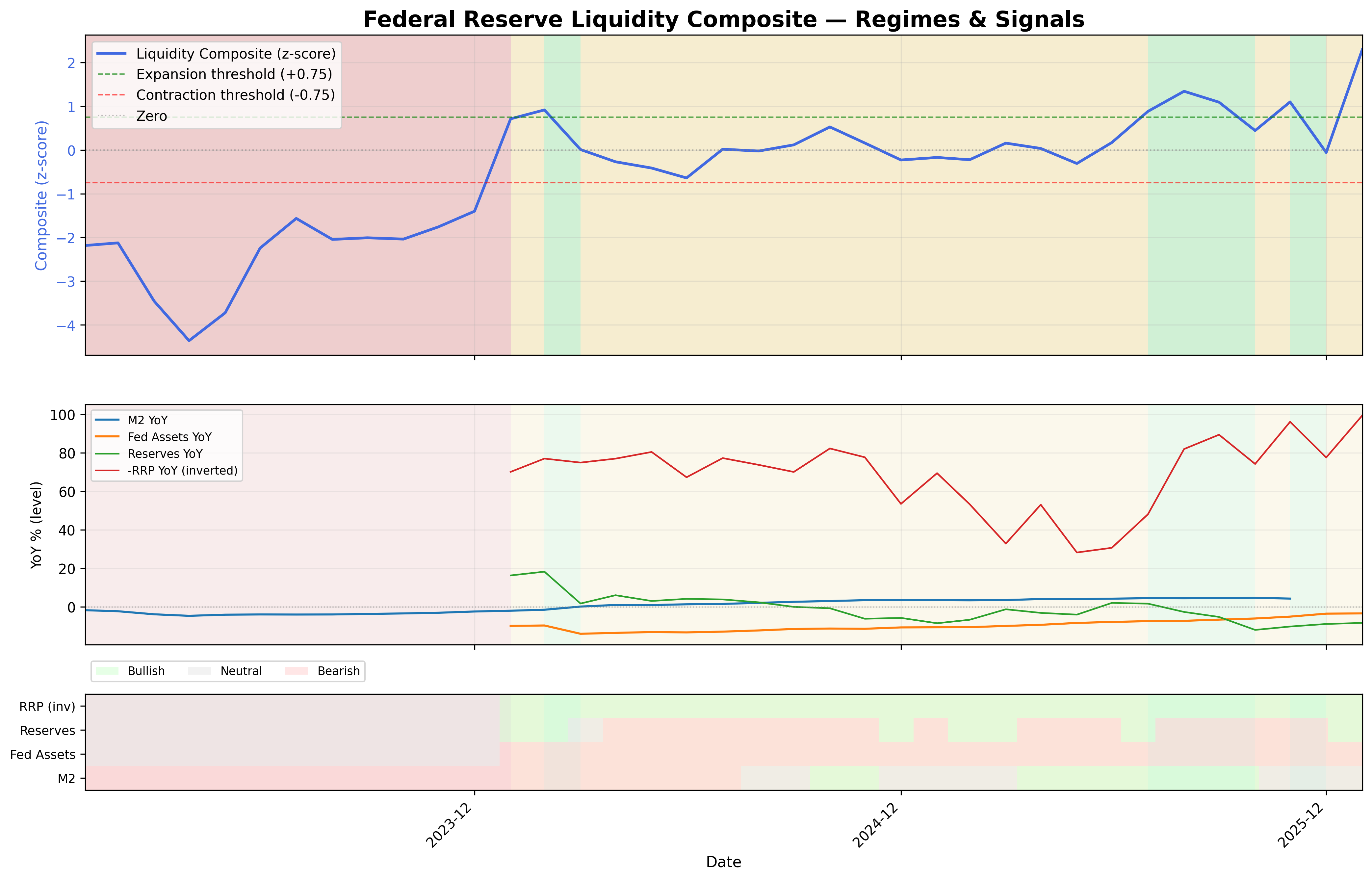

Federal Reserve Liquidity Composite Signal

Federal Reserve balance sheet, RRP, and reserves as a composite liquidity signal.

Gemini Summary

Signal Summary:

- The Federal Reserve Liquidity Composite (1) indicates a strong Expansion regime as of 2026-01-31, with a composite score of 2.297.

- This reflects a substantial easing of liquidity conditions, despite some underlying tensions.

- Conviction Band: Low | Interpretation Confidence: Mixed Signals | Internal Conflict Flag: Yes.

Key Dynamics:

- The composite's strong expansion is primarily driven by bullish signals from reserve balances and significantly declining Overnight Reverse Repo (ON RRP) usage (1).

- Federal Reserve total assets continue to show bearish contraction, providing a material offset to the other components (1).

- M2 money supply currently registers as Neutral due to missing data, contributing neutrally to the composite (1).

- The signal transitioned from Neutral in December 2025 to a strong Expansion in January 2026, indicating a notable positive inflection.

- Conditional Invalidation: A significant and sustained rise in Overnight Reverse Repo (ON RRP) facility usage would invalidate this easing liquidity interpretation.

Scenario Balance:

- Base Case dominant: Liquidity conditions continue to expand, supported by ongoing declines in ON RRP usage and stable reserve balances.

- Upside secondary: Further strong inflows into reserves or an acceleration in M2 growth beyond current levels, amplifying the expansionary trend.

- Downside residual: A reversal in the decline of Fed assets, or a resurgence in ON RRP usage, could quickly tighten liquidity.

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months), reflecting the monthly aggregation of underlying monetary components.

- Aggregation Weight Hint: Medium, as despite mixed internal signals, the overall expansionary regime represents a significant shift in macro liquidity conditions.

Macro Relevance:

- Macro dimension informed: Liquidity.

- Cycle position: This strong liquidity expansion often supports early-to-mid cycle activity, potentially easing financial conditions and fostering risk-on sentiment.

- Typical interaction with other macro signals: Strong liquidity expansion typically correlates positively with demand signals and risk asset performance, and can precede shifts in credit conditions (2).

Data & References:

- M2 Money Stock (FRED), latest value 2025-11-30 (1).

- Total Assets of the Federal Reserve (FRED), latest value 2026-01-31 (1).

- Reserve Balances with Federal Reserve Banks (FRED), latest value 2026-01-31 (1).

- ON Reverse Repo usage (FRED), latest value 2026-01-31 (1).

- The most influential datapoints are the significantly negative (inverted positive) YoY and 3M changes in ON RRP usage.

- Additional public datasets that would improve depth or reliability include the SOFR 3M (3) and 5Y (4) CoT signals to capture market-implied liquidity, and the Credit Spreads signal (5) for financial conditions impact.

Federal Reserve Liquidity Composite Chart

Federal Reserve liquidity composite and signal regimes.