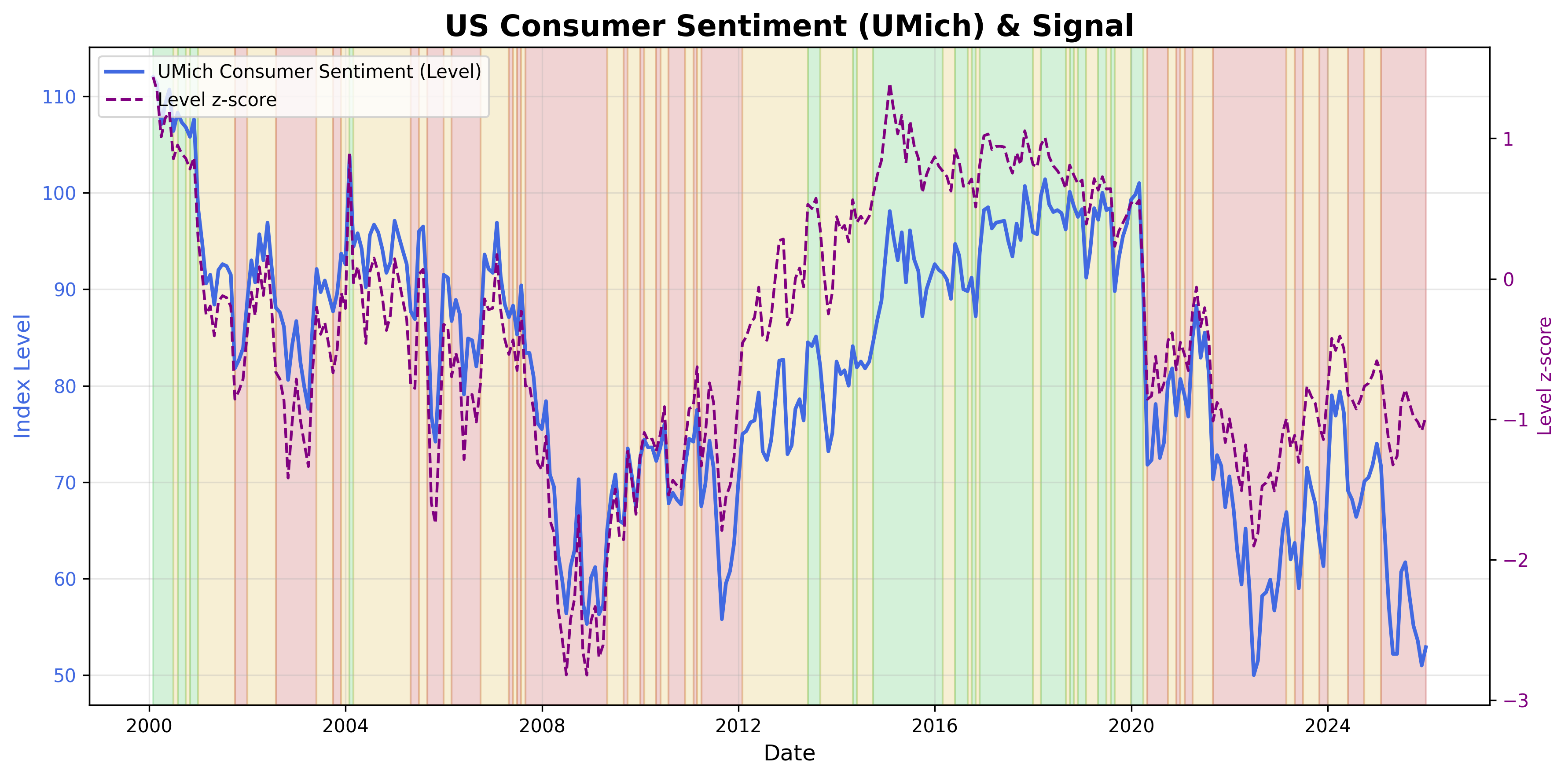

University of Michigan Consumer Sentiment Signal

Consumer confidence and expectations as a forward demand indicator.

Gemini Summary

Signal Summary:

- U.S. consumer sentiment is currently in a Bearish regime, with the UMCSENT index at 52.9 as of 2025-12-31 (1). This signifies a contraction in consumer optimism.

- Conviction Band: High, Interpretation Confidence: High Confidence, Internal Conflict Flag: No.

Key Dynamics:

- The primary driver is the robust z-score of the sentiment level at -0.98, which is below the -0.5 threshold for Bearish conditions (1).

- Momentum is strongly negative, with year-over-year sentiment declining by 28.51% and 3-month momentum down by 3.99% (1).

- The signal shows clear, consistent deterioration across its level and momentum components.

- Conditional Invalidation: A rebound in the sentiment's level z-score above -0.5 or a sustained positive shift in both YoY and 3-month momentum would invalidate this Bearish interpretation (1).

Scenario Balance:

- Base Case dominant: Continued weak consumer sentiment due to persistent low absolute levels and negative momentum (1).

- Upside secondary: A notable and sustained improvement in short-term (3-month) sentiment momentum.

- Downside residual: Further erosion in the sentiment level and acceleration of negative momentum.

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months). Rationale: The signal uses monthly data, including 3-month and year-over-year changes, suitable for capturing medium-term cyclical shifts in demand (1).

- Aggregation Weight Hint: High. Justification: As a core demand indicator, consumer sentiment holds significant weight in broader macro composites (1).

Macro Relevance:

- This signal primarily informs the macro dimensions of demand and sentiment (1).

- Its current state suggests a late-cycle or potentially contracting phase for household consumption.

- It typically interacts with labor market (2), inflation (3), and credit conditions (4) signals to form a comprehensive macro regime view (1).

Data & References:

- University of Michigan Consumer Sentiment (UMCSENT) from FRED, latest observation 2025-12-31 (1).

- The UMCSENT level (52.9), its robust Level_z (-0.980061), YoY_pct (-28.51%), and 3M_pct (-3.99%) for 2025-12-31 are most influential (1).

- Additional public datasets that would improve depth or reliability include the Employment Composition Signal (5) and Wage Growth and Inflation Signal (6).

Consumer Sentiment Chart

University of Michigan Consumer Sentiment Index.