Global Risk-On / Risk-Off Positioning Tone

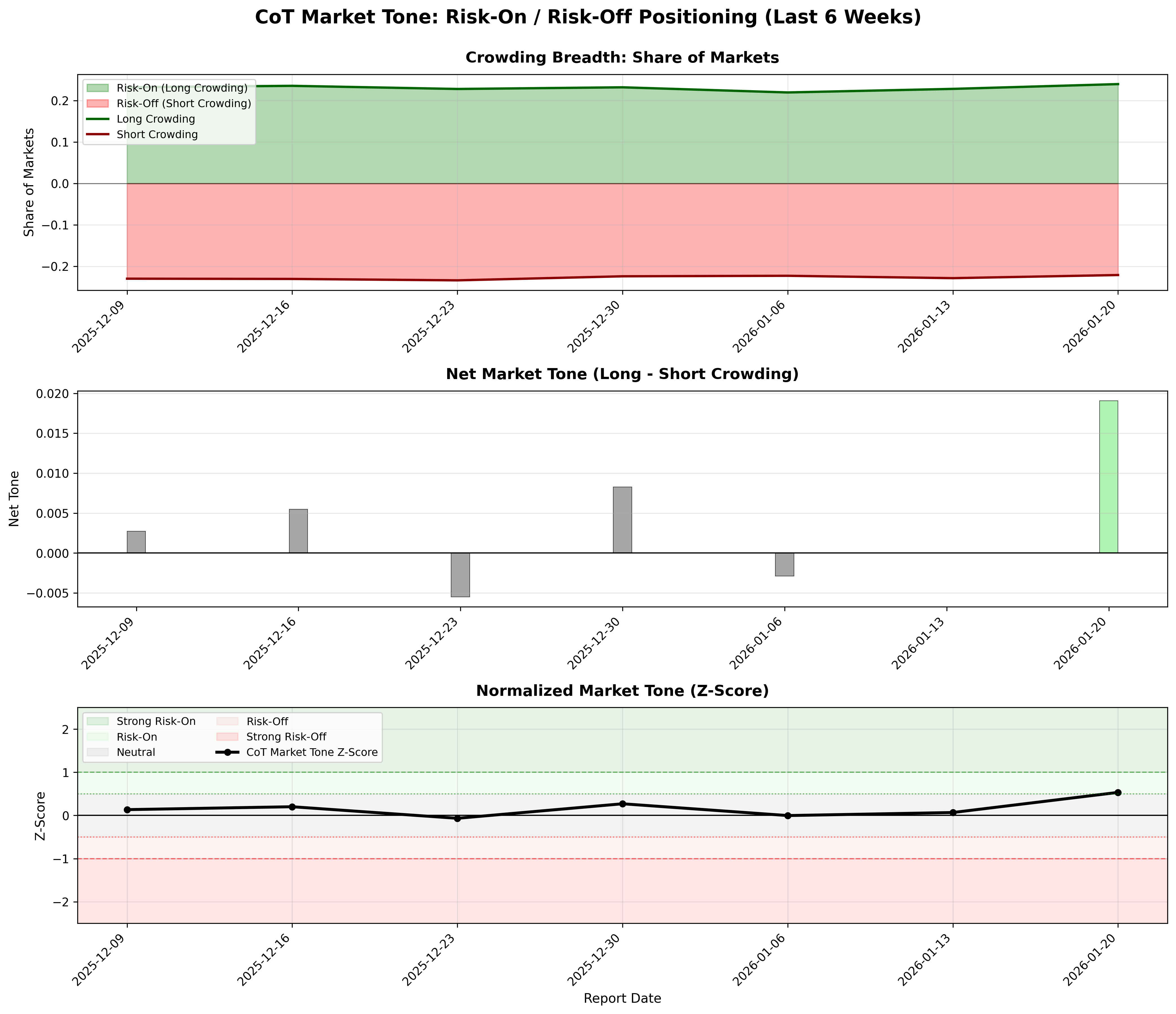

CoT market tone: risk-on vs risk-off positioning.

Gemini Summary

Signal Summary:

- The CoT Market Tone signal is currently in a "Risk-On" regime as of 2026-01-20 (1).

- This indicates an expansion of speculative appetite.

- Conviction Band: Medium, Interpretation Confidence: High Confidence, Internal Conflict Flag: No.

Key Dynamics:

- The `net_tone` metric, representing the difference between crowded long and crowded short shares, registered 0.019074 (1).

- This positive shift pushed the robust z-score to 0.533811, moving the signal from "Neutral" to "Risk-On" (1).

- No internal offsets or tensions are observed.

- Conditional Invalidation: The "Risk-On" interpretation would be invalidated if the CoT Market Tone robust z-score falls below 0.5.

Scenario Balance:

- Base Case dominant: Continued "Risk-On" sentiment, supported by sustained positive net speculative positioning.

- Upside secondary: A transition to "Strong Risk-On", driven by further relative increases in crowded long positions.

- Downside residual: A reversion to "Neutral" or "Risk-Off" if net long crowding diminishes significantly.

Time Horizon & Aggregation:

- Time Horizon: Tactical (weeks), reflecting near-term shifts in speculative positioning from weekly CoT data (1).

- Aggregation Weight Hint: Medium, as this signal is a valuable gauge of broad speculative sentiment and tactical market shifts.

Macro Relevance:

- This signal primarily informs macro dimensions of Sentiment and Liquidity.

- It is sensitive to shifts across all cycle positions.

- It typically interacts with volatility signals (2) or credit conditions (3) to confirm risk regime transitions and contributes to cross-asset positioning composites (4).

Data & References:

Market Tone Chart

Risk-on / risk-off crowding and tone by market breadth.