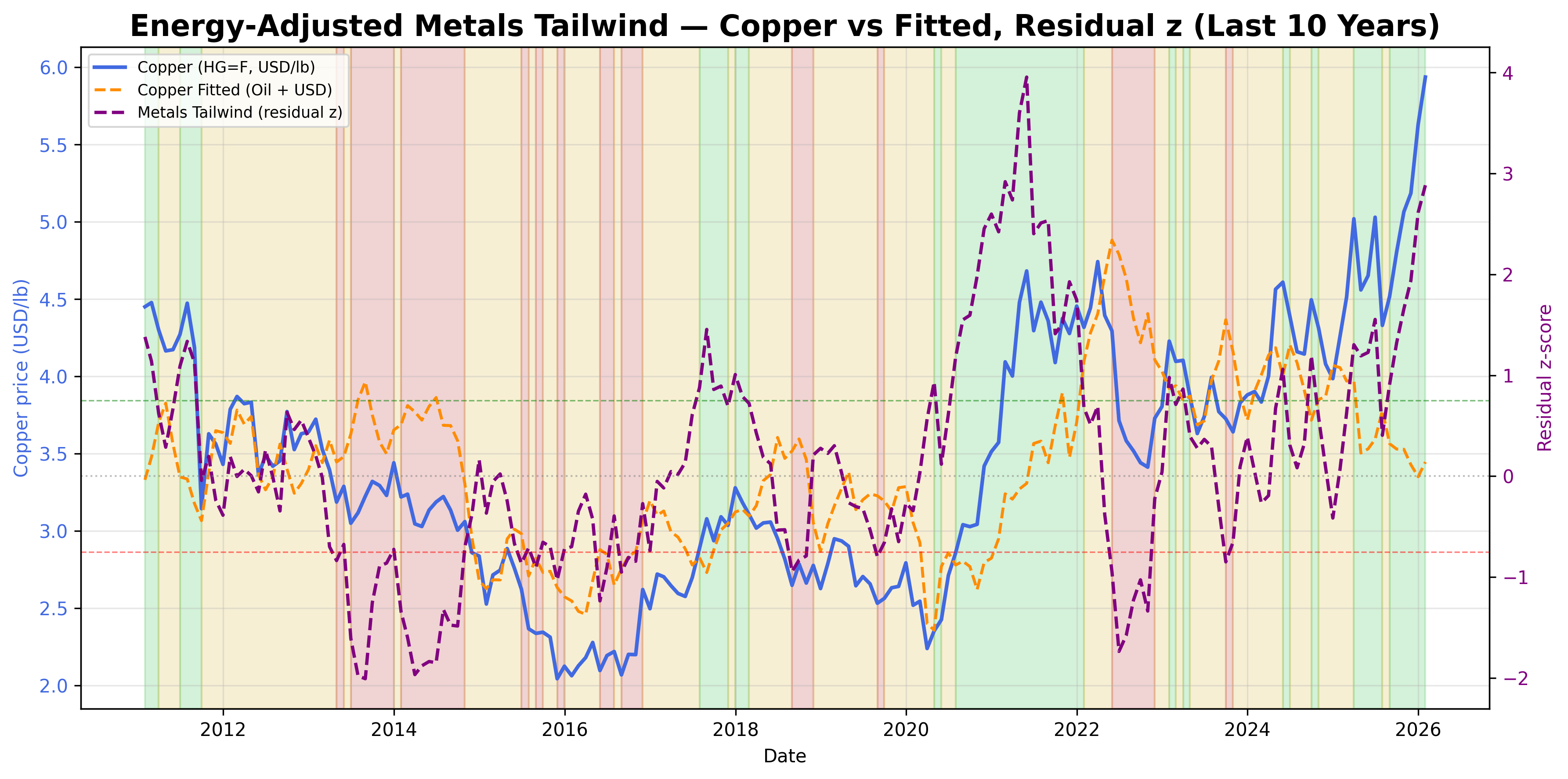

Energy-Adjusted Metals Tailwind Signal

Energy- and FX-adjusted copper residual as a metals demand tailwind indicator.

Gemini Summary

Signal Summary:

- The Energy-Adjusted Metals Tailwind signal indicates a strong Demand_Tailwind regime for copper, with a z-score of 2.883388 as of 2026-01-31 (1). This reflects significant copper-specific demand expansion.

- Conviction Band: Extreme, Interpretation Confidence: High Confidence, Internal Conflict Flag: No.

Key Dynamics:

- Copper prices (5.9370 USD/LB on 2026-01-31) are strongly outperforming expectations based on oil prices (60.30 USD/BBL) and USD strength (120.4478 on 2026-01-31).

- The Copper_Residual stands at 2.490457, showing robust copper-specific demand not explained by general energy or currency movements (1).

- Conditional Invalidation: A significant and sustained rise in oil prices or USD strength without a commensurate increase in copper prices, leading to a `Metals_Tailwind` z-score below -0.75.

Scenario Balance:

- Base Case dominant: Copper-specific demand remains strong, supporting the current Demand_Tailwind regime.

- Upside secondary: Further acceleration in copper-specific demand could drive the z-score even higher.

- Downside residual: An uncaptured macro shock or reversal in underlying demand dynamics could weaken the copper residual.

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months), as it reflects sustained shifts in copper-specific demand regimes.

- Aggregation Weight Hint: High, due to the extreme conviction and high confidence in the signal's indication of strong demand for copper.

Macro Relevance:

- This signal primarily informs the demand and pricing dimensions within the commodity sector.

- It suggests a mid-cycle position for demand-driven industrial commodities.

- Strong demand tailwinds for metals often correlate with positive global growth (2) and could interact with inflation signals (3).

Data & References:

- COPPER_YF_USD_LB (latest: 2026-01-31).

- DCOILWTICO (latest: 2026-01-31).

- DTWEXBGS (latest: 2026-01-31).

- The `Metals_Tailwind` z-score (2.883388) and `Metals_Regime` (Demand_Tailwind) on 2026-01-31 are most influential for the current state (1).

- Additional public datasets that would improve depth or reliability include global industrial production indices (4) and manufacturing Purchasing Managers' Index (PMI) data.

Energy-Adjusted Metals Tailwind Chart

Copper residual after controlling for WTI and the broad USD, scaled as a metals tailwind index.