| 197 |

2025-10-14 |

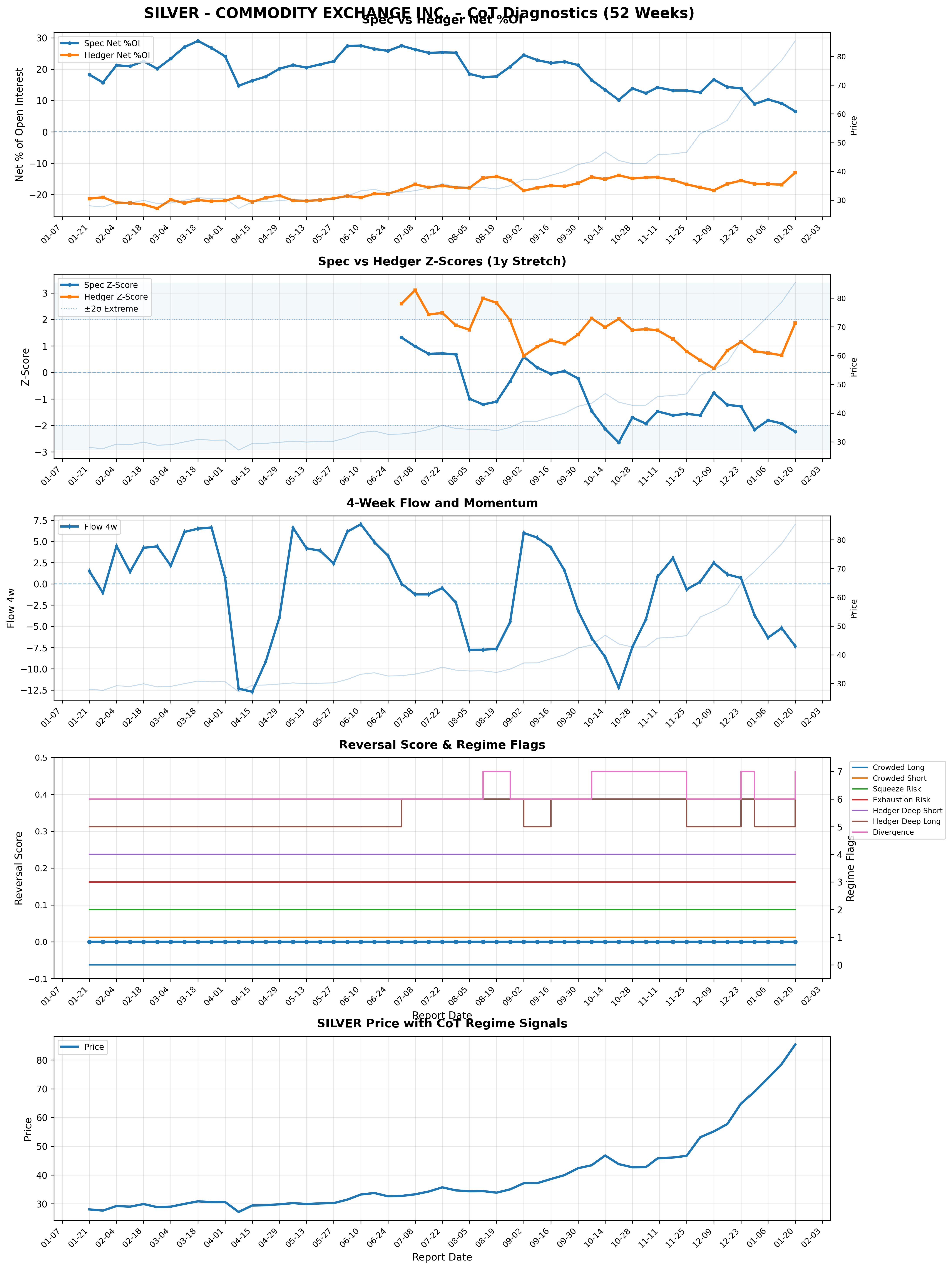

SILVER - COMMODITY EXCHANGE INC. |

13.361946 |

-15.087434 |

-2.127949 |

1.710174 |

-8.611126 |

Balanced |

-1.725488 |

True |

False |

True |

Spec_Extreme_Short |

Long_Reduction |

-8.611126 |

False |

False |

False |

False |

Hedgers_Deep_Long |

False |

False |

No_Clear_Reversal |

Balanced_Short_Bias |

3.838122 |

1 |

High_Tension_Low_Flags |

084691 |

CMX |

1.0 |

84.0 |

Other |

Unknown |

Other / Unknown |

0.000000 |

23038 |

-26013 |

False |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

True |

0 |

46.799999 |

| 198 |

2025-10-21 |

SILVER - COMMODITY EXCHANGE INC. |

10.159487 |

-13.865115 |

-2.641603 |

2.024384 |

-12.215592 |

Balanced |

-3.705628 |

True |

True |

True |

Spec_Extreme_Short |

Long_Reduction |

-12.215592 |

False |

False |

False |

False |

Hedgers_Deep_Long |

False |

False |

No_Clear_Reversal |

Balanced_Short_Bias |

4.665987 |

1 |

High_Tension_Low_Flags |

084691 |

CMX |

1.0 |

84.0 |

Other |

Unknown |

Other / Unknown |

0.000000 |

17212 |

-23490 |

False |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

True |

0 |

43.790001 |

| 199 |

2025-10-28 |

SILVER - COMMODITY EXCHANGE INC. |

13.843742 |

-14.868478 |

-1.702667 |

1.599474 |

-7.470735 |

Balanced |

-1.024737 |

False |

False |

False |

None |

Long_Reduction |

-7.470735 |

False |

False |

False |

False |

Hedgers_Deep_Long |

False |

False |

No_Clear_Reversal |

Balanced_Short_Bias |

3.302140 |

0 |

High_Tension_Low_Flags |

084691 |

CMX |

1.0 |

84.0 |

Other |

Unknown |

Other / Unknown |

19.540451 |

21899 |

-23520 |

False |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

True |

0 |

42.700001 |

| 200 |

2025-11-04 |

SILVER - COMMODITY EXCHANGE INC. |

12.338896 |

-14.561018 |

-1.931070 |

1.633288 |

-4.175995 |

Balanced |

-2.222122 |

False |

False |

False |

None |

Long_Reduction |

-4.175995 |

False |

False |

False |

False |

Hedgers_Deep_Long |

False |

False |

No_Clear_Reversal |

Balanced_Short_Bias |

3.564358 |

0 |

High_Tension_Low_Flags |

084691 |

CMX |

1.0 |

84.0 |

Other |

Unknown |

Other / Unknown |

11.559091 |

19157 |

-22607 |

False |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

True |

0 |

42.740002 |

| 201 |

2025-11-10 |

SILVER - COMMODITY EXCHANGE INC. |

14.190505 |

-14.484901 |

-1.470464 |

1.592584 |

0.828559 |

Balanced |

-0.294396 |

False |

False |

False |

None |

Long_Build |

0.828559 |

False |

False |

False |

False |

Hedgers_Deep_Long |

False |

False |

No_Clear_Reversal |

Balanced_Long_Bias |

3.063048 |

0 |

High_Tension_Low_Flags |

084691 |

CMX |

1.0 |

84.0 |

Other |

Unknown |

Other / Unknown |

21.379607 |

22655 |

-23125 |

False |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

True |

0 |

45.790001 |

| 202 |

2025-11-18 |

SILVER - COMMODITY EXCHANGE INC. |

13.199387 |

-15.363841 |

-1.617233 |

1.262691 |

3.039900 |

Balanced |

-2.164454 |

False |

False |

False |

None |

Long_Build |

3.039900 |

False |

False |

False |

False |

Hedgers_Deep_Long |

False |

False |

No_Clear_Reversal |

Balanced_Long_Bias |

2.879924 |

0 |

High_Tension_Low_Flags |

084691 |

CMX |

1.0 |

84.0 |

Other |

Unknown |

Other / Unknown |

16.122938 |

20234 |

-23552 |

False |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

True |

0 |

46.099998 |

| 203 |

2025-11-25 |

SILVER - COMMODITY EXCHANGE INC. |

13.187262 |

-16.737811 |

-1.559542 |

0.794198 |

-0.656480 |

Balanced |

-3.550550 |

False |

False |

False |

None |

Long_Reduction |

-0.656480 |

False |

False |

False |

False |

Hedgers_Neutral |

False |

False |

No_Clear_Reversal |

Balanced_Short_Bias |

2.353739 |

0 |

High_Tension_Low_Flags |

084691 |

CMX |

1.0 |

84.0 |

Other |

Unknown |

Other / Unknown |

16.058630 |

19061 |

-24193 |

False |

False |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

False |

0 |

46.669998 |

| 204 |

2025-12-02 |

SILVER - COMMODITY EXCHANGE INC. |

12.579559 |

-17.727671 |

-1.621394 |

0.459695 |

0.240663 |

Hedgers |

-5.148112 |

False |

False |

False |

None |

Long_Build |

0.240663 |

False |

False |

False |

False |

Hedgers_Neutral |

False |

False |

No_Clear_Reversal |

Hedger_Covering |

2.081089 |

0 |

High_Tension_Low_Flags |

084691 |

CMX |

1.0 |

84.0 |

Other |

Unknown |

Other / Unknown |

12.835511 |

18974 |

-26739 |

False |

False |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

False |

0 |

53.130001 |

| 205 |

2025-12-09 |

SILVER - COMMODITY EXCHANGE INC. |

16.654605 |

-18.633127 |

-0.773225 |

0.154980 |

2.464100 |

Balanced |

-1.978522 |

False |

False |

False |

None |

Long_Build |

2.464100 |

False |

False |

False |

False |

Hedgers_Neutral |

False |

False |

No_Clear_Reversal |

Balanced_Long_Bias |

0.928205 |

0 |

Normal |

084691 |

CMX |

1.0 |

84.0 |

Other |

Unknown |

Other / Unknown |

34.448633 |

25775 |

-28837 |

False |

False |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

False |

0 |

55.169998 |

| 206 |

2025-12-16 |

SILVER - COMMODITY EXCHANGE INC. |

14.312619 |

-16.592227 |

-1.223455 |

0.830603 |

1.113232 |

Balanced |

-2.279608 |

False |

False |

False |

None |

Long_Build |

1.113232 |

False |

False |

False |

False |

Hedgers_Neutral |

False |

False |

No_Clear_Reversal |

Balanced_Long_Bias |

2.054058 |

0 |

High_Tension_Low_Flags |

084691 |

CMX |

1.0 |

84.0 |

Other |

Unknown |

Other / Unknown |

22.027269 |

21887 |

-25373 |

False |

False |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

False |

0 |

57.730000 |

| 207 |

2025-12-23 |

SILVER - COMMODITY EXCHANGE INC. |

13.877079 |

-15.560337 |

-1.278259 |

1.153254 |

0.689817 |

Balanced |

-1.683257 |

False |

False |

False |

None |

Long_Build |

0.689817 |

False |

False |

False |

False |

Hedgers_Deep_Long |

False |

False |

No_Clear_Reversal |

Balanced_Long_Bias |

2.431512 |

0 |

High_Tension_Low_Flags |

084691 |

CMX |

1.0 |

84.0 |

Other |

Unknown |

Other / Unknown |

19.717265 |

21608 |

-24229 |

False |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

True |

0 |

64.839996 |

| 208 |

2025-12-30 |

SILVER - COMMODITY EXCHANGE INC. |

8.900128 |

-16.566386 |

-2.161632 |

0.800370 |

-3.679431 |

Hedgers |

-7.666258 |

True |

False |

True |

Spec_Extreme_Short |

Long_Reduction |

-3.679431 |

False |

False |

False |

False |

Hedgers_Neutral |

False |

False |

No_Clear_Reversal |

Hedger_Adding_Short |

2.962003 |

1 |

High_Tension_Low_Flags |

084691 |

CMX |

1.0 |

84.0 |

Other |

Unknown |

Other / Unknown |

0.000000 |

14008 |

-26074 |

False |

False |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

False |

0 |

68.980003 |

| 209 |

2026-01-06 |

SILVER - COMMODITY EXCHANGE INC. |

10.324980 |

-16.669930 |

-1.804998 |

0.734203 |

-6.329625 |

Hedgers |

-6.344949 |

False |

False |

False |

None |

Long_Reduction |

-6.329625 |

False |

False |

False |

False |

Hedgers_Neutral |

False |

False |

No_Clear_Reversal |

Hedger_Adding_Short |

2.539201 |

0 |

High_Tension_Low_Flags |

084691 |

CMX |

1.0 |

84.0 |

Other |

Unknown |

Other / Unknown |

7.083934 |

15822 |

-25545 |

False |

False |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

False |

0 |

73.709999 |

| 210 |

2026-01-13 |

SILVER - COMMODITY EXCHANGE INC. |

9.102849 |

-16.837499 |

-1.925240 |

0.647423 |

-5.209770 |

Hedgers |

-7.734650 |

False |

False |

False |

None |

Long_Reduction |

-5.209770 |

False |

False |

False |

False |

Hedgers_Neutral |

False |

False |

No_Clear_Reversal |

Hedger_Adding_Short |

2.572663 |

0 |

High_Tension_Low_Flags |

084691 |

CMX |

1.0 |

84.0 |

Other |

Unknown |

Other / Unknown |

1.007870 |

13792 |

-25511 |

False |

False |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

False |

0 |

78.599998 |

| 211 |

2026-01-20 |

SILVER - COMMODITY EXCHANGE INC. |

6.542560 |

-12.995658 |

-2.235587 |

1.866029 |

-7.334519 |

Hedgers |

-6.453098 |

True |

False |

True |

Spec_Extreme_Short |

Long_Reduction |

-7.334519 |

False |

False |

False |

False |

Hedgers_Deep_Long |

False |

False |

No_Clear_Reversal |

Hedger_Adding_Short |

4.101616 |

1 |

High_Tension_Low_Flags |

084691 |

CMX |

1.0 |

84.0 |

Other |

Unknown |

Other / Unknown |

0.000000 |

9946 |

-19756 |

False |

True |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

True |

0 |

85.389999 |