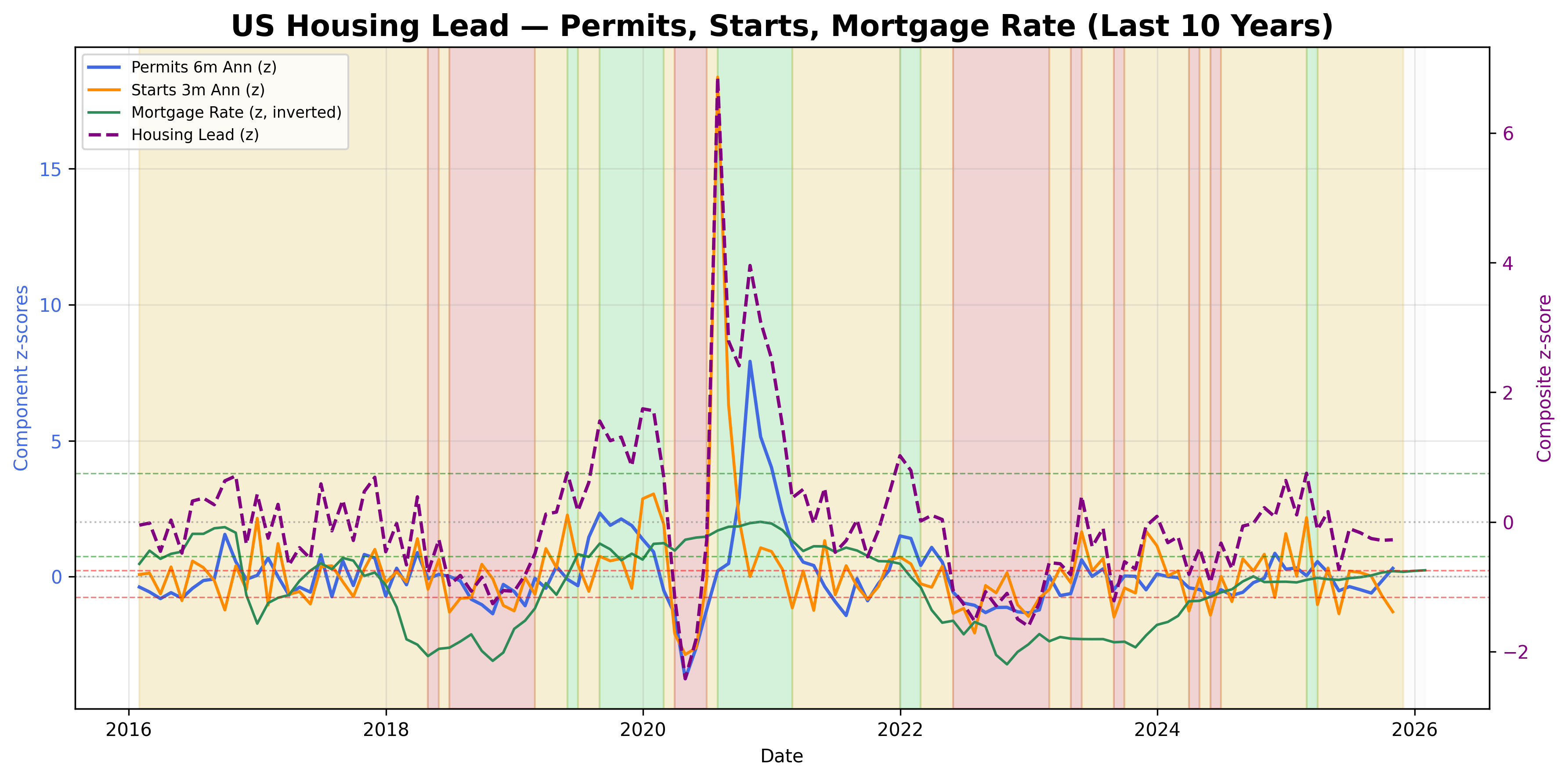

Housing Lead Signal

Housing lead indicator: permits, starts momentum, and mortgage headwinds.

Gemini Summary

Signal Summary:

- The Housing Lead Signal (1) indicates a Neutral regime in housing market activity as of 2025-10-31, despite mixed underlying dynamics.

- The composite score of -0.275847 reflects stable overall conditions rather than expansion or contraction.

- Conviction Band: Low | Interpretation Confidence: Mixed Signals | Internal Conflict Flag: Yes.

Key Dynamics:

- Building Permits (PERMIT) showed near-flat 6-month annualised growth (-0.014015), while Housing Starts (HOUST) displayed contracting 3-month annualised momentum (-0.407186) as of 2025-10-31.

- Mortgage rates (MORTGAGE30US) eased to 6.17% by 2025-10-31, with a positive z-score (0.201943) indicating less restrictive conditions relative to recent history.

- An internal tension exists between easing mortgage rate headwinds and stable permits against contracting starts momentum.

- Conditional Invalidation: A sustained decline in building permits combined with a reversal towards rising mortgage rates would likely reverse this neutral interpretation to contracting.

Scenario Balance:

- Base Case dominant: The housing market remains in a Neutral phase, supported by a composite score near zero and balancing dynamics.

- Upside secondary: Further easing of mortgage rates or a material rebound in building permit momentum could drive an expansionary phase.

- Downside secondary: A continued deceleration in housing starts momentum or an unexpected re-tightening of credit conditions could push the signal into contraction.

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months), as the signal captures medium-term trends in housing construction and financing.

- Aggregation Weight Hint: Medium, given housing's significant contribution to broader economic cycles and its sensitivity to interest rates.

Macro Relevance:

- This signal primarily informs the `demand` and `growth` dimensions of the macro landscape.

- It suggests the economy is in a mid-cycle position where housing activity is stable but not strongly expanding.

- It typically interacts with `credit conditions` (3), `consumer sentiment` (2), and overall `US Growth & Business Cycle` (4) signals.

Data & References:

- U.S. Census Bureau Building Permits (PERMIT) & Housing Starts (HOUST), last observed 2025-10-31.

- Freddie Mac 30-Year Fixed Rate Mortgage Average (MORTGAGE30US), last observed 2025-10-31.

- The `Housing_Lead` composite and `Housing_Regime` (Neutral) for 2025-10-31 were most influential.

- Additional public datasets that would improve depth or reliability include the `University of Michigan Consumer Sentiment Signal` (2) and `Credit Conditions Signal` (3).

Housing Lead Chart

Permits, starts momentum, and mortgage-rate headwinds combined into a housing lead index.