Job Flows Signal

Job flows signal: tracking hires, separations and net flows in the labour market.

Gemini Summary

Signal Summary:

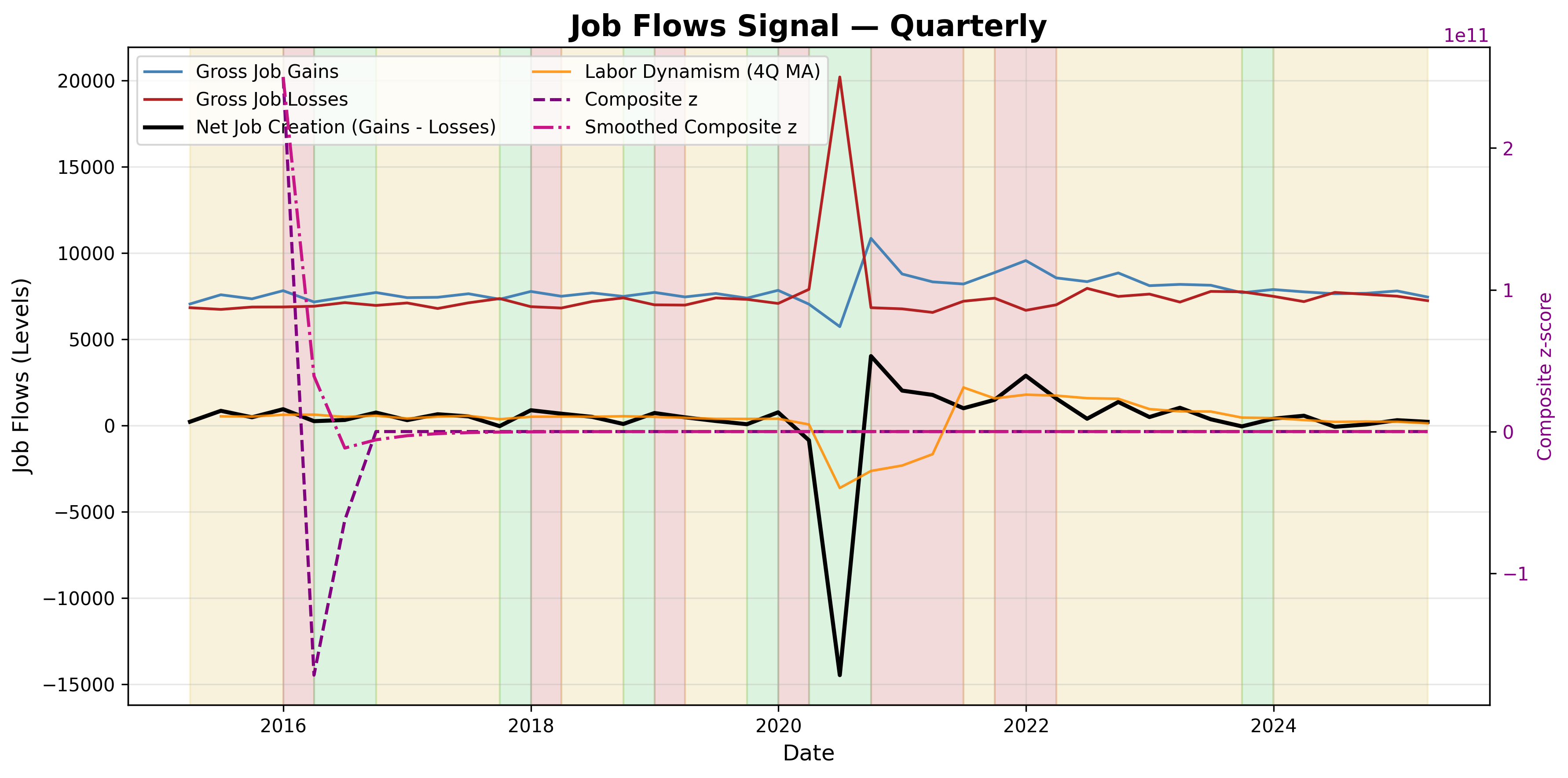

- The Job Flows & Labor Dynamism signal is currently in a NEUTRAL regime as of 2025-03-31, reflecting balanced job creation and destruction dynamics (1). Net Job Creation stands at 210.0, with the composite z-score at -0.21, indicating neither strong dynamism nor significant slackening.

- This signals a stable state in labor market dynamism, showing neither expansion nor contraction.

- Conviction Band: Medium | Interpretation Confidence: High Confidence | Internal Conflict Flag: No

Key Dynamics:

- The NEUTRAL regime is driven by the Job Flows Composite z-score of -0.21, which falls between the -0.75 and +0.75 thresholds (1).

- Net Job Creation was 210.0 at the latest observation, influenced by Gross Job Gains of 7448.0 and Gross Job Losses of 7238.0.

- Momentum has stabilised following a "COOL" period in 2023-09-30, with subsequent quarters remaining neutral.

- Conditional Invalidation: The signal would reverse if the `Job_Flows_Composite_z` falls below -0.75, indicating a shift to a "COOL" (dynamism ↓) regime (1).

Scenario Balance:

- Base Case dominant: Job flows remain in a NEUTRAL regime, with steady but not accelerating dynamism, as the composite z-score hovers near zero.

- Upside secondary: An increase in Gross Job Gains relative to Gross Job Losses, pushing Net Job Creation higher and the composite z-score above +0.75.

- Downside residual: A significant decline in Gross Job Gains or a rise in Gross Job Losses, leading to negative Net Job Creation and the composite z-score falling below -0.75.

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months). This is appropriate given the quarterly frequency of the underlying Business Employment Dynamics data and its focus on labor market cycles (1).

- Aggregation Weight Hint: Medium. The signal provides clear and consistently derived insights into firm-level labor market activity, warranting a moderate weight in broader macro composites.

Macro Relevance:

- This signal primarily informs the Macro Theme: US Labour Market (5), specifically regarding labor dynamism and firm hiring appetite.

- It typically corresponds to a mid-to-late cycle position, reflecting shifts in underlying business activity.

- It interacts with other macro signals like payroll breadth (2), unemployment duration (3)(4), and broader growth indicators.

Data & References:

- Bureau of Labor Statistics (BLS) Business Employment Dynamics (BDS) data, latest observation 2025-03-31 (1).

- The `Job_Flows_Regime` and `Job_Flows_Composite_z` are most influential for the current state.

- Additional public datasets that would improve depth or reliability include payroll breadth data (e.g., Sectoral Employment Diffusion Signal (2)) and unemployment duration (e.g., Underemployment Risk Signal (3) or Explicit Slack Gap Signal (4)).

Job Flows Signal Chart

Job flows: hires, separations and net flows across the labour market.