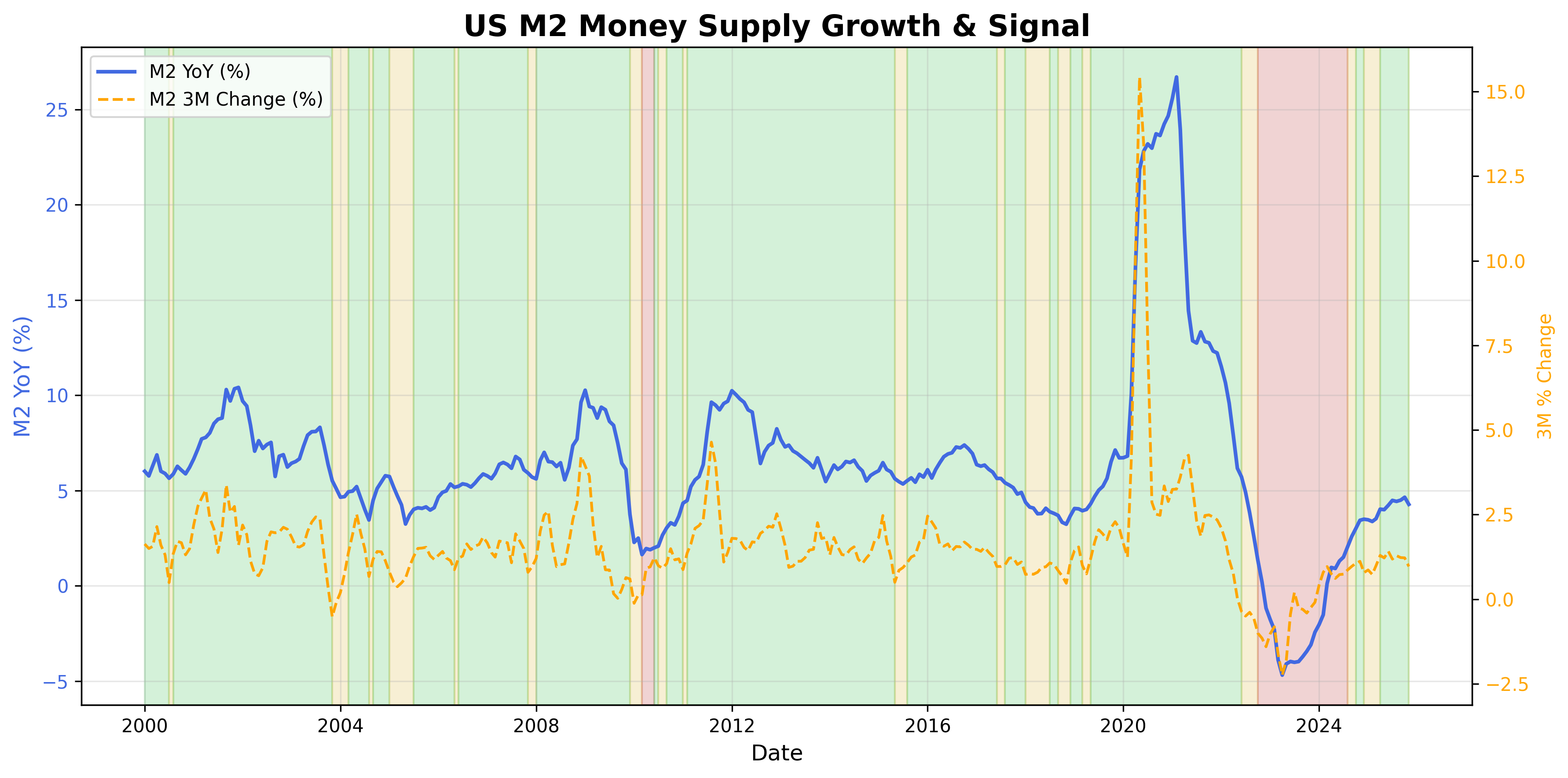

M2 Money Supply Signal

M2 money supply growth as a broad liquidity indicator.

Gemini Summary

Signal Summary:

- The M2 Money Supply signal currently indicates a Bullish liquidity regime as of 2025-11-01, driven by positive 3-month momentum. However, this state appears transient, with the signal projected to transition to Neutral in 2025-12-01.

- Conviction Band: Medium, Interpretation Confidence: High Confidence, Internal Conflict Flag: No.

Key Dynamics:

- The current Bullish classification for 2025-11-01 stems from the 3-month change in M2 Money Stock (M2SL) being 1.12%, which is just above the 1.0% acceleration threshold (1).

- The year-over-year growth rate stands at 3.44%, which is below the 6.0% high growth threshold (1).

- Momentum indicates weakening, as the 3-month change is projected to drop to 0.79% for 2025-12-01, causing a shift to a Neutral regime.

- Conditional Invalidation: A sustained drop in the 3-month M2 growth rate below 1.0% would invalidate the Bullish signal, moving it to Neutral or Bearish if further deceleration occurs (1).

Scenario Balance:

- Base Case dominant: Neutral liquidity conditions with moderating momentum are expected to prevail as the 3-month growth rate normalizes.

- Upside secondary: M2 3-month momentum re-accelerates above 1.0%, or year-over-year growth exceeds 6.0%.

- Downside residual: M2 year-over-year growth falls below 2.0%, or 3-month momentum drops below -1.0%, indicating significant liquidity contraction (1).

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months), reflecting the medium-term impact of money supply trends on economic activity and asset markets.

- Aggregation Weight Hint: Medium, given M2 is a foundational liquidity indicator but its current Bullish signal is fragile and near a regime shift.

Macro Relevance:

- This signal primarily informs the Liquidity dimension of the macro environment.

- The transition from Bullish to Neutral suggests a shift from an expansive to a more stable or moderately contracting liquidity phase, potentially signaling a mid-to-late cycle liquidity environment.

- It typically interacts with other macro signals by influencing risk-on/off sentiment, particularly for metals and cyclical assets, and serves as an input to broader liquidity composites (1).

Data & References:

- M2 Money Stock (FRED: M2SL), latest observation 2025-11-01.

- The `M2SL_YoY` (3.44%) and `M2SL_3Month_Change` (1.12%) values were most influential for the current Bullish state.

- Additional public datasets that would improve depth or reliability include the velocity of M2 money stock and commercial bank credit growth.

M2 Money Supply Chart

Growth in U.S. M2 money supply as a proxy for system-wide liquidity.