| 192 |

2025-10-14 |

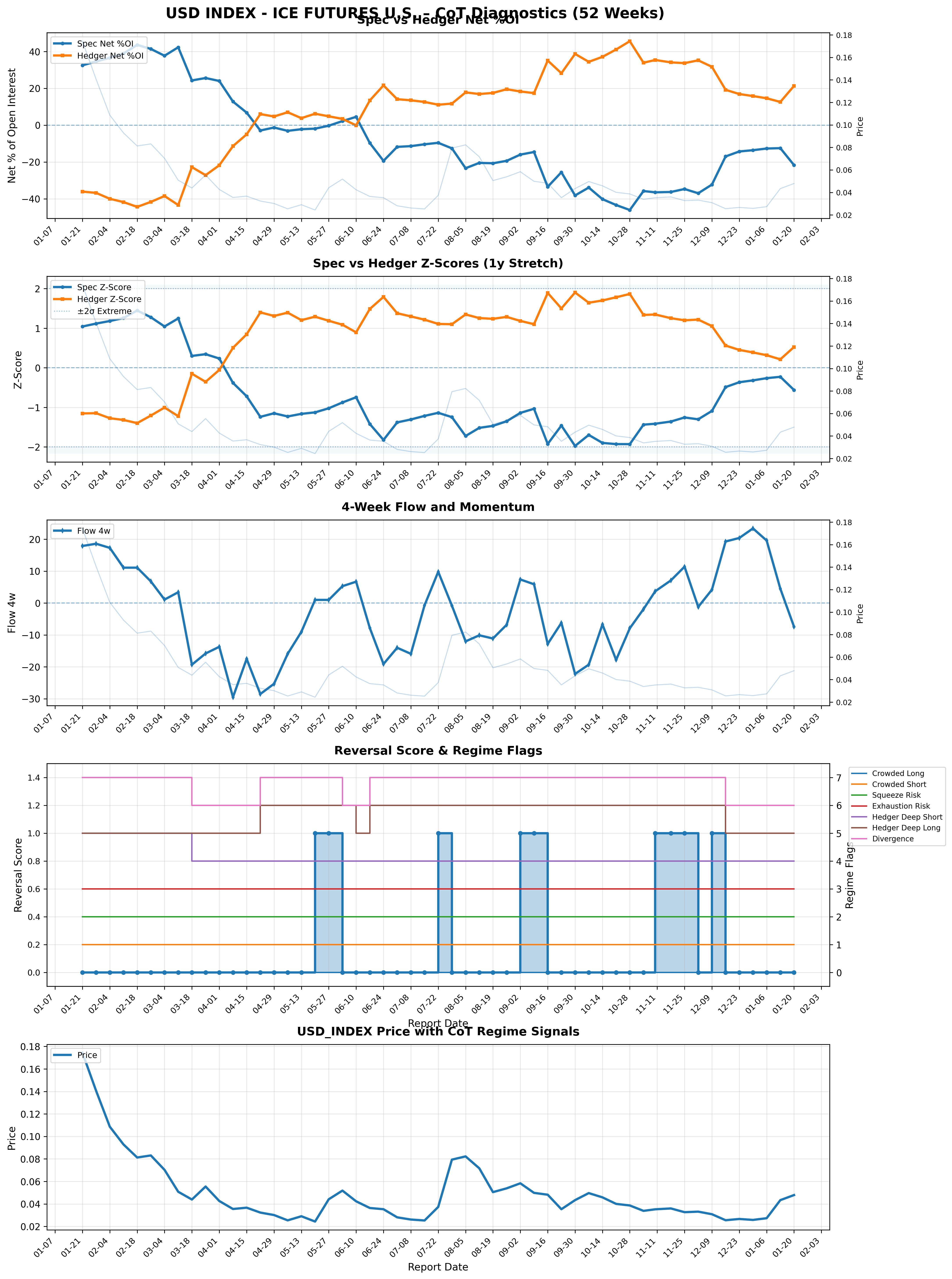

USD INDEX - ICE FUTURES U.S. |

-40.2 |

37.1 |

-1.898620 |

1.699115 |

-6.7 |

Balanced |

3.1 |

False |

False |

False |

None |

Long_Reduction |

-6.7 |

False |

False |

False |

False |

Hedgers_Deep_Long |

False |

False |

No_Clear_Reversal |

Balanced_Short_Bias |

3.597735 |

0 |

High_Tension_Low_Flags |

NaN |

NaN |

NaN |

NaN |

Other |

Unknown |

Other / Unknown |

0.000000 |

-14933 |

13766 |

False |

True |

legacy |

USD INDEX - ICE FUTURES U.S. |

098662 |

1.0 |

98.0 |

False |

True |

0 |

0.045869 |

| 193 |

2025-10-21 |

USD INDEX - ICE FUTURES U.S. |

-43.4 |

41.1 |

-1.928744 |

1.779894 |

-17.8 |

Balanced |

2.3 |

False |

False |

False |

None |

Long_Reduction |

-17.8 |

False |

False |

False |

False |

Hedgers_Deep_Long |

False |

False |

No_Clear_Reversal |

Balanced_Short_Bias |

3.708638 |

0 |

High_Tension_Low_Flags |

NaN |

NaN |

NaN |

NaN |

Other |

Unknown |

Other / Unknown |

0.000000 |

-15367 |

14537 |

False |

True |

legacy |

USD INDEX - ICE FUTURES U.S. |

098662 |

1.0 |

98.0 |

False |

True |

0 |

0.040060 |

| 194 |

2025-10-28 |

USD INDEX - ICE FUTURES U.S. |

-46.1 |

45.6 |

-1.929677 |

1.863648 |

-7.9 |

Balanced |

0.5 |

False |

False |

False |

None |

Long_Reduction |

-7.9 |

False |

False |

False |

False |

Hedgers_Deep_Long |

False |

False |

No_Clear_Reversal |

Balanced_Short_Bias |

3.793325 |

0 |

High_Tension_Low_Flags |

NaN |

NaN |

NaN |

NaN |

Other |

Unknown |

Other / Unknown |

0.000000 |

-16126 |

15939 |

False |

True |

legacy |

USD INDEX - ICE FUTURES U.S. |

098662 |

1.0 |

98.0 |

False |

True |

0 |

0.038655 |

| 195 |

2025-11-04 |

USD INDEX - ICE FUTURES U.S. |

-35.8 |

33.9 |

-1.437605 |

1.333939 |

-1.9 |

Balanced |

1.9 |

False |

False |

False |

None |

Long_Reduction |

-1.9 |

False |

False |

False |

False |

Hedgers_Deep_Long |

False |

False |

No_Clear_Reversal |

Balanced_Short_Bias |

2.771544 |

0 |

High_Tension_Low_Flags |

NaN |

NaN |

NaN |

NaN |

Other |

Unknown |

Other / Unknown |

11.482720 |

-15562 |

14704 |

False |

True |

legacy |

USD INDEX - ICE FUTURES U.S. |

098662 |

1.0 |

98.0 |

False |

True |

0 |

0.033865 |

| 196 |

2025-11-10 |

USD INDEX - ICE FUTURES U.S. |

-36.5 |

35.4 |

-1.414521 |

1.344824 |

3.7 |

Balanced |

1.1 |

False |

False |

False |

None |

Long_Build |

3.7 |

False |

False |

False |

False |

Hedgers_Deep_Long |

True |

False |

Bullish_Reversal_Risk |

Balanced_Long_Bias |

2.759346 |

1 |

High_Tension_Low_Flags |

NaN |

NaN |

NaN |

NaN |

Other |

Unknown |

Other / Unknown |

10.702341 |

-15627 |

15172 |

False |

True |

legacy |

USD INDEX - ICE FUTURES U.S. |

098662 |

1.0 |

98.0 |

False |

True |

1 |

0.035240 |

| 197 |

2025-11-18 |

USD INDEX - ICE FUTURES U.S. |

-36.3 |

34.1 |

-1.359372 |

1.252009 |

7.1 |

Balanced |

2.2 |

False |

False |

False |

None |

Long_Build |

7.1 |

False |

False |

False |

False |

Hedgers_Deep_Long |

True |

False |

Bullish_Reversal_Risk |

Balanced_Long_Bias |

2.611381 |

1 |

High_Tension_Low_Flags |

NaN |

NaN |

NaN |

NaN |

Other |

Unknown |

Other / Unknown |

10.925307 |

-16108 |

15131 |

False |

True |

legacy |

USD INDEX - ICE FUTURES U.S. |

098662 |

1.0 |

98.0 |

False |

True |

1 |

0.036015 |

| 198 |

2025-11-25 |

USD INDEX - ICE FUTURES U.S. |

-34.7 |

33.7 |

-1.255897 |

1.198515 |

11.4 |

Balanced |

1.0 |

False |

False |

False |

None |

Long_Build |

11.4 |

False |

False |

False |

False |

Hedgers_Deep_Long |

True |

False |

Bullish_Reversal_Risk |

Balanced_Long_Bias |

2.454411 |

1 |

High_Tension_Low_Flags |

NaN |

NaN |

NaN |

NaN |

Other |

Unknown |

Other / Unknown |

12.709030 |

-16347 |

15883 |

False |

True |

legacy |

USD INDEX - ICE FUTURES U.S. |

098662 |

1.0 |

98.0 |

False |

True |

1 |

0.032690 |

| 199 |

2025-12-02 |

USD INDEX - ICE FUTURES U.S. |

-37.0 |

35.2 |

-1.302410 |

1.215718 |

-1.2 |

Balanced |

1.8 |

False |

False |

False |

None |

Long_Reduction |

-1.2 |

False |

False |

False |

False |

Hedgers_Deep_Long |

False |

False |

No_Clear_Reversal |

Balanced_Short_Bias |

2.518128 |

0 |

High_Tension_Low_Flags |

NaN |

NaN |

NaN |

NaN |

Other |

Unknown |

Other / Unknown |

10.144928 |

-16218 |

15404 |

False |

True |

legacy |

USD INDEX - ICE FUTURES U.S. |

098662 |

1.0 |

98.0 |

False |

True |

0 |

0.033163 |

| 200 |

2025-12-09 |

USD INDEX - ICE FUTURES U.S. |

-32.3 |

31.7 |

-1.091150 |

1.052211 |

4.2 |

Balanced |

0.6 |

False |

False |

False |

None |

Long_Build |

4.2 |

False |

False |

False |

False |

Hedgers_Deep_Long |

True |

False |

Bullish_Reversal_Risk |

Balanced_Long_Bias |

2.143361 |

1 |

High_Tension_Low_Flags |

NaN |

NaN |

NaN |

NaN |

Other |

Unknown |

Other / Unknown |

15.384615 |

-13874 |

13628 |

False |

True |

legacy |

USD INDEX - ICE FUTURES U.S. |

098662 |

1.0 |

98.0 |

False |

True |

1 |

0.030882 |

| 201 |

2025-12-16 |

USD INDEX - ICE FUTURES U.S. |

-17.0 |

19.2 |

-0.488620 |

0.560006 |

19.3 |

Balanced |

-2.2 |

False |

False |

False |

None |

Long_Build |

19.3 |

False |

False |

False |

False |

Hedgers_Neutral |

False |

False |

No_Clear_Reversal |

Balanced_Long_Bias |

1.048626 |

0 |

Normal |

NaN |

NaN |

NaN |

NaN |

Other |

Unknown |

Other / Unknown |

32.441472 |

-4595 |

5189 |

False |

False |

legacy |

USD INDEX - ICE FUTURES U.S. |

098662 |

1.0 |

98.0 |

False |

False |

0 |

0.025533 |

| 202 |

2025-12-23 |

USD INDEX - ICE FUTURES U.S. |

-14.3 |

16.9 |

-0.366098 |

0.450491 |

20.4 |

Balanced |

-2.6 |

False |

False |

False |

None |

Long_Build |

20.4 |

False |

False |

False |

False |

Hedgers_Neutral |

False |

False |

No_Clear_Reversal |

Balanced_Long_Bias |

0.816589 |

0 |

Normal |

NaN |

NaN |

NaN |

NaN |

Other |

Unknown |

Other / Unknown |

35.451505 |

-4021 |

4777 |

False |

False |

legacy |

USD INDEX - ICE FUTURES U.S. |

098662 |

1.0 |

98.0 |

False |

False |

0 |

0.026658 |

| 203 |

2025-12-30 |

USD INDEX - ICE FUTURES U.S. |

-13.6 |

15.8 |

-0.319275 |

0.386220 |

23.4 |

Balanced |

-2.2 |

False |

False |

False |

None |

Long_Build |

23.4 |

False |

False |

False |

False |

Hedgers_Neutral |

False |

False |

No_Clear_Reversal |

Balanced_Long_Bias |

0.705496 |

0 |

Normal |

NaN |

NaN |

NaN |

NaN |

Other |

Unknown |

Other / Unknown |

36.231884 |

-3960 |

4588 |

False |

False |

legacy |

USD INDEX - ICE FUTURES U.S. |

098662 |

1.0 |

98.0 |

False |

False |

0 |

0.025810 |

| 204 |

2026-01-06 |

USD INDEX - ICE FUTURES U.S. |

-12.7 |

14.6 |

-0.263235 |

0.316781 |

19.6 |

Balanced |

-1.9 |

False |

False |

False |

None |

Long_Build |

19.6 |

False |

False |

False |

False |

Hedgers_Neutral |

False |

False |

No_Clear_Reversal |

Balanced_Long_Bias |

0.580016 |

0 |

Normal |

NaN |

NaN |

NaN |

NaN |

Other |

Unknown |

Other / Unknown |

37.235229 |

-3831 |

4398 |

False |

False |

legacy |

USD INDEX - ICE FUTURES U.S. |

098662 |

1.0 |

98.0 |

False |

False |

0 |

0.027334 |

| 205 |

2026-01-13 |

USD INDEX - ICE FUTURES U.S. |

-12.5 |

12.6 |

-0.229241 |

0.212009 |

4.5 |

Balanced |

-0.1 |

False |

False |

False |

None |

Long_Build |

4.5 |

False |

False |

False |

False |

Hedgers_Neutral |

False |

False |

No_Clear_Reversal |

Balanced_Long_Bias |

0.441250 |

0 |

Normal |

NaN |

NaN |

NaN |

NaN |

Other |

Unknown |

Other / Unknown |

37.458194 |

-3730 |

3739 |

False |

False |

legacy |

USD INDEX - ICE FUTURES U.S. |

098662 |

1.0 |

98.0 |

False |

False |

0 |

0.043395 |

| 206 |

2026-01-20 |

USD INDEX - ICE FUTURES U.S. |

-21.7 |

21.3 |

-0.561709 |

0.522963 |

-7.4 |

Balanced |

0.4 |

False |

False |

False |

None |

Long_Reduction |

-7.4 |

False |

False |

False |

False |

Hedgers_Neutral |

False |

False |

No_Clear_Reversal |

Balanced_Short_Bias |

1.084672 |

0 |

Normal |

NaN |

NaN |

NaN |

NaN |

Other |

Unknown |

Other / Unknown |

27.201784 |

-6418 |

6305 |

False |

False |

legacy |

USD INDEX - ICE FUTURES U.S. |

098662 |

1.0 |

98.0 |

False |

False |

0 |

0.047901 |