold 4, silver 5, and copper 6.

Data & References:

- Industrial Production Index (INDPRO), latest observed YoY value: 1.99% as of 2025-12-01.

- Value Added by Industry: Mining as a Share of GDP (RIWG21222S), latest observed YoY value: 20.88% as of 2025-12-01.

- Additional public datasets that would improve depth or reliability include manufacturing new orders ex-transportation and global manufacturing PMIs.

Industrial Production Chart

Year-over-year growth in U.S. industrial production.