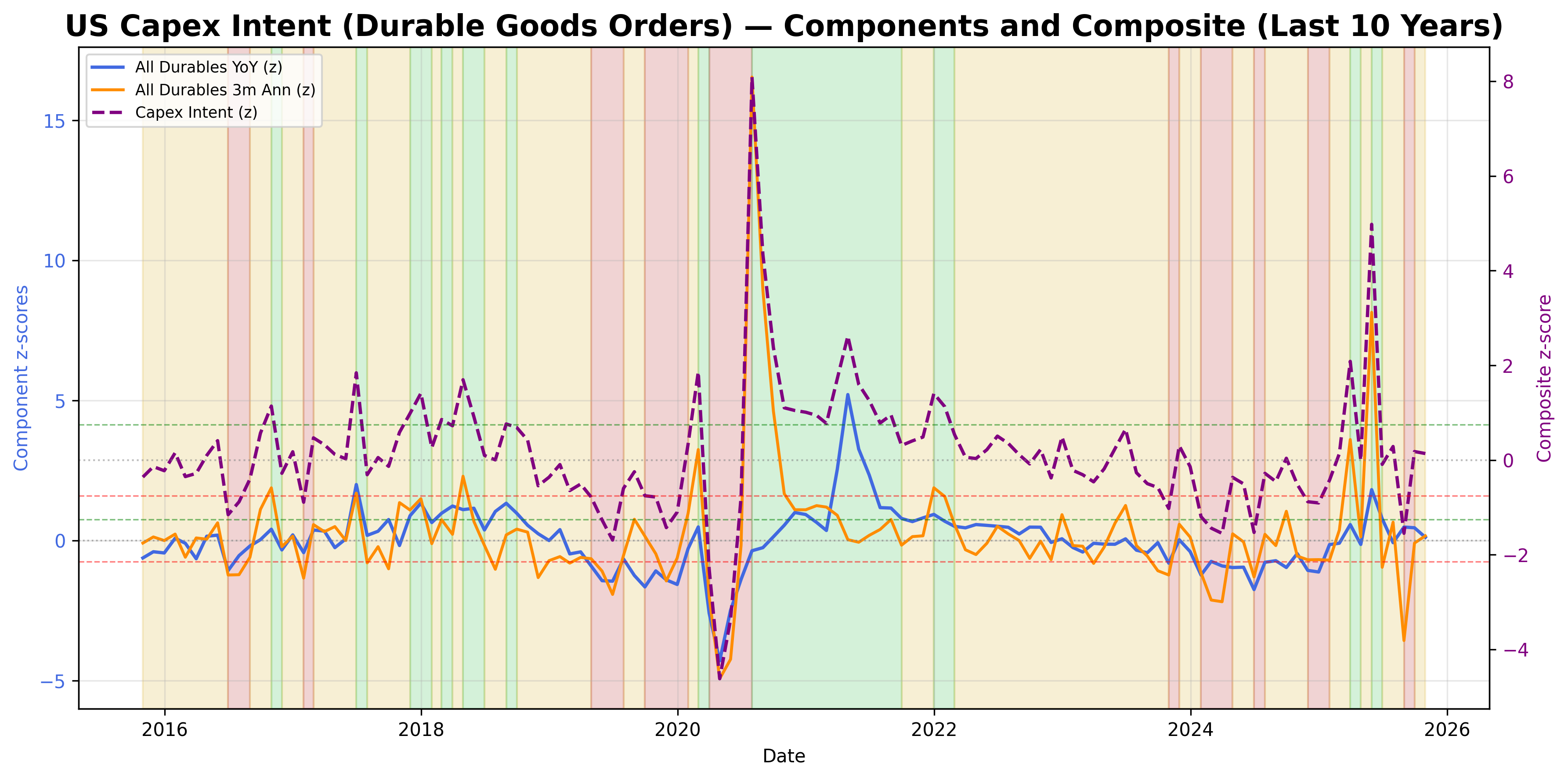

Capex Intent Signal

Capex intent from durable goods order momentum.

Gemini Summary

Signal Summary:

- The Capex Intent signal is currently Neutral, indicating stable business investment momentum as of October 2025 (1). The composite score is 0.137673, well within the neutral band (1).

- Conviction Band: Medium | Interpretation Confidence: High Confidence | Internal Conflict Flag: No.

Key Dynamics:

- The neutral state is driven by year-over-year growth (z-score 0.111786) and 3-month annualized growth (z-score 0.163560) of durable goods orders, both near zero (1).

- Momentum is stable, reflecting a baseline investment pace (1).

- Conditional Invalidation: A composite score below -0.75 would signal a contraction in capex intent (1).

Scenario Balance:

- Base Case dominant: Continued stable capex momentum, with the signal remaining Neutral.

- Upside secondary: Stronger durable goods orders could push the composite above 0.75, signaling expansion (1).

- Downside residual: A notable deceleration in durable goods orders could lead to a composite below -0.75, indicating contraction (1).

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months). The signal aims to detect inflection points in investment cycles using monthly data (1).

- Aggregation Weight Hint: Medium. This signal offers a direct read on business investment trends, making it a valuable input for broader growth composites.

Macro Relevance:

- Macro dimension informed: Demand (business investment/capex) and growth.

- Cycle position: Mid-cycle, consistent with stable investment trends.

- Typical interaction with other macro signals: Correlates with industrial production, employment, and overall economic activity, often leading broader growth measures.

Data & References:

- Manufacturers’ New Orders: Durable Goods (DGORDER) from FRED, latest observation 2025-10-31 (1).

- The Capex_Intent composite score (0.137673), Z_ALL_YoY (0.111786), and Z_ALL_3mAnn (0.163560) were most influential (1).

- Additional public datasets that would improve depth or reliability include Manufacturers’ New Orders: Durable Goods Ex-Transportation (ADXTNO) and New Orders for Nondefense Capital Goods Excluding Aircraft.

Capex Intent Chart

Durable goods orders as a proxy for business investment intent.