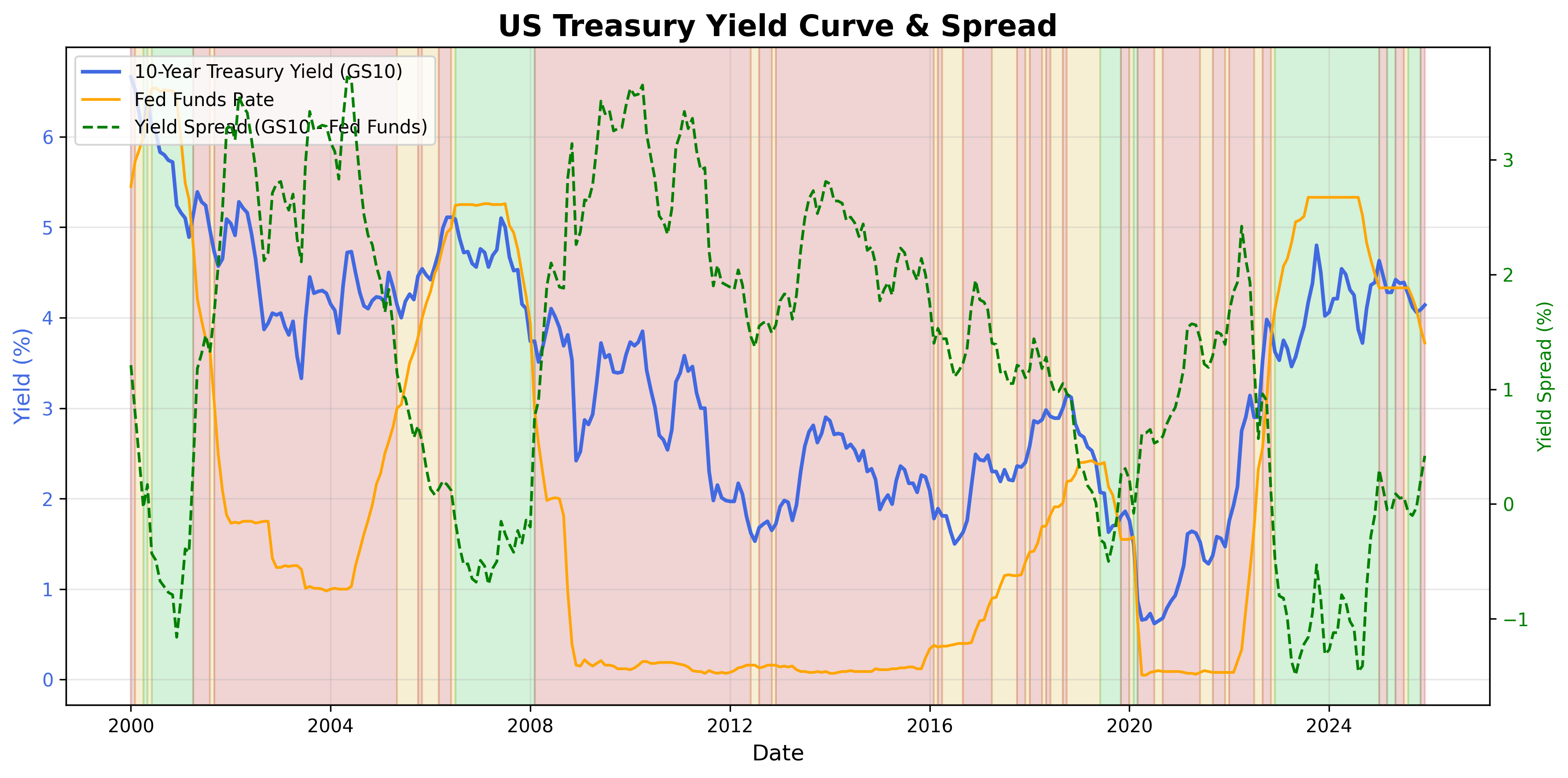

U.S. Treasury Yield Curve Signal

U.S. Treasury curve shape as an indicator of growth and policy stance.

Gemini Summary

Signal Summary:

- The US Treasury Yield Curve Signal is currently Bullish as of 2025-12-01, indicating a flat or inverted curve condition (1). This reflects a transition into a potentially more restrictive or recessionary environment.

- Conviction Band: Medium, Interpretation Confidence: High Confidence, Internal Conflict Flag: No.

Key Dynamics:

- The 10-year Treasury rate (GS10) at 4.39% is below the effective federal funds rate (FEDFUNDS) at 4.48%, resulting in a negative yield spread of -0.09% (1). This spread is also above its 3-month trend of -0.37%.

- The signal recently shifted from Bearish (2025-11-01) back to Bullish (2025-12-01), after oscillating between Bullish, Neutral, and Bearish in prior months, suggesting ongoing volatility and uncertainty around the zero spread (1).

- Conditional Invalidation: A consistent yield spread above 0% that is either steepening (Yield_Spread > Yield_Spread_Trend) or exceeding 1.5% would reverse the Bullish classification (1).

Scenario Balance:

- Base Case dominant: The yield curve remains flat or mildly inverted, consistent with a Bullish signal (1).

- Most plausible upside risk: A sustained re-steepening of the curve that remains below the 0.5% threshold without strong momentum, leading to a Neutral classification (1).

- Most plausible downside risk: The curve steepens significantly, with the spread exceeding 1.5% or actively steepening above its trend, triggering a Bearish signal (1).

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months). This signal uses monthly data and a 3-month moving average, making it suitable for assessing medium-term economic cycles (1).

- Aggregation Weight Hint: High. The yield curve is a historically reliable macro indicator, crucial for understanding economic cycles and policy expectations.

Macro Relevance:

- Macro dimension informed: Monetary conditions, growth outlook, and risk sentiment.

- Cycle position: The current Bullish signal often corresponds to late-cycle or recessionary warnings, depending on persistence and depth of inversion.

- Typical interaction with other macro signals: Often correlates with `US Macro Regime State, Momentum and Transition Risk` (2), influences `Federal Reserve Watcher Consolidated` (3) interpretations, and is a key input for `Explicit Neutral Rate (r*) Proxy Signal` (4).

Data & References:

- U.S. Treasury Yield Curve Signal (FRED), latest observation 2025-12-01 (1).

- The most influential datapoints are the 10-Year Treasury Constant Maturity Rate (GS10) at 4.39% and the Effective Federal Funds Rate (FEDFUNDS) at 4.48% as of 2025-12-01 (1).

- Additional public datasets that would improve depth or reliability include the 10-year minus 3-month Treasury spread for alternative curve perspectives.

U.S. Treasury Yield Curve Chart

Treasury yield curve across maturities.