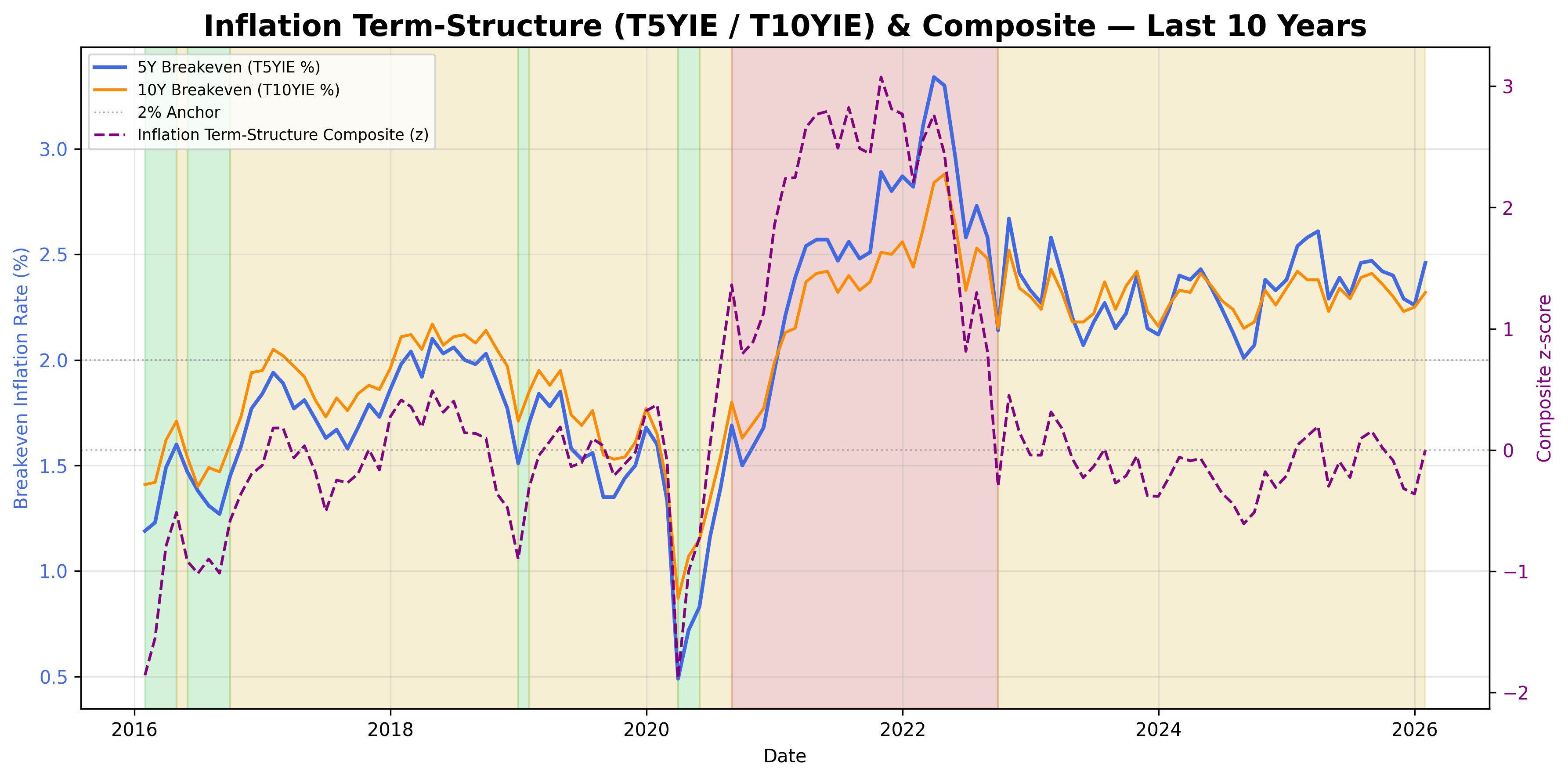

Inflation Term-Structure Signal

Inflation term-structure: breakevens and real yields across the 5–10 year horizon.

Gemini Summary

Signal Summary:

- The Inflation Term-Structure signal currently indicates a Neutral regime, with the composite value at 0.001376 as of January 31, 2026. This reflects a stable inflation expectations outlook, consistent across recent observations.

- Conviction Band: Low | Interpretation Confidence: High Confidence | Internal Conflict Flag: No

Key Dynamics:

- The neutral state is driven by the 5-year breakeven inflation rate (T5YIE) z-score (0.202347), 10-year breakeven inflation rate (T10YIE) z-score (-0.107919), and the inverted 10-year TIPS real yield (DFII10) z-score (-0.157292) (1).

- These components are near their historical medians, resulting in a composite value close to zero.

- Conditional Invalidation: A sustained move of the composite above +0.75 (reflation) or below -0.75 (disinflation) would reverse this neutral interpretation (1).

Scenario Balance:

- Base Case dominant: Continued neutral inflation term-structure, supported by stable, moderate market inflation expectations and real yields.

- Upside secondary: A significant and sustained rise in market-implied breakeven inflation rates, potentially from stronger growth or increased liquidity, pushing the composite into a "Reflation" regime.

- Downside residual: A notable decline in breakeven rates or a sharp increase in real yields, indicating disinflationary pressures, shifting the composite into a "Disinflation" regime.

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months). This signal uses month-end data and robust rolling z-scores, designed to capture medium-term trends rather than short-term fluctuations (1).

- Aggregation Weight Hint: Low. The signal's current neutral stance and low conviction suggest a minor influence on overall macro composites, serving more as a cross-check.

Macro Relevance:

- Macro dimension informed: Pricing (inflation expectations) and Monetary Conditions (real yields) (1).

- Cycle position: Mid-cycle, reflecting a balanced state where inflationary pressures are neither accelerating nor decelerating significantly.

- Typical interaction with other macro signals: Pairs well with liquidity and activity signals for broader regime classification, and can condition inflation-sensitive asset tilts (1).

Data & References:

- T5YIE (FRED), T10YIE (FRED), DFII10 (FRED); last observation date: 2026-01-31.

- The z-scores for T5YIE (0.202347), T10YIE (-0.107919), and -DFII10 (-0.157292) are the most influential for the current neutral state.

- Weekly inflation expectations or higher-frequency real rates could improve depth for tactical analysis (1).

Inflation Term-Structure Chart

Inflation term-structure composite from 5y/10y breakevens and 10y real yields.