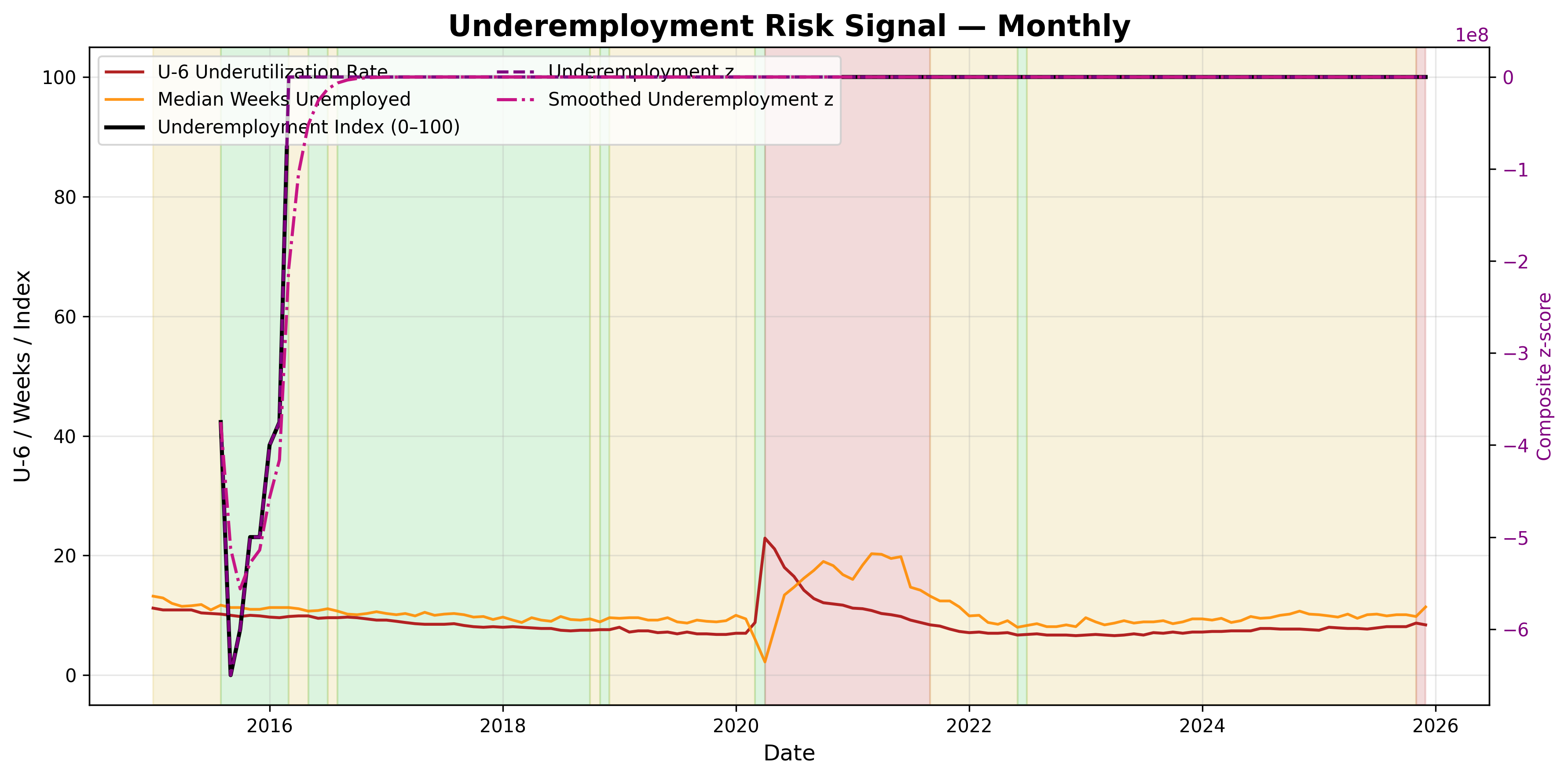

Underemployment Risk Signal

Underemployment risk signal: assessing slack and under-utilisation in the labour market.

Gemini Summary

Signal Summary:

- The Underemployment Risk signal (1) has transitioned to a HOT (stress ↑) regime as of 2025-12-01 (1). This indicates rising broad labour market slack and longer job-finding durations. Conviction Band: High, Interpretation Confidence: High Confidence, Internal Conflict Flag: No.

Key Dynamics:

- The shift to HOT is driven by the composite z-score increasing to 1.25, surpassing the +0.75 threshold (1). Both the U-6 underutilization rate (8.4%) and median weeks unemployed (11.4 weeks) contributed, with their z-scores at 0.99 and 1.51, respectively (1). Both components show positive 3-month momentum.

- Conditional Invalidation: The signal would weaken or reverse if the composite z-score consistently falls below +0.75, moving out of the HOT regime (1).

Scenario Balance:

- Base Case dominant: Underemployment stress persists or slightly increases, supported by current positive momentum in slack indicators.

- Upside secondary: Labour market resilience improves, and median weeks unemployed begin a sustained decline.

- Downside residual: U-6 underutilization rises further, and job-finding frictions prolong significantly.

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months), reflecting the use of monthly data and 3-month momentum for assessing medium-term labour market trends (1).

- Aggregation Weight Hint: High, due to its strong and coherent indication of rising labour market slack, which is a critical macro input.

Macro Relevance:

- This signal primarily informs the slack dimension of the US labour market (1). A HOT regime suggests a mid-to-late cycle slowdown, with cooling demand and softening employment conditions (1). It typically interacts with inflation (potential downward pressure) and consumption (weakening).

Data & References:

- U-6: Alternative measure of labor underutilization (LNS13327709), latest 8.4% as of 2025-12-01 (1).

- Median weeks unemployed (LNS13008276), latest 11.4 weeks as of 2025-12-01 (1).

- These two components and their 3-month momentum were most influential in the current state (1).

- Additional public datasets: Job Openings and Labor Turnover Survey (JOLTS) data on quits and hires, and initial jobless claims, could enhance depth.

Underemployment Risk Signal Chart

Underemployment risk: diagnostic of slack in the labour market.