Hedger Pressure Indicator

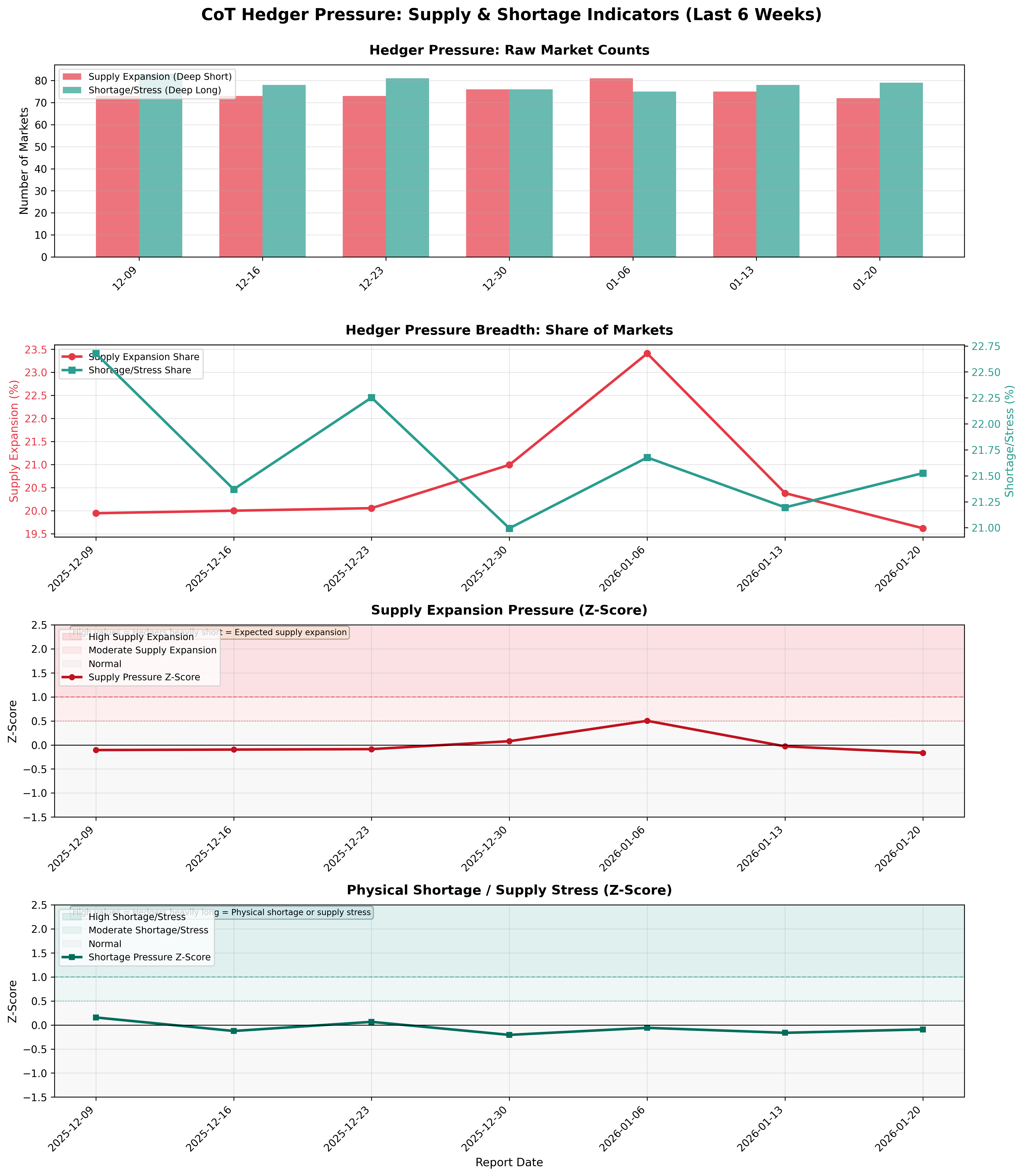

CoT hedger pressure: supply expansion & shortage stress.

Gemini Summary

Signal Summary:

- The Hedger Pressure signal currently indicates a Normal regime for both supply expansion and physical shortage pressures as of 2026-01-20 (1). This reflects commercial positioning within typical historical bounds.

- Conviction Band: Low | Interpretation Confidence: High Confidence | Internal Conflict Flag: No.

Key Dynamics:

- The robust z-scores for Hedger Supply Pressure (-0.16) and Hedger Shortage Pressure (-0.09) remain well within the "Normal" range (below 0.5) (1).

- Momentum is stable, with both z-scores oscillating around zero without indicating a strong directional shift.

- Conditional Invalidation: If either the Hedger Supply Pressure z-score or Hedger Shortage Pressure z-score rises to 0.5 or above, indicating a shift to 'Moderate' pressure (1).

Scenario Balance:

- Base Case dominant: Hedger positioning remains normal, with no significant signs of impending supply expansion or physical shortage. This is supported by current z-scores close to zero.

- Upside secondary: Increased Hedger Supply Pressure (z-score >= 1.0), signaling potential future supply expansion. Trigger: A sustained increase in the share of markets with deep short hedger positioning.

- Downside secondary: Increased Hedger Shortage/Stress Pressure (z-score >= 1.0), indicating tightening physical supply. Trigger: A sustained increase in the share of markets with deep long hedger positioning.

Time Horizon & Aggregation:

- Time Horizon: Tactical (weeks), as it is based on weekly Commitment of Traders (CoT) data reflecting short-to-medium term positioning dynamics (1).

- Aggregation Weight Hint: Low, due to the current neutral regime and corresponding low conviction.

Macro Relevance:

- Macro dimension informed: Supply, pricing, and underlying physical market conditions.

- Cycle position: Not a primary cycle indicator, but can reflect supply-side pressures within an ongoing cycle.

- Typical interaction with other macro signals: Provides a micro-level commercial perspective that can cross-check broader demand signals (e.g., Copper Tailwinds (2)) and overall market sentiment (e.g., Global Risk-On / Risk-Off Positioning Tone (3)).

Data & References:

- `df_cot_signals` (latest observation date: 2026-01-20).

- The most influential datapoints are `Hedger_SupplyPressure_z` (-0.16) and `Hedger_ShortagePressure_z` (-0.09) from the 2026-01-20 report.

- Additional public datasets that would improve depth or reliability: Sector-specific inventory levels and demand surveys could offer granular insights into physical market balances.

Hedger Pressure Chart

Supply expansion and shortage stress by hedger positioning.