Wage Growth and Inflation Signal

Wage growth and inflation composite: assessing labour-cost pressures and price dynamics.

Gemini Summary

Signal Summary:

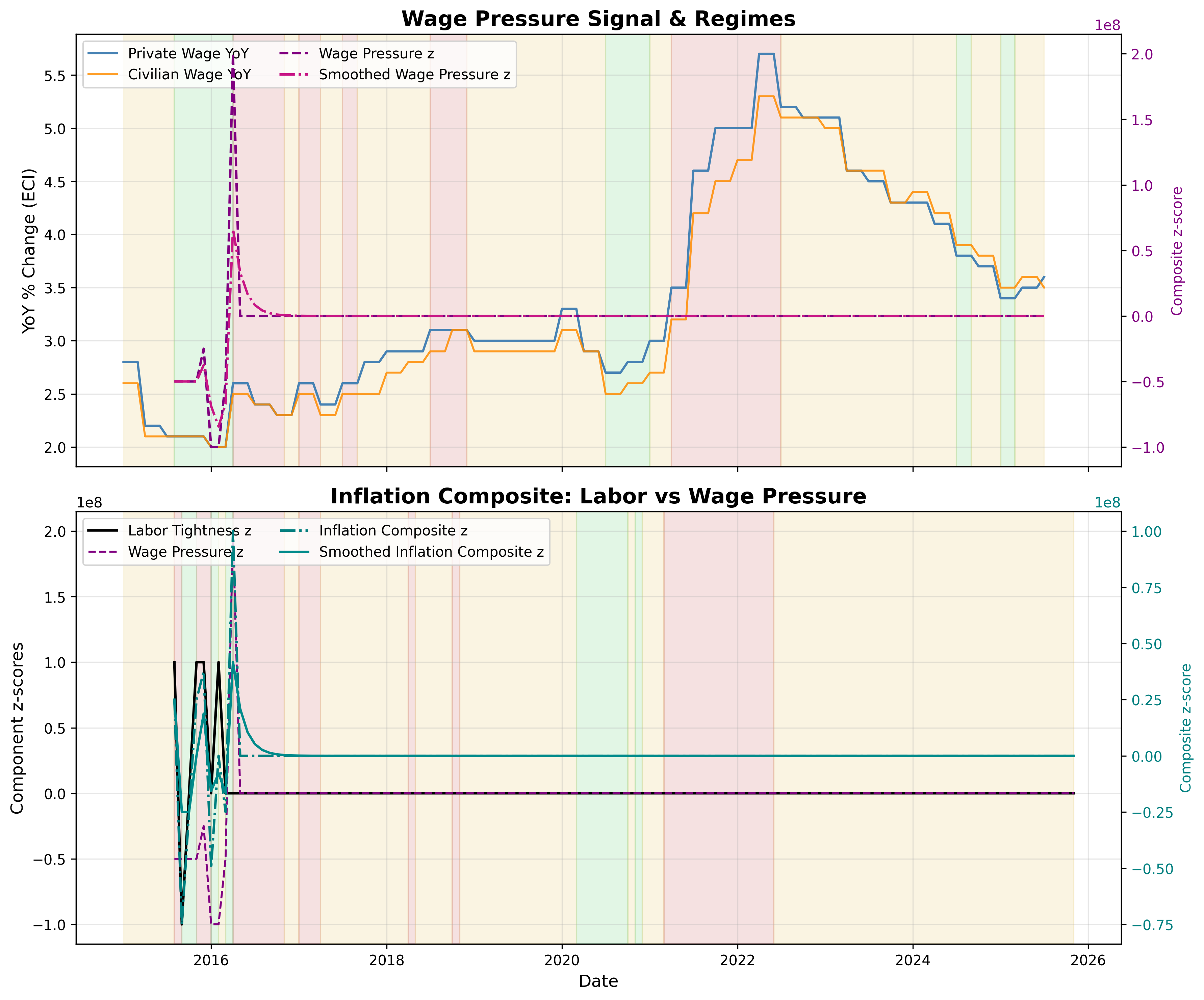

- The Wage Growth and Inflation Composite signal indicates a NEUTRAL regime for inflation pressure (1). Current wage growth for private and civilian workers stands at 3.6% and 3.5% year-over-year, respectively, reflecting stable conditions (1). Conviction Band: Medium, Interpretation Confidence: High Confidence, Internal Conflict Flag: No.

Key Dynamics:

- The latest Wage Pressure z-score is -0.357684, firmly within the NEUTRAL band of -1.0 to +1.0, reflecting a moderation from earlier 'COOL' readings (1).

- Labor Market Tightness z-score is currently 0.000000, suggesting balanced conditions in the labor market (1).

- The combined Inflation Composite z-score is -0.178842, also well within the NEUTRAL regime threshold of -0.75 to +0.75, showing stability (1).

- Conditional Invalidation: A sustained shift in the Inflation Composite z-score above +0.75 (HOT) or below -0.75 (COOL) would reverse the current neutral interpretation (1).

Scenario Balance:

- Base Case dominant: Continued neutral wage growth and inflation pressure, supported by current z-scores near zero (1).

- Upside secondary: A re-acceleration in either private or civilian wage growth (e.g., above 4%), or a notable tightening in the labor market, could shift the composite towards a 'HOT' regime.

- Downside residual: A sustained deceleration of wage growth below 3% could push the composite into a 'COOL' (disinflationary) regime.

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months), given the reliance on quarterly ECI data up-sampled to monthly and a 3-month exponential moving average smoothing (1).

- Aggregation Weight Hint: High, as this composite provides a fundamental, coherent assessment of underlying wage and labor market driven inflation pressures.

Macro Relevance:

- Macro dimension informed: Pricing and Slack (1).

- Cycle position: Mid-cycle, consistent with stable, non-extreme inflation and labor market conditions.

- Typical interaction with other macro signals: This signal is a critical input to US inflation and labor market themes and often influences Federal Reserve policy outlooks and bond market expectations.

Data & References:

- Private Industry Wages & Salaries, 12-month % change (CIU2020000000000A), latest available monthly up-sample reflects 3.6%.

- Civilian Workers Wages & Salaries, 12-month % change (CIU1020000000000A), latest available monthly up-sample reflects 3.5%.

- Labor Market Tightness z-score (derived from JOLTS data), latest 0.000000.

- Additional public datasets that would improve depth or reliability: Policy-Relevant Inflation (PCE) Signal (2), CPI vs PPI Divergence Signal (3).

Wage Growth and Inflation Composite Chart

Composite of wage growth and inflation indicators.