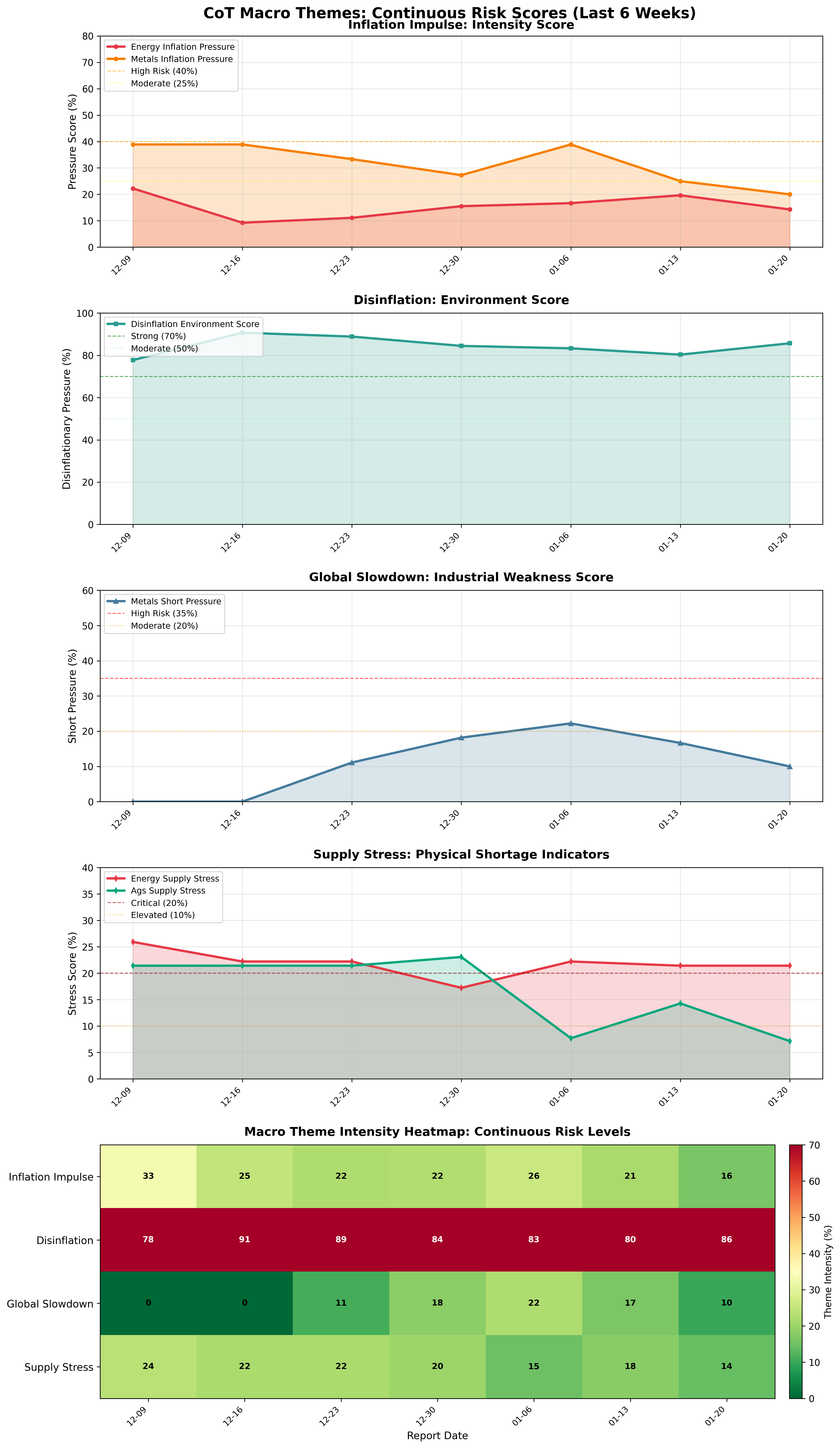

Regime-Specific Macro Themes

CoT regime-specific macro themes: inflation, slowdown, supply stress, disinflation.

Gemini Summary

Signal Summary:

- For the latest date of 2026-01-20, only the "Supply_Stress" macro theme is currently active, indicating potential physical tightness in Energy or Agricultural markets (1). Other themes, "Inflation_Impulse" and "Global_Slowdown," are not active based on available data, while "Disinflation" cannot be fully assessed due to missing components.

- The signal is in a state of partial classification. Conviction Band: Low | Interpretation Confidence: Low Confidence | Internal Conflict Flag: Yes.

Key Dynamics:

- The "Supply_Stress" theme is driven by hedgers being deeply long in Energy markets, with a `hedger_deep_long_share` of 0.214286 (exceeding 0.20) on 2026-01-20 (1). This share increased from 0.178571 on 2026-01-13, showing rising physical market stress.

- A key tension arises from the inability to evaluate the "Disinflation" and "Global_Slowdown" themes due to the absence of explicit overall market breadth data (`cl_total`, `cs_total`, `net_tone`) in the provided tables (1).

- Conditional Invalidation: The "Supply_Stress" theme would be invalidated if the `hedger_deep_long_share` in both Energy and Ags sectors falls below 0.20 (1).

Scenario Balance:

- Base Case dominant: Continued Supply Stress, supported by persistent commercial hedger long positioning in Energy, implying ongoing physical market tightness.

- Upside secondary: An unexpected broad increase in speculative long crowding across Energy and Metals could activate an "Inflation_Impulse" theme (1).

- Downside residual: A significant rise in speculative short positioning in Metals, combined with a broad risk-off sentiment, could trigger a "Global_Slowdown" theme (1).

Time Horizon & Aggregation:

- Time Horizon: Tactical (weeks). The signal relies on weekly CoT data and immediate breadth conditions (1).

- Aggregation Weight Hint: Low. The signal's incomplete assessment capability due to missing data reduces its utility and composite weighting.

Macro Relevance:

- Macro dimension informed: Primarily informs Supply dynamics and potential Pricing pressures (1).

- Cycle position: It flags specific thematic pressures within the broader economic cycle.

- Typical interaction with other macro signals: Provides commodity positioning context for inflation measures (2), global growth indicators (3), and other commodity-specific signals (4).

Data & References:

- Sector Theme and Theme Continuous tables from 2026-01-06 to 2026-01-20.

- The `hedger_deep_long_share` for Energy (0.214286 on 2026-01-20) was most influential for the "Supply_Stress" theme (1).

- The explicit overall market breadth data (`crowded_long_share`, `crowded_short_share`, `net_tone` for total markets) would significantly enhance the signal's reliability and enable full theme evaluation (1).

Macro Themes Chart

Continuous macro theme intensity scores and heatmap.