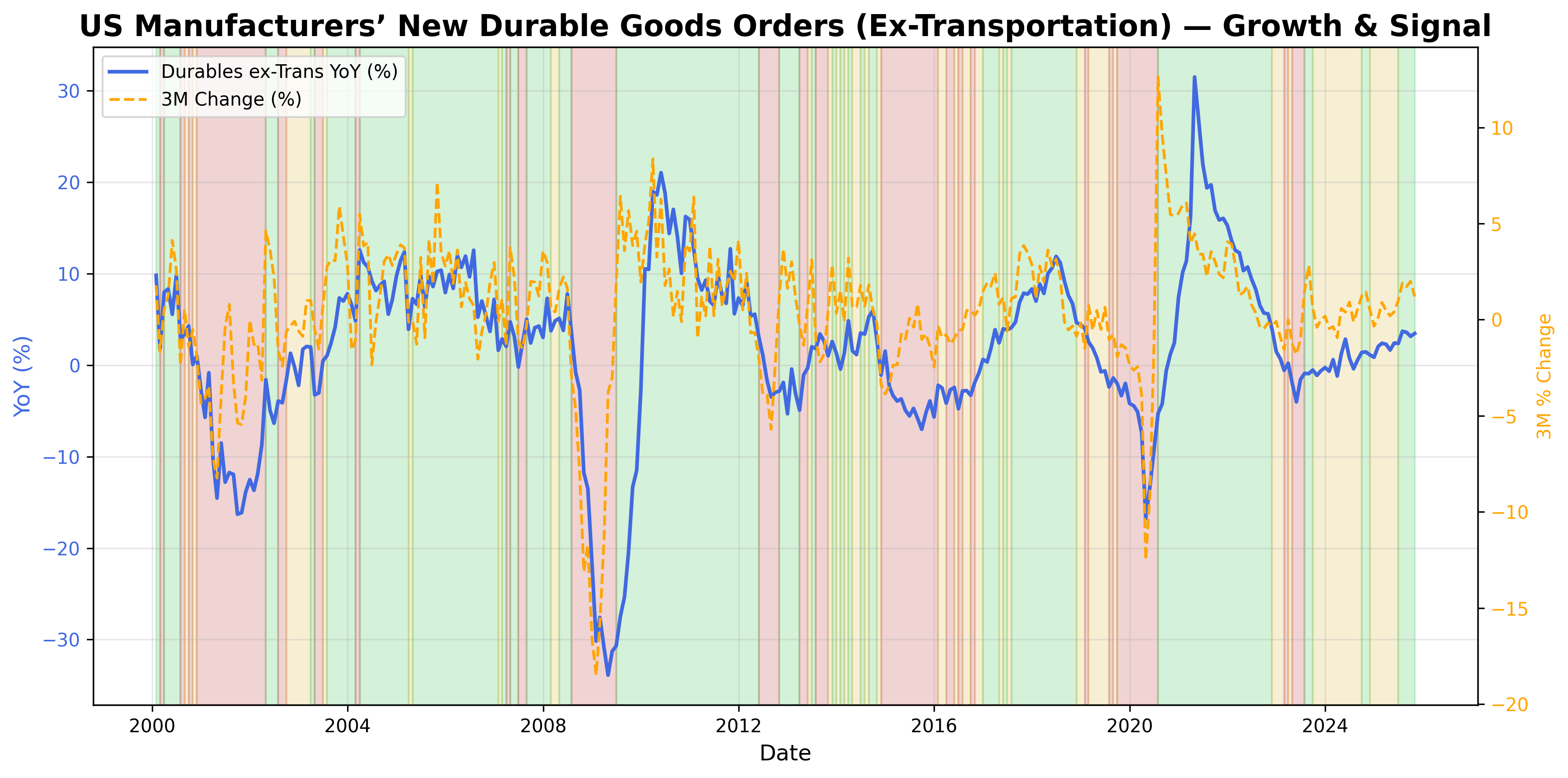

Durable Goods ex-Transportation Signal

Core durable goods demand excluding transportation volatility.

Gemini Summary

Signal Summary:

- The Durable Goods ex-Transportation signal indicates a Bullish regime for core U.S. manufacturing orders as of 2025-10-31. This reflects an expansion in underlying demand (1).

- Conviction Band: High | Interpretation Confidence: High Confidence | Internal Conflict Flag: No.

Key Dynamics:

- The 3-month percentage change in durable goods ex-transportation orders is +1.20% as of 2025-10-31, exceeding the +1% bullish threshold and driving the signal classification (1).

- Year-over-year growth stands at +3.46% on the same date, contributing to the overall positive momentum (1).

- Conditional Invalidation: A reversal where the 3-month percentage change falls below +1% would move the signal back to Neutral.

Scenario Balance:

- Base Case dominant: Core manufacturing orders maintain expansionary momentum driven by near-term growth.

- Upside secondary: Sustained year-over-year growth exceeding +5% would reinforce the bullish outlook (1).

- Downside residual: A decline in 3-month momentum below -1% or year-over-year growth below -3% would signal contraction (1).

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months). The signal relies on 3-month and 12-month growth rates, capturing medium-term trends (1).

- Aggregation Weight Hint: High. It is a fundamental indicator for assessing core manufacturing sector health.

Macro Relevance:

- Macro dimension informed: Demand (specifically industrial and capital goods demand) (1).

- Cycle position: Suggests mid-cycle expansion or re-acceleration in the industrial sector.

- Typical interaction with other macro signals: Often correlates with broader economic growth indicators, commodity demand, and corporate earnings expectations.

Data & References:

- FRED ADXTNO (Manufacturers’ New Orders: Durable Goods Excluding Transportation), latest observation 2025-10-31 (1).

- The 3-month percentage change (+1.20%) and year-over-year percentage change (+3.46%) are most influential for the current state.

- Additional public datasets: ISM Manufacturing PMI new orders sub-index, Capex Intent Signal (2).

Durable Goods ex-Transportation Chart

Durable goods orders excluding transportation equipment.