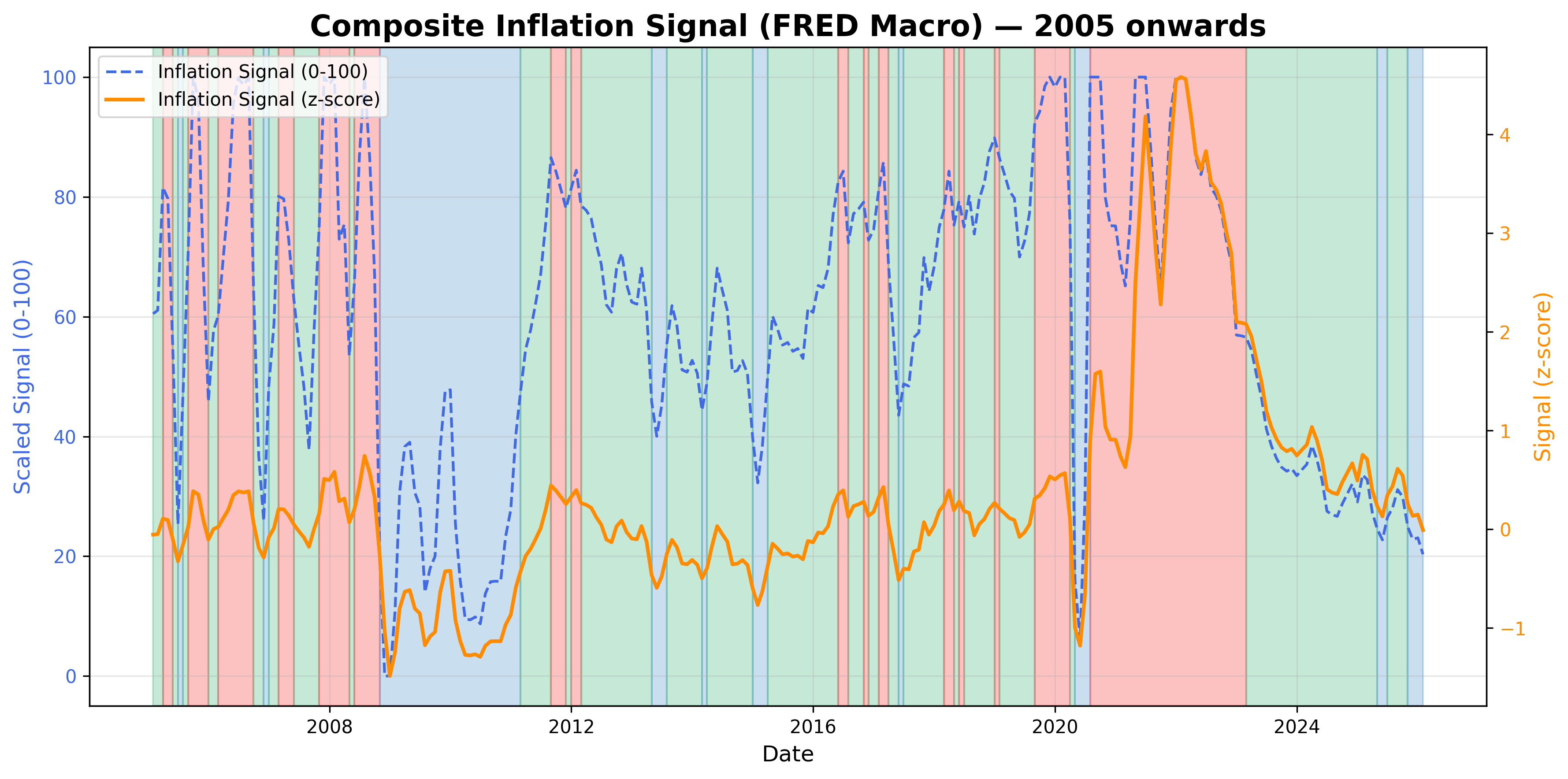

Inflation Signal

Broad U.S. inflation signal from price-level dynamics.

Gemini Summary

Signal Summary:

- The Fed Inflation Signal (1) indicates a persistent "COOL" regime as of 2026-01-31, with the composite value at -0.007997. This signifies continued disinflationary pressure.

- The signal transitioned from a "NEUTRAL" regime to "COOL" in April 2025 and is projected to remain in a contractionary phase of pricing.

- Conviction Band: High, Interpretation Confidence: High Confidence, Internal Conflict Flag: No.

Key Dynamics:

- The shift to a "COOL" regime is driven by a broad composite of declining inflation pressures, including components like CPI, breakeven inflation, and potentially liquidity measures (1).

- Momentum indicates a sustained downward trend in inflation pressure since early 2024.

- No material internal offsets or tensions are observed within the composite structure.

- Conditional Invalidation: The signal would reverse if the composite z-score rises above -0.5, moving out of the "COOL" regime (1).

Scenario Balance:

- Base Case dominant: Disinflationary pressures continue, leading to further easing of inflation expectations and actual price growth, supported by the signal remaining firmly in the "COOL" regime.

- Upside secondary: A notable re-acceleration in key inflation drivers (e.g., CPI, breakevens) could push the signal back to "NEUTRAL".

- Downside residual: A deeper economic slowdown could intensify disinflationary forces, pushing the composite further negative.

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months). The signal captures momentum shifts over several months and projects a multi-quarter regime.

- Aggregation Weight Hint: High. The signal's comprehensive nature and direct relevance to price stability make it a critical input for macro composites.

Macro Relevance:

- This signal primarily informs the pricing dimension of the macro economy (1), indicating easing cost pressures.

- It suggests a mid-to-late cycle position where inflation concerns are receding.

- This signal typically interacts strongly with monetary policy signals, influencing real interest rate expectations and central bank doves/hawks (e.g., Fed Watcher signals).

Data & References:

- US_Inflation_Signal composite value and regime data, latest 2026-01-31.

- The "COOL" regime classification (z-score <= -0.5) and the composite value of -0.007997 for 2026-01-31 are most influential (1).

- Explicit per-component contributions of the composite and Employment Cost Index (ECI) data would further enhance depth and reliability (1).

Inflation Signal Chart

Inflation signal constructed from recent U.S. price dynamics.