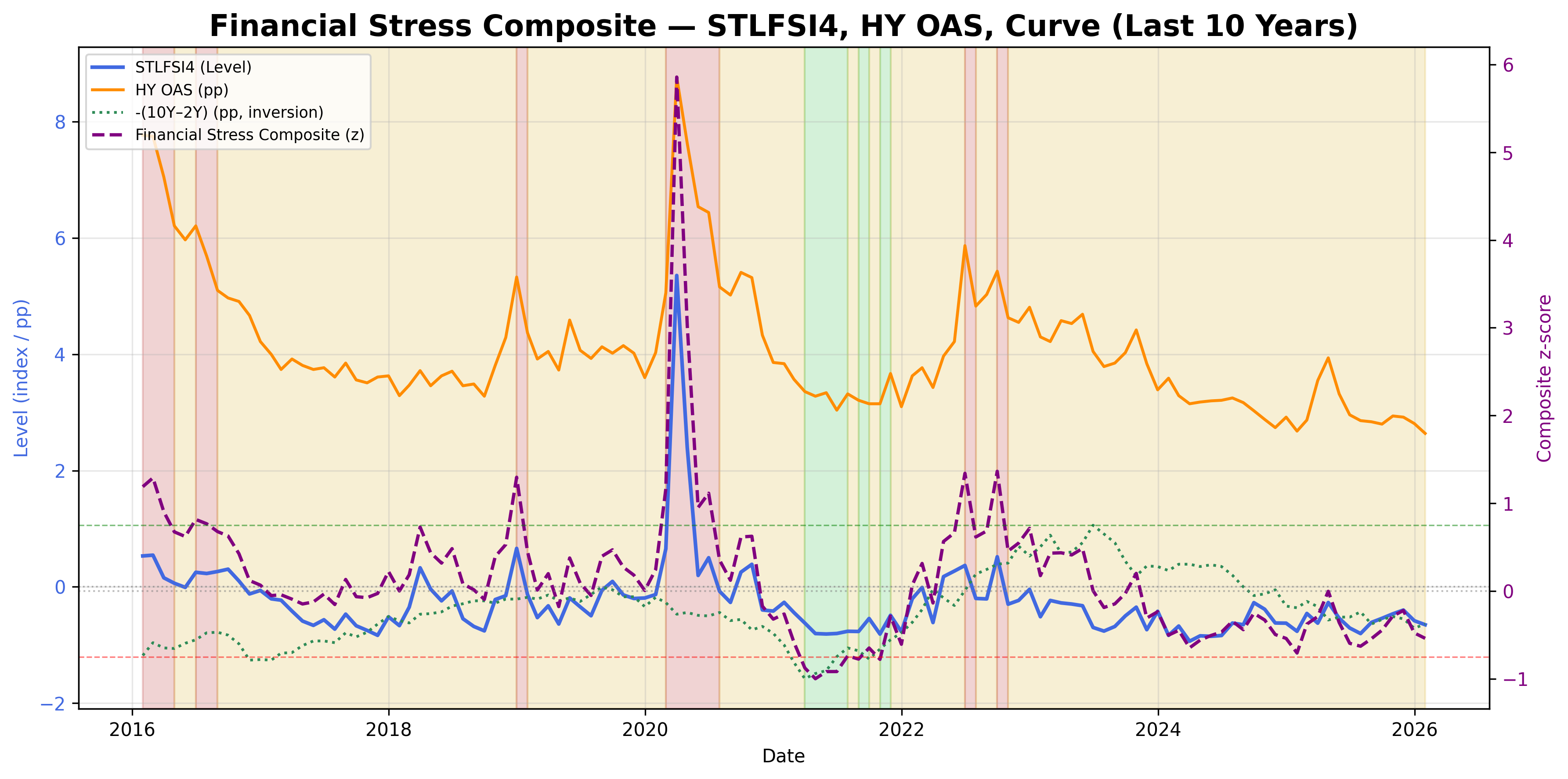

Financial Stress Composite Signal

Systemic stress from credit spreads, curve inversion, and financial conditions.

Gemini Summary

Signal Summary:

- The Financial Stress Composite signal (1) indicates a persistent Neutral regime for financial stress, with the composite z-score at -0.539072 as of 2026-01-31.

- This represents stable and normal functioning of credit and funding markets, showing a continued easing trend from prior periods.

- Conviction Band: Medium | Interpretation Confidence: High Confidence | Internal Conflict Flag: No.

Key Dynamics:

- The St. Louis Fed Financial Stress Index (STLFSI4) z-score is -0.240368 (1), indicating subdued systemic stress.

- High-yield option-adjusted spreads (HY_OAS) z-score is -0.731127 (1), reflecting tight credit conditions.

- The inverted 10-year minus 2-year Treasury yield spread (T10Y2Y) z-score is -0.645721 (1), pointing to a less inverted or steeper yield curve.

- All three components consistently signal low or neutral financial stress, maintaining the overall Neutral regime.

- Conditional Invalidation: The signal would reverse to High_Stress if the composite z-score rises above 0.75 (1), particularly driven by widening high-yield spreads or a significant increase in the STLFSI4.

Scenario Balance:

- Base Case dominant: Continued Neutral financial stress, supported by stable to improving credit conditions and a normalized yield curve.

- Upside secondary: A transition to Low_Stress, should HY_OAS and STLFSI4 z-scores decline further, indicating ample liquidity.

- Downside residual: A shift to High_Stress, triggered by a material widening of credit spreads or a sharp increase in systemic stress indicators.

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months), reflecting the monthly frequency of inputs and the rolling window robust standardization (1).

- Aggregation Weight Hint: Medium, due to its consistent assessment of financial conditions, though acknowledging methodological overlaps (1).

Macro Relevance:

- This signal primarily informs on liquidity and risk sentiment (1), reflecting the prevailing credit conditions.

- It indicates a mid-cycle or stable phase where financial stress is not a primary concern.

- Typically interacts with other macro signals by confirming or contradicting assessments of credit availability, investment climate, and overall economic stability.

Data & References:

- St. Louis Fed Financial Stress Index (STLFSI4) as of 2026-01-31 (1).

- ICE BofA U.S. High-Yield Option-Adjusted Spread (HY_OAS) as of 2026-01-31 (1).

- 10-Year minus 2-Year Treasury Yield Spread (T10Y2Y) as of 2026-01-31 (1).

- Additional public datasets that would improve depth or reliability include the Federal Reserve's Senior Loan Officer Opinion Survey (SLOOS) and broader market volatility indices.

Financial Stress Composite Chart

Composite of STLFSI, HY spreads, and yield-curve inversion.