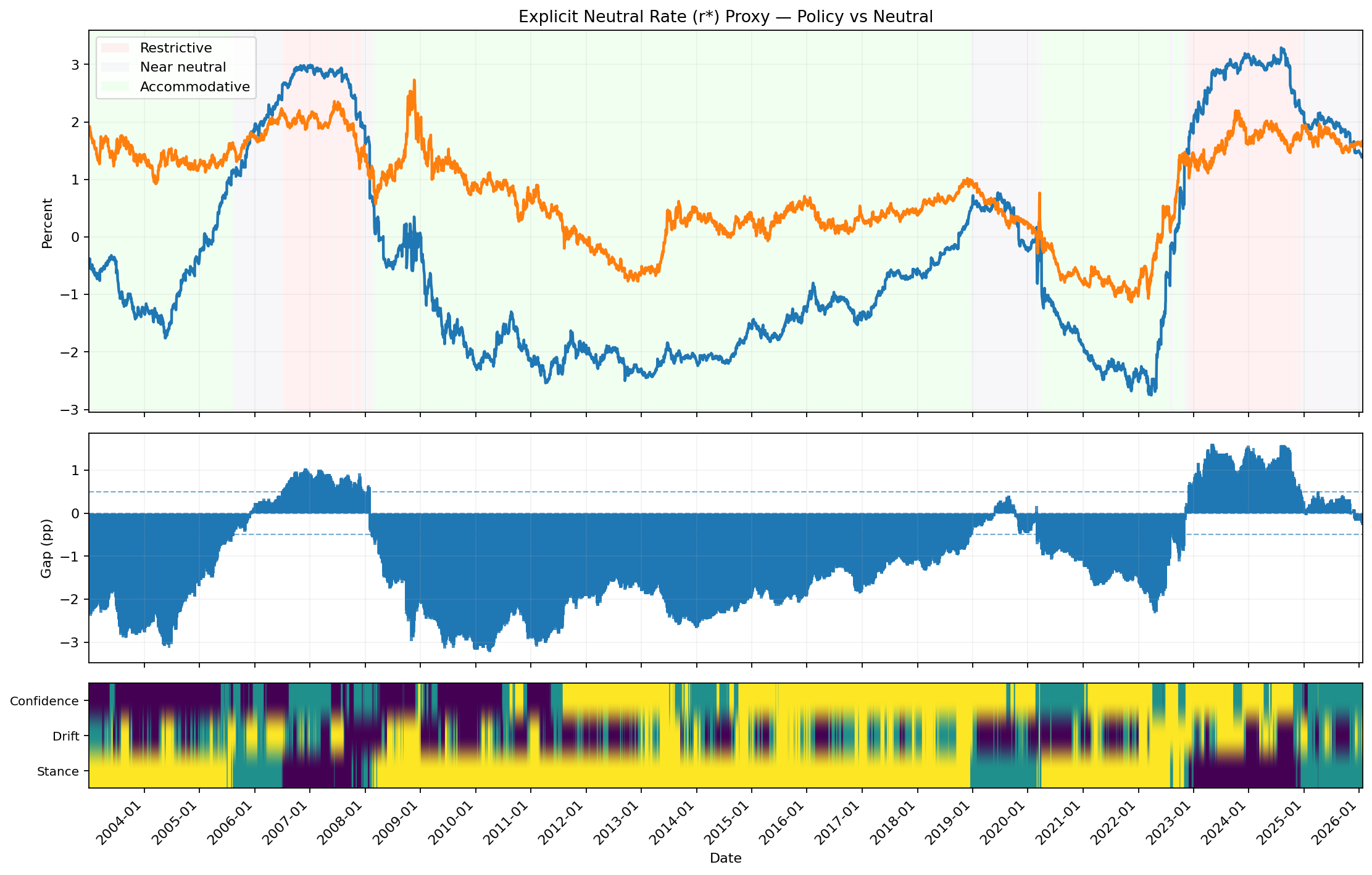

Explicit Neutral Rate (r*) Proxy Signal

Explicit Neutral Rate (r*) Proxy Signal based on market-implied real rates and term premiums.

Gemini Summary

Signal Summary:

- The Explicit Neutral Rate (r*) Proxy signal (1) indicates that the policy stance is currently Near neutral as of 2026-01-23.

- The neutral rate itself is in a Rising trend, suggesting a potential shift towards a more restrictive stance if policy rates do not adjust.

- Conviction Band: Medium | Interpretation Confidence: Medium Confidence | Internal Conflict Flag: No.

Key Dynamics:

- The `policy_stance_vs_neutral` has consistently remained "Near neutral" over the recent period (1).

- The `neutral_drift` has predominantly been "Rising", with the latest observation (2026-01-23) at 1.64790, while the `policy_real_proxy` stands at 1.40 (1).

- This results in a `stance_gap` of -0.24790, indicating the real policy rate is slightly accommodative to neutral but still within the "Near neutral" band (1).

- Conditional Invalidation: A sustained movement of the `stance_gap` above +0.50 would signify a shift to a restrictive policy stance, invalidating the current "Near neutral" assessment (1).

Scenario Balance:

- Base Case dominant: Policy remains near neutral as the real policy rate broadly tracks the rising neutral rate proxy.

- Upside secondary: A notable decline in the neutral rate (r*proxy) would make the current policy stance relatively more accommodative.

- Downside residual: Continued upward drift of the neutral rate without policy adjustment could push the policy into restrictive territory.

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months), reflecting the three-month window used for drift calculation and the relevance to monetary policy cycles (1).

- Aggregation Weight Hint: Medium, as this signal offers essential context for evaluating the Federal Reserve's monetary policy stance.

Macro Relevance:

- Macro dimension informed: Liquidity & Monetary Conditions (2).

- Cycle position: Mid-cycle, where the evolving neutral rate critically informs policy decisions.

- Typical interaction with other macro signals: This signal complements insights from inflation momentum (3), labour market slack (4), and financial stress (5) to provide a comprehensive view of the Federal Reserve's reaction function (6).

Data & References:

- Explicit Neutral Rate (r*) Proxy Signal (1), latest observation 2026-01-23.

- The `rstar_proxy`, `policy_real_proxy`, `stance_gap`, and `neutral_drift` are the most influential data points.

- Further depth could be gained by integrating directly observed forward policy rate expectations to refine the `policy_real_proxy`.

Explicit Neutral Rate (r*) Proxy Signal Chart

Explicit Neutral Rate (r*) Proxy Signal based on market-implied real rates and term premiums.