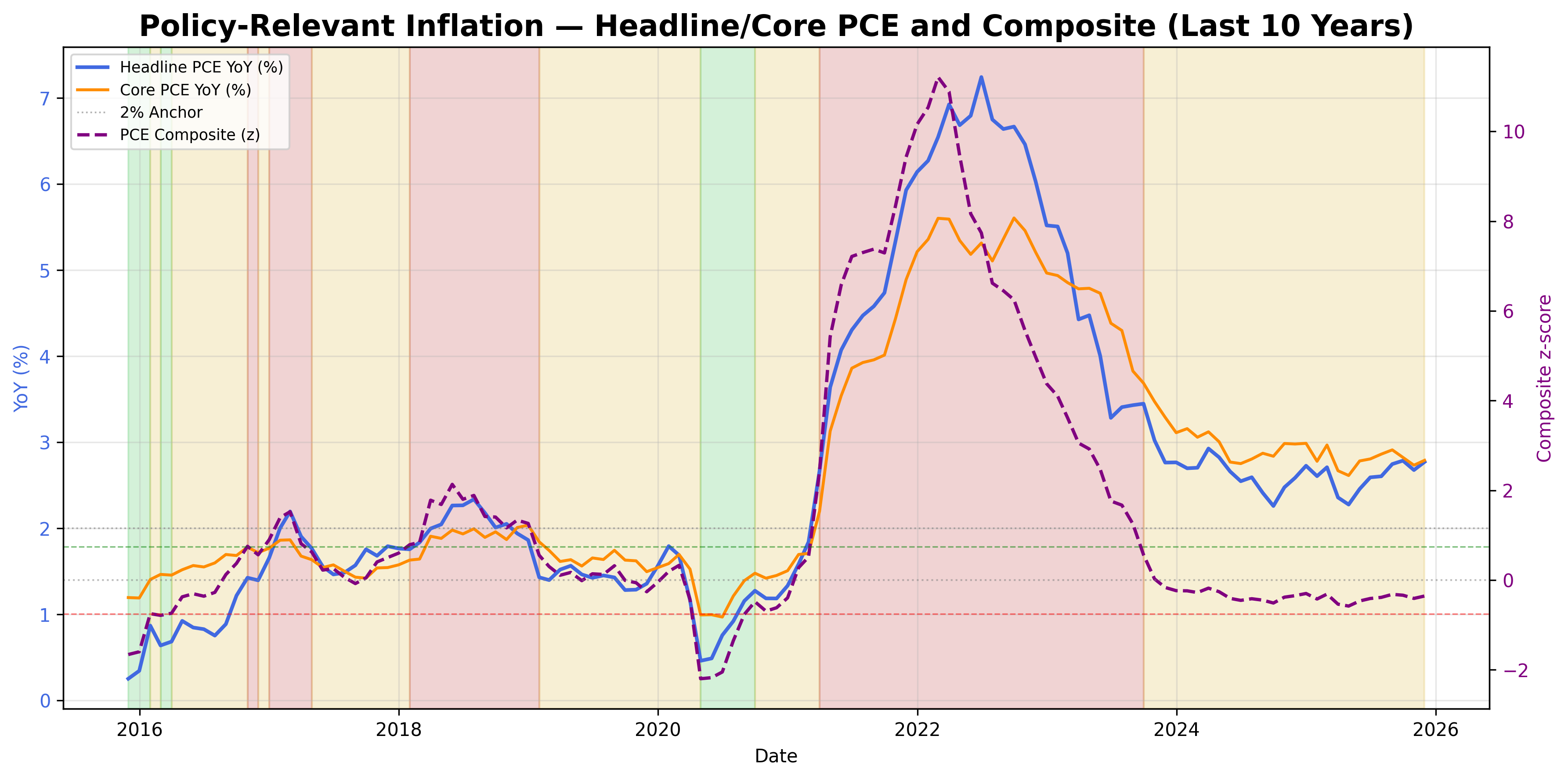

Policy-Relevant Inflation (PCE) Signal

Policy-relevant inflation: composite of headline and core PCE.

Gemini Summary

Signal Summary:

- The Policy-Relevant Inflation (PCE) signal indicates a "Neutral" regime, with the composite Z-score at -0.346 on 2025-11-30 (1). This state suggests inflation is near its trend, maintaining a stable position within the defined thresholds.

- Conviction Band: Medium | Interpretation Confidence: High Confidence | Internal Conflict Flag: No.

Key Dynamics:

- The composite PCE signal remains in a "Neutral" regime, driven by both headline PCE and core PCE year-over-year robust Z-scores being within the ±0.75 thresholds (1).

- On 2025-11-30, the headline PCE Z-score was -0.368 and the core PCE Z-score was -0.324, both indicating below-trend inflation pressure but not in a "Cool" regime (1).

- The signal has shown a slight downward momentum since March 2024, indicating easing pressure, but remains firmly within the "Neutral" band.

- Conditional Invalidation: A sustained rise in the PCE_Composite above +0.75 (triggering a "Hot" regime) or a fall below -0.75 (triggering a "Cool" regime) would invalidate this neutral interpretation (1).

Scenario Balance:

- Base Case dominant: Inflation remains "Neutral," with PCE and core PCE year-over-year growth rates hovering around their historical trend levels (1).

- Upside secondary: A re-acceleration of demand or significant supply-side shocks could push inflation into a "Hot" regime.

- Downside residual: A pronounced weakening of economic activity could drive PCE_Composite towards a "Cool" inflation regime.

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months) – The signal, based on monthly year-over-year changes, captures medium-term inflation trends (1).

- Aggregation Weight Hint: High – This signal is crucial for assessing monetary policy and overall macro conditions due to its direct relevance to the Federal Reserve's mandate.

Macro Relevance:

- Macro dimension informed: Pricing (1).

- Cycle position: Mid-cycle, characterized by moderating inflation pressures after an initial surge.

- Typical interaction with other macro signals: Strongly influences monetary conditions and Federal Reserve policy decisions (2)(3), and is a key input for the broader US macro regime assessment (4).

Data & References:

- Personal Consumption Expenditures: Chain-Type Price Index (PCEPI), latest 2025-11-30 (1).

- Personal Consumption Expenditures Excluding Food and Energy (PCEPILFE), latest 2025-11-30 (1).

- The PCE_Composite value of -0.346 on 2025-11-30 and its component Z-scores were most influential (1).

- Additional public datasets that would improve depth or reliability: Wage Growth and Inflation Signal (5) and Market Implied Inflation Signal (6).

Policy-Relevant Inflation (PCE) Chart

Equal-weight composite of headline and core PCE, scaled into a policy-relevant inflation index.