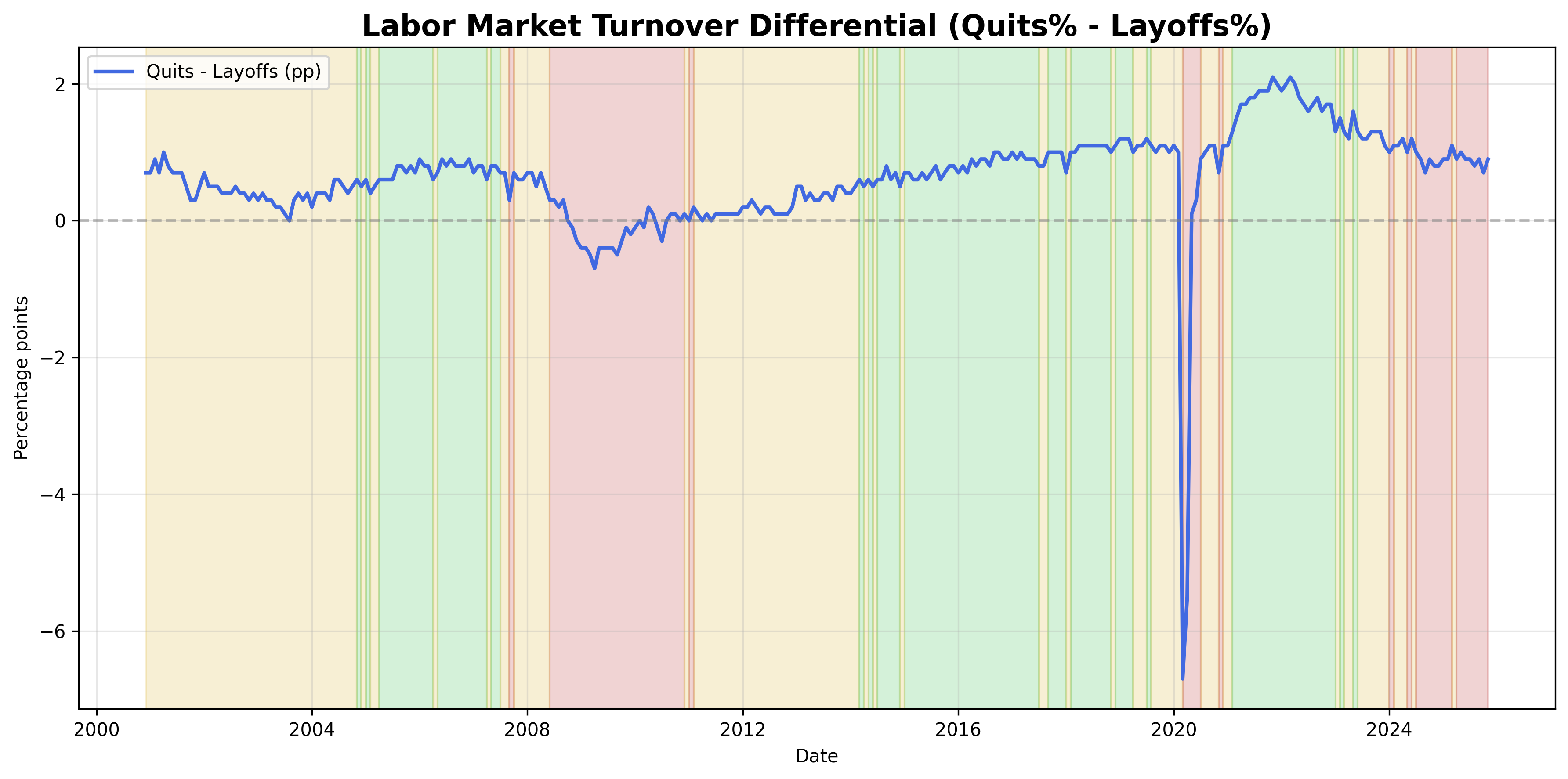

Labor Market Turnover Signal

Hiring, quits, and separations as a labor market tightness signal.

Gemini Summary

Signal Summary:

- The Labor Market Turnover Differential signal is currently in a Bearish regime as of November 2025 (1). This indicates a softening in labor market conditions.

- Conviction Band: Low, Interpretation Confidence: Mixed Signals, Internal Conflict Flag: Yes.

Key Dynamics:

- The quits rate (2.0%) still exceeds the layoff rate (1.1%), yielding a positive raw differential of 0.9 percentage points for 2025-11-01.

- However, the robust z-score of this differential has fallen to -0.67, crossing the -0.50 threshold that triggers a Bearish classification.

- This suggests weakening worker confidence and declining labor market dynamism, despite quits still outpacing layoffs on an absolute basis.

- Conditional Invalidation: The robust z-score of the turnover differential rises above -0.50, which would transition the signal to a Neutral regime.

Scenario Balance:

- Base Case dominant: Continued labor market softening with the z-score remaining below -0.50, reflecting ongoing declines in worker confidence.

- Downside secondary: The raw turnover differential turns negative, or the z-score drops further below -1.0, signaling significant labor market deterioration.

- Upside residual: The robust z-score rebounds above -0.50 due to an unexpected surge in quits or a further fall in layoffs, shifting the signal to Neutral.

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months), as it tracks shifts in labor market dynamics that evolve over several months and are relevant to business cycle phases.

- Aggregation Weight Hint: Medium, given its importance as a labor market barometer; however, the internal conflict between the raw level and z-score suggests careful weighting.

Macro Relevance:

- This signal primarily informs the US Labour Market dimension, indicating shifts in tightness or slack and reflecting worker sentiment.

- A Bearish reading often signifies a mid-to-late cycle phase, preceding broader economic slowdowns or increased recession risk.

- It typically interacts with other labor market indicators (e.g., job openings, unemployment rate) and consumption data, potentially confirming a broader easing trend.

Data & References:

- JTSQUR: Quits Rate (2.0%, 2025-11-01).

- JTSLDR: Layoffs & Discharges Rate (1.1%, 2025-11-01).

- The `Turnover_Diff_z` (-0.67) is the most influential datapoint for the current Bearish regime, with `Turnover_Diff_pp` (0.9) providing important context.

- Additional public datasets that would improve depth: Employment Composition Signal (2) and Labor Market Tightness Signal (3).

Labor Market Turnover Chart

Labor turnover and labor market fluidity.