Labor Market Tightness Signal

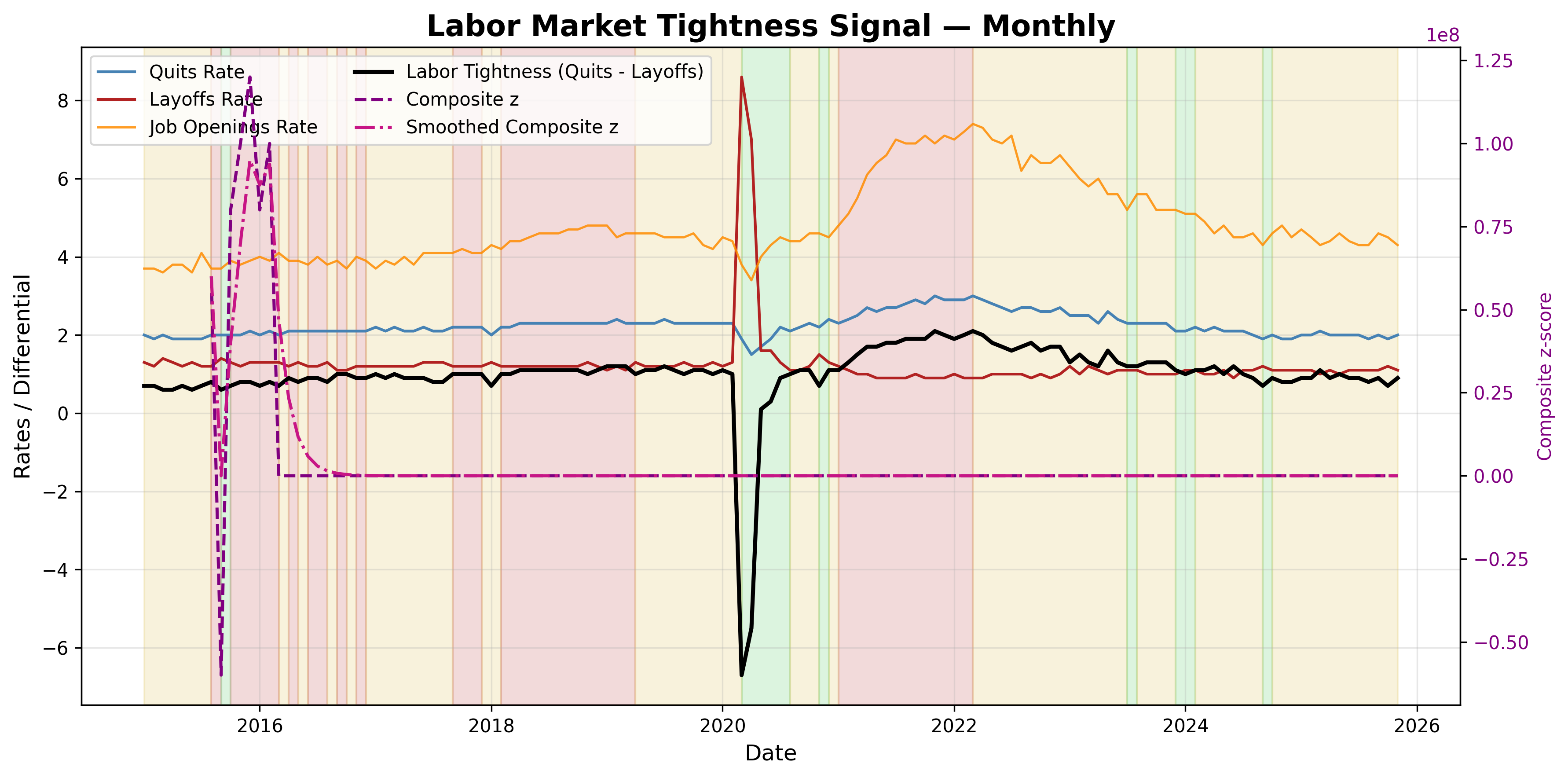

Labor market tightness signal: tracking the balance between labour demand and supply.

Gemini Summary

Signal Summary:

- The Labor Market Tightness signal indicates NEUTRAL conditions, a regime maintained consistently since 2024-10-01 (1). The composite z-score shows stable labor market dynamics, remaining within the established neutral band.

- Conviction Band: Medium | Interpretation Confidence: High Confidence | Internal Conflict Flag: No.

Key Dynamics:

- As of 2025-11-01, the `LMT_Regime` is NEUTRAL, with a smoothed composite z-score of -0.2058 (1). This value is comfortably above the `COOL` threshold of -0.75 (1).

- The quits rate (2.0%) and layoffs rate (1.1%) have remained stable, resulting in a `Labor_Tightness` differential of 0.9 (1).

- The job openings rate stands at 4.3% (1). Momentum diagnostics (3-month changes) for both tightness (0.1) and openings (0.0) are subdued (1).

- Conditional Invalidation: A sustained movement of the composite z-score outside the +/- 0.75 range, driven by significant changes in quits, layoffs, or job openings rates (1).

Scenario Balance:

- Base case dominant: Labor market tightness is expected to persist in a NEUTRAL regime, characterized by stable quits, layoffs, and job openings rates.

- Upside secondary: A sustained increase in the quits rate or job openings rate could signal a shift towards 'HOT' labor market conditions.

- Downside residual: A significant rise in layoffs or a notable decline in job openings could push conditions towards a 'COOL' regime.

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months) – This signal, based on monthly data, captures medium-term shifts in labor market dynamics, relevant for business cycle analysis.

- Aggregation Weight Hint: Medium – The signal provides a consistent and important assessment of labor market health, offering reliable input for broader macro composites.

Macro Relevance:

- This signal primarily informs the macro dimensions of labor market slack and potential wage inflation (pricing). It also provides insights into worker confidence.

- The current NEUTRAL regime is indicative of a mid-cycle economic position, where labor demand is balanced rather than showing extreme overheating or cooling.

- It typically complements inflation signals (2), monetary conditions (3), and overall growth indicators (4) for a holistic economic assessment.

Data & References:

- Labor Market Tightness Signal (1) - Latest observation: 2025-11-01.

- The `LMT_Regime`, `LMT_Composite_z`, `quits_rate`, `layoffs_rate`, and `openings_rate` are the most influential data points (1).

- Additional public datasets that would improve depth: BLS Unemployment Rate, and the Employment Cost Index (ECI) for comprehensive wage growth insights (5).

Labor Market Tightness Chart

Labor market tightness: diagnostic of demand vs supply conditions.