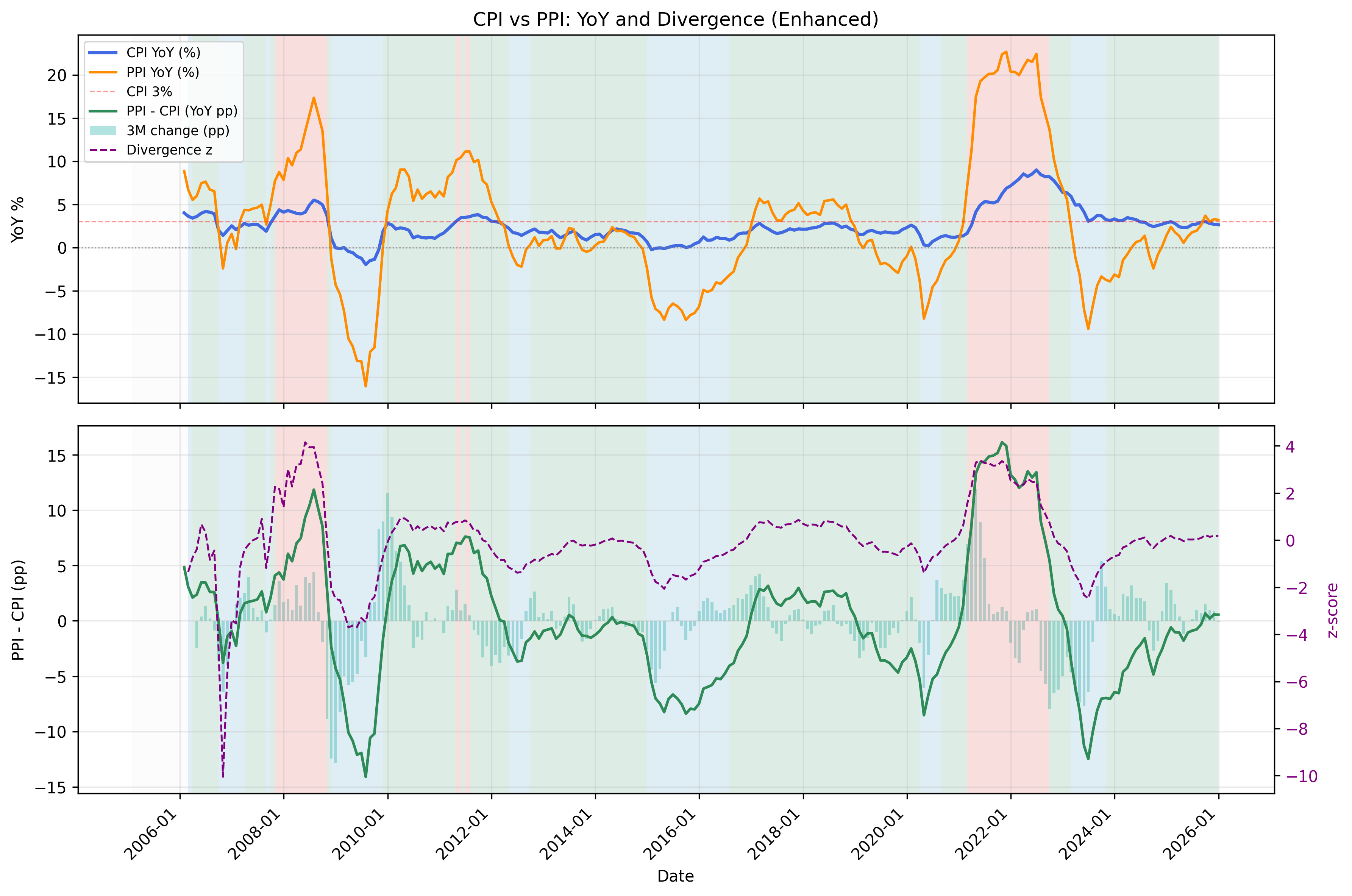

CPI vs PPI Divergence Signal

Consumer vs producer inflation divergence as a margin-pressure indicator.

Gemini Summary

Signal Summary:

- The CPI vs PPI Divergence signal (1) is currently in a NEUTRAL regime as of 2025-12-31.

- This indicates a transition from prolonged disinflationary pressures, with the gap between producer and consumer price inflation narrowing.

- Conviction Band: Medium, Interpretation Confidence: High Confidence, Internal Conflict Flag: No.

Key Dynamics:

- The `divergence_z` currently stands at 0.176015 (1), well within the neutral range.

- The PPI-CPI year-over-year gap has narrowed to -1.448803% (1), significantly recovering from prior deep negative values.

- The 3-month change in this divergence is strongly positive at 3.398253% (1), signaling upward momentum.

- Conditional Invalidation: A sustained acceleration in producer prices, causing `divergence_z` to exceed 0.75, particularly with CPI above 3.0% (1), would shift the signal to HOT.

Scenario Balance:

- Base Case dominant: The NEUTRAL regime persists as the PPI-CPI divergence remains within its current bounds, suggesting balanced inflationary pressures.

- Upside secondary: A shift to a HOT regime is plausible if PPI inflation accelerates beyond CPI, driving the `divergence_z` into positive territory above 0.75 or 1.0 (1).

- Downside residual: A reversion to a COOL regime could occur if the negative divergence widens again, pushing `divergence_z` below -0.5 or -1.0 (1).

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months) as the signal relies on year-over-year changes and rolling z-scores over 60 months (1).

- Aggregation Weight Hint: Medium, given its specific focus on the divergence of price pressures, offering distinct insights into inflation dynamics.

Macro Relevance:

- This signal primarily informs the Pricing and Inflation macro dimensions (1).

- It helps gauge the relative strength of cost-push (PPI) versus demand-pull (CPI) inflationary forces within the economic cycle, currently suggesting easing disinflation.

- This signal complements broader inflation indicators such as the Policy-Relevant Inflation (PCE) Signal (2) and the Market Implied Inflation Signal (3) by detailing the transmission of price pressures.

Data & References:

- Consumer Price Index for All Urban Consumers (CPIAUCSL), monthly, not seasonally adjusted, latest observation 2025-12-31 (1).

- Producer Price Index for All Commodities (PPIACO), monthly, not seasonally adjusted, latest observation 2025-12-31 (1).

- The `PPI_minus_CPI_YoY` and `divergence_z` datapoints are most influential for the current NEUTRAL state.

- Additional public datasets that would improve depth or reliability include the Employment Cost Index (ECI) for wage pressures, or various regional Fed manufacturing surveys' prices paid components.

CPI vs PPI Divergence Chart

Divergence between consumer and producer inflation.