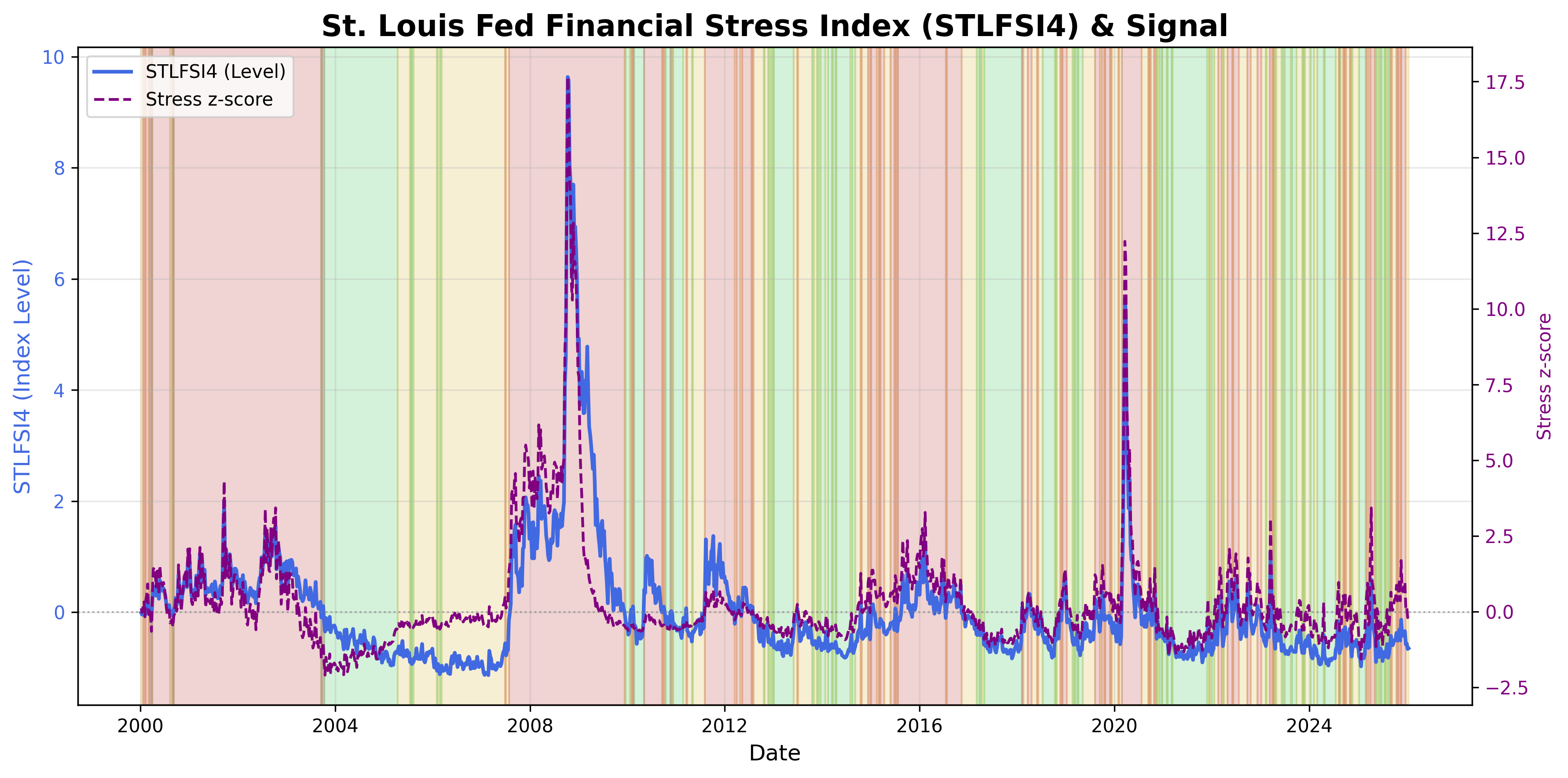

Financial Stress Index Signal

Market-wide financial stress and systemic risk conditions.

Gemini Summary

Signal Summary:

- The Financial Stress Index signal (1) currently indicates a Neutral regime as of 2026-01-16.

- Financial stress is below average (STLFSI4 at -0.6510) but not loose enough to be considered Bullish (z-score at -0.142663).

- Conviction Band: Medium | Interpretation Confidence: High Confidence | Internal Conflict Flag: No.

Key Dynamics:

- The signal has recently transitioned from a period of Bearish (risk-off) conditions in late 2025 to its current Neutral state.

- The underlying STLFSI4 value remains negative, suggesting below-average stress, while its robust z-score has stabilised near zero after peaking in November 2025 (1).

- Conditional Invalidation: The signal would reverse to "Bearish" if the STLFSI4 level rises above 0 or its robust z-score exceeds +0.5.

Scenario Balance:

- Base Case dominant: continued Neutral conditions, as the z-score fluctuates between -0.5 and +0.5 and the STLFSI4 remains negative.

- Upside secondary: easing conditions leading to a Bullish signal if the z-score drops below -0.5 while STLFSI4 stays negative.

- Downside residual: re-escalation of stress leading to a Bearish signal if the STLFSI4 turns positive or the z-score exceeds +0.5.

Time Horizon & Aggregation:

- Time Horizon: Tactical (weeks), given its role as a weekly risk-on/risk-off classifier (1).

- Aggregation Weight Hint: Medium, as it offers a clear sentiment gauge but should be complemented by other macro signals for broader conclusions.

Macro Relevance:

- Macro dimension informed: Sentiment, Credit, and broad Risk Conditions.

- Cycle position: It can indicate shifts within the mid to late cycle as financial conditions tighten or ease.

- Typical interaction with other macro signals: Often combined with credit spreads (1) and volatility (VIX) (1) to form a comprehensive view of financial stability and risk appetite.

Data & References:

Financial Stress Index Chart

Composite financial stress conditions across markets.