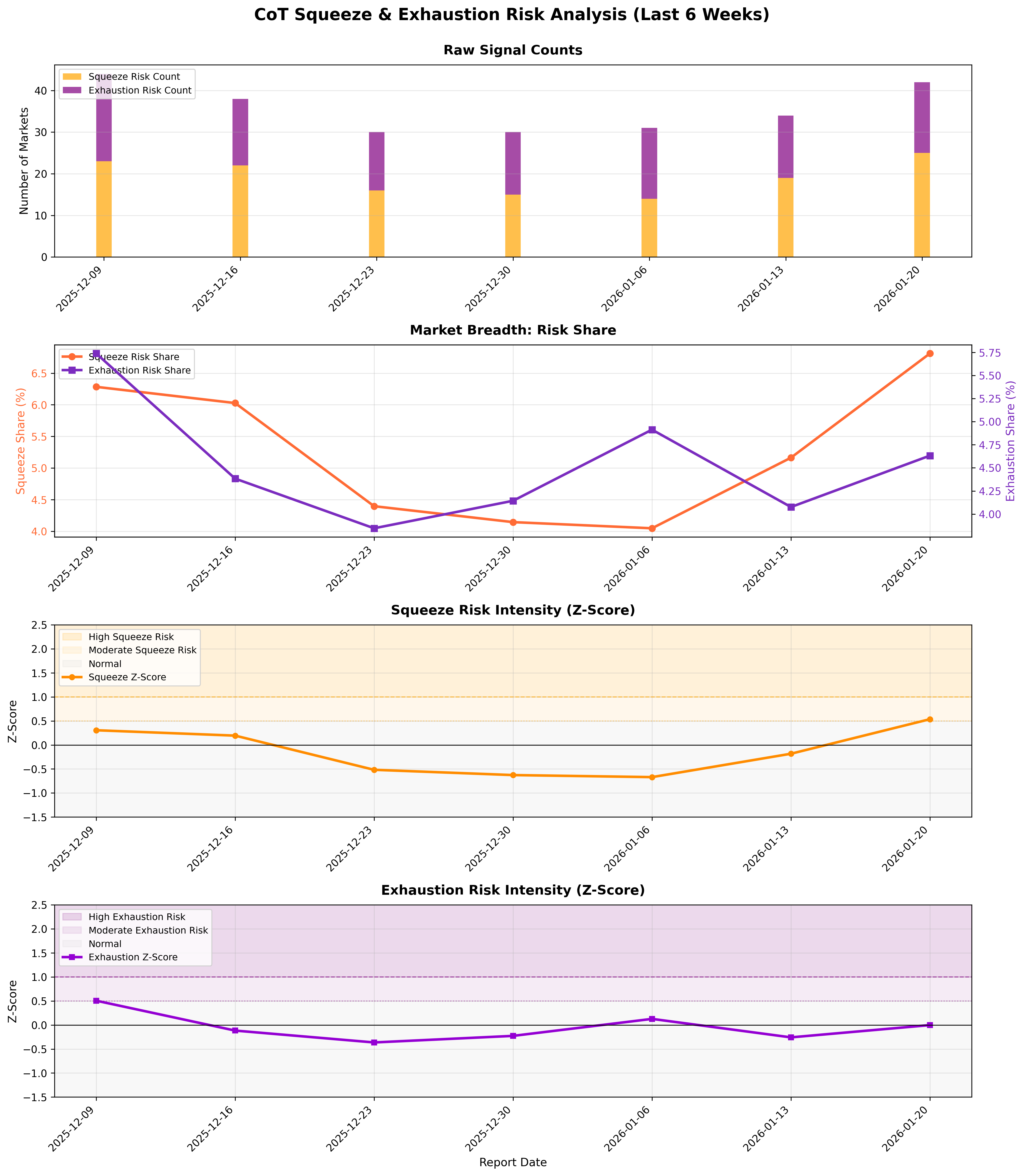

Squeeze & Exhaustion Risk Indicators

CoT tactical squeeze and exhaustion risk signals.

Gemini Summary

Signal Summary:

- The Squeeze & Exhaustion Breadth signal currently shows Moderate Squeeze Risk and Normal Exhaustion Risk as of 2026-01-20 (1). This indicates a transition towards heightened vulnerability to short-covering while trend fatigue remains typical.

- Conviction Band: Medium | Interpretation Confidence: High Confidence | Internal Conflict Flag: No.

Key Dynamics:

- The "Squeeze_z" component rose to 0.535634, crossing the 0.5 threshold for Moderate Squeeze Risk (1).

- Conversely, "Exhaustion_z" is at -0.002458, keeping it within the Normal range below 0.5 (1).

- Conditional Invalidation: A significant concentration of stress in a single, macro-critical sector could be underrepresented by the breadth measure (1).

Scenario Balance:

- Base Case dominant: Moderate Squeeze Risk persists with Normal Exhaustion, driven by current z-scores near the moderate threshold (1).

- Upside secondary: Squeeze Risk recedes to Normal if fewer markets show squeeze flags.

- Downside residual: Squeeze Risk elevates to High, or Exhaustion Risk rises to Moderate/High, if more markets become vulnerable.

Time Horizon & Aggregation:

- Time Horizon: Tactical (weeks) | Rationale: The signal aggregates market-level tactical flags for short-term risk assessment (1).

- Aggregation Weight Hint: Medium | Justification: Provides a valuable tactical overlay, but is not a primary driver for structural macro views.

Macro Relevance:

- Macro dimension informed: Market Sentiment, Pricing Dynamics, and Liquidity.

- Cycle position: Primarily relevant for identifying tactical vulnerabilities within any economic cycle phase.

- Typical interaction with other macro signals: Supplements broader risk gauges like the VIX (2) or Global Risk-On/Risk-Off Positioning Tone (3) to assess market fragility.

Data & References:

Squeeze & Exhaustion Risk Chart

Market breadth of squeeze and exhaustion risk signals.