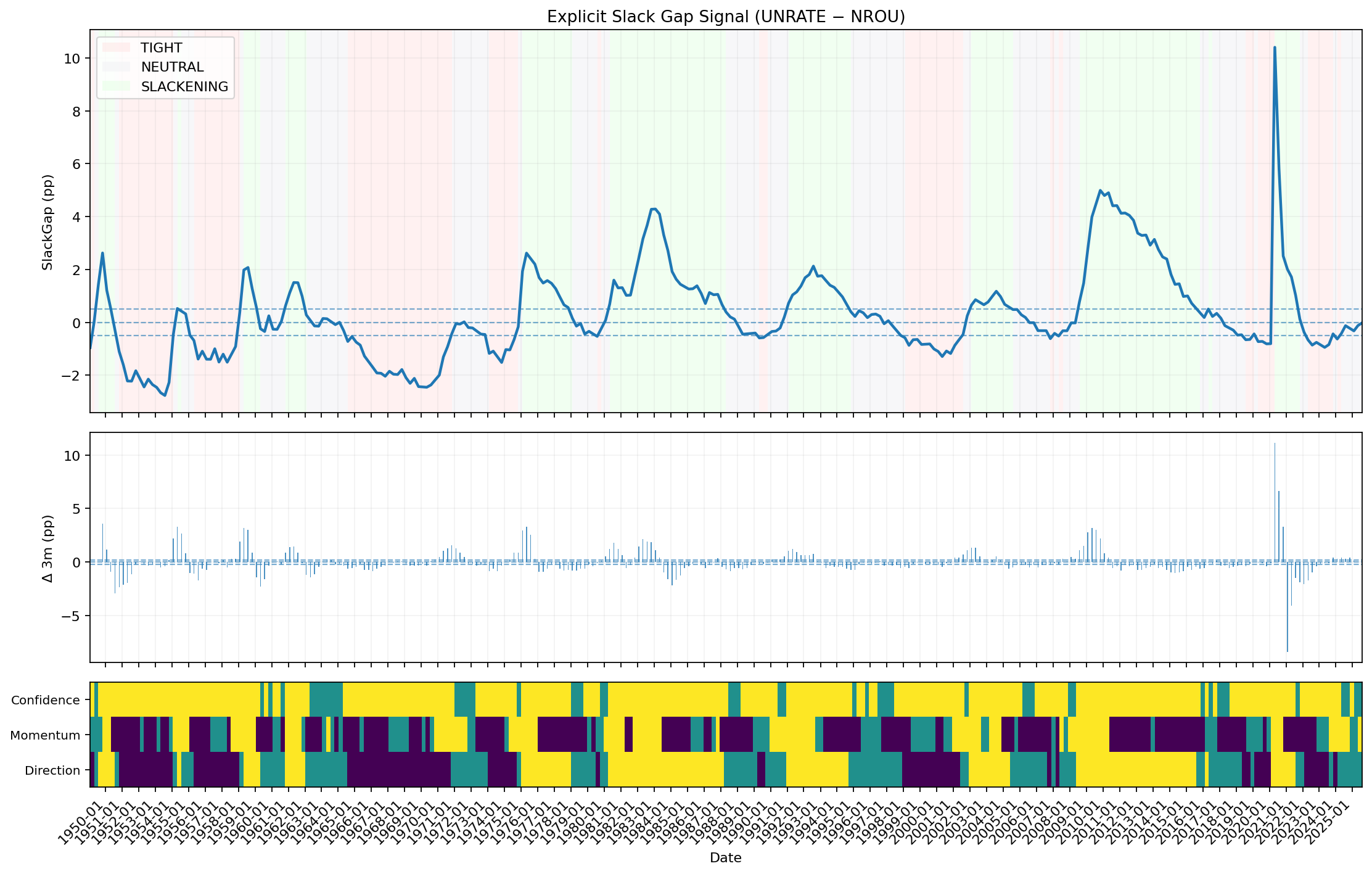

Explicit Slack Gap Signal

Explicit labour market slack: UNRATE minus NROU.

Gemini Summary

Signal Summary:

- The Explicit Slack Gap signal indicates a Neutral labor market slack regime as of July 31, 2025 (1). The unemployment rate is nearly aligned with the natural rate, showing a minor negative gap of -0.015608 percentage points (1). Momentum is currently widening, suggesting a slight trend towards more slack.

- Conviction Band: Medium | Interpretation Confidence: Medium | Internal Conflict Flag: No.

Key Dynamics:

- The neutral state is driven by the unemployment rate (UNRATE) at 4.3% closely tracking the natural rate of unemployment (NROU) at 4.315608% (1). The slack gap of -0.015608 pp falls within the neutral zone (between -0.50 pp and +0.50 pp) (1).

- However, the 3-month change in the slack gap is +0.206065 pp, indicating "Widening" momentum towards more slack (1). Confidence is Medium due to the gap being in the "near-neutral zone" (1).

- Conditional Invalidation: A material revision to the NROU estimate that moves the slack gap outside the ±0.25 pp near-neutral zone, as highlighted by NAIRU proxy uncertainty (1).

Scenario Balance:

- Base Case dominant: Neutral slack conditions persist, as the unemployment gap remains near zero despite recent widening momentum.

- Downside secondary: A continued widening of the slack gap beyond +0.50 pp, potentially driven by higher UNRATE, would shift the regime to Slackening.

- Upside residual: A reversal of the current widening momentum, pushing the slack gap below -0.50 pp, would indicate a return to Tight labor market conditions.

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months). This signal captures monthly labor market dynamics and 3-month momentum shifts, relevant for medium-term policy analysis (1).

- Aggregation Weight Hint: Medium. The signal provides a core input for labor market slack, but its current neutral state and medium confidence suggest balancing with other indicators.

Macro Relevance:

- This signal primarily informs the **slack** dimension of the macro economy. It indicates a **mid-cycle** position where the labor market is no longer tightening rapidly.

- It typically interacts with **inflation signals** (as slack influences wage and price pressures) and **monetary policy expectations** (as the Federal Reserve targets maximum employment) (1).

Data & References:

- UNRATE: Civilian Unemployment Rate (BLS-origin via FRED), 4.3% as of 2025-07-31 (1).

- NROU: Natural Rate of Unemployment (CBO estimate via FRED), 4.315608% as of 2025-07-31 (1).

- The `SlackGap_pp` of -0.015608 and `SlackGap_change_3m_pp` of +0.206065 are most influential for the current state.

- 1–2 additional public datasets that would improve depth or reliability: U-6 Underemployment Rate (2) for broader labor underutilization, and Labor Force Participation Rate (3) for labor supply dynamics.

Explicit Slack Gap Signal Chart

Explicit labour market slack: UNRATE minus NROU.