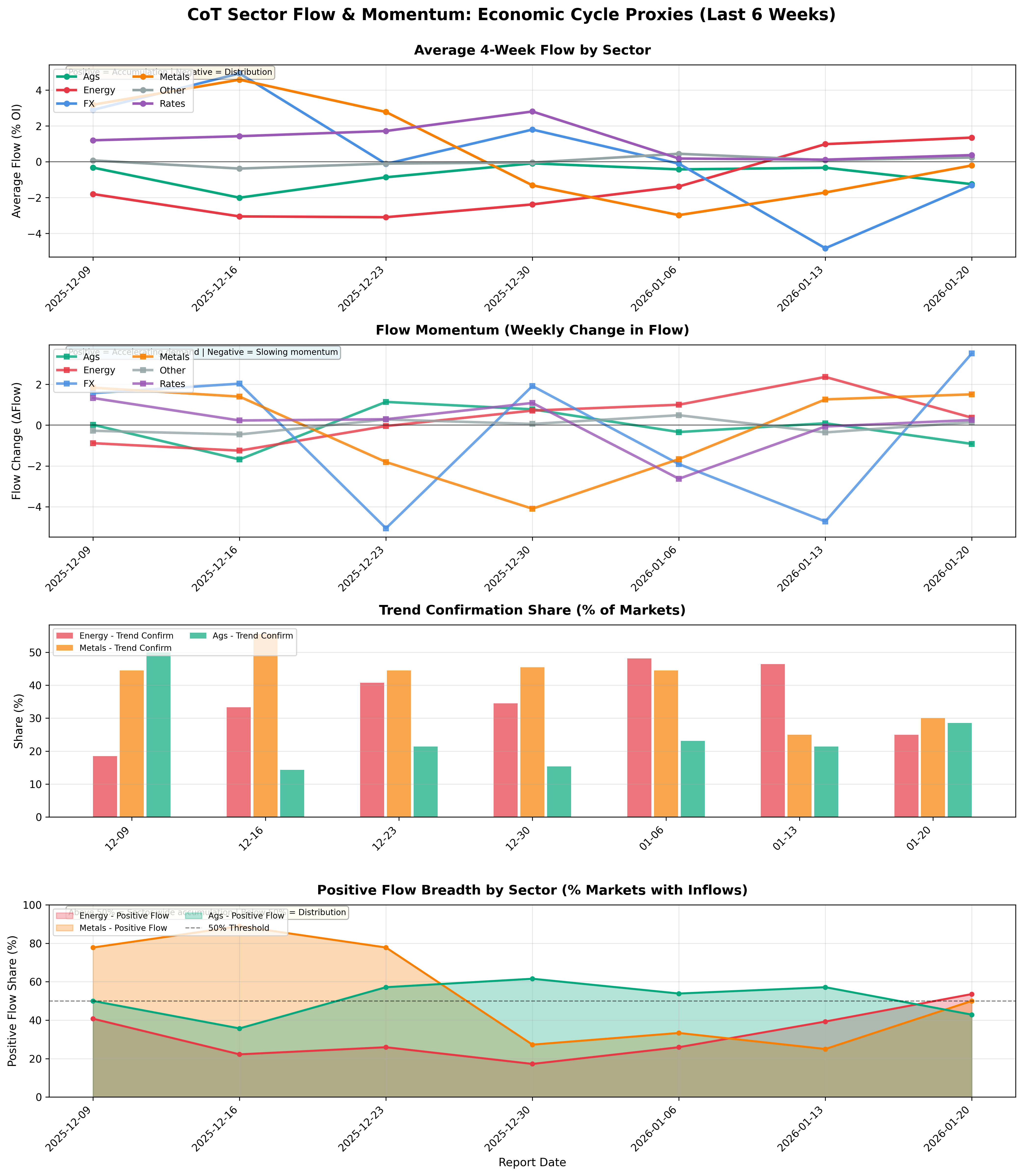

Forward Indicators of Economic Cycles (Momentum of Flows)

CoT sector flow & momentum: economic cycle proxies.

Gemini Summary

Signal Summary:

- The Rates sector shows mildly positive average 4-week speculative flows, with more markets experiencing positive flows than negative as of 2026-01-20 (1). Flow momentum is currently positive, indicating an improving trend.

- Conviction Band: Medium

- Interpretation Confidence: High Confidence

- Internal Conflict Flag: No

Key Dynamics:

- Average 4-week flow for the Rates sector is positive at 0.37 on 2026-01-20, up from -2.10 on 2025-11-04 (1).

- A majority of markets (63.6%) within the Rates sector experienced positive flows, while 36.4% saw negative flows (1).

- Flow momentum (avg_flow_4w_mom) is positive at 0.25, continuing an upward trend since 2025-11-25 (1).

- Contrarian flow share remains low at 9.1%, suggesting limited immediate pressure from flows opposing existing crowding (1).

- Conditional Invalidation: A significant and sustained increase in the contrarian_flow_share (e.g., above 20%) or a reversal of average 4-week flow momentum to consistently negative values.

Scenario Balance:

- Base Case dominant: Moderate positive flows in Rates are likely to continue, supported by recent improving momentum and low contrarian interest.

- Upside secondary: Stronger trend-confirming flows could emerge if market conviction in the central bank policy path or economic outlook becomes more solidified.

- Downside residual: Deterioration in average flows and momentum could occur if macro data introduces fresh uncertainty or shifts interest rate expectations.

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months), given the 4-week flow aggregation period and 3-week smoothing, which captures near-to-medium term dynamics.

- Aggregation Weight Hint: Medium, reflecting the coherent positive momentum and the absence of material internal conflicts, making it a reliable cyclical indicator.

Macro Relevance:

- Macro dimension informed: Liquidity, Sentiment.

- Cycle position: Mid-cycle, as stable-to-improving flows in interest rate futures often align with periods of economic stability and clearer policy outlook.

- Typical interaction with other macro signals: Positive flow momentum in Rates can precede shifts in credit conditions (2) or influence overall financial stress (3), by reflecting evolving market expectations for monetary policy.

Data & References:

- Sector Flow & Momentum (1) - Latest observation: 2026-01-20 for the Rates sector.

- Datapoints most influential for the current state: avg_flow_4w (0.37), pos_flow_share (0.64), neg_flow_share (0.36), avg_flow_4w_mom (0.25), and contrarian_flow_share (0.09).

- 1–2 additional public datasets that would improve depth or reliability: Treasury International Capital (TIC) data for broader bond capital flows, and Federal Reserve communications for policy context (4).

Sector Flow & Momentum Chart

Sector-level flow and momentum as proxies for economic cycles.