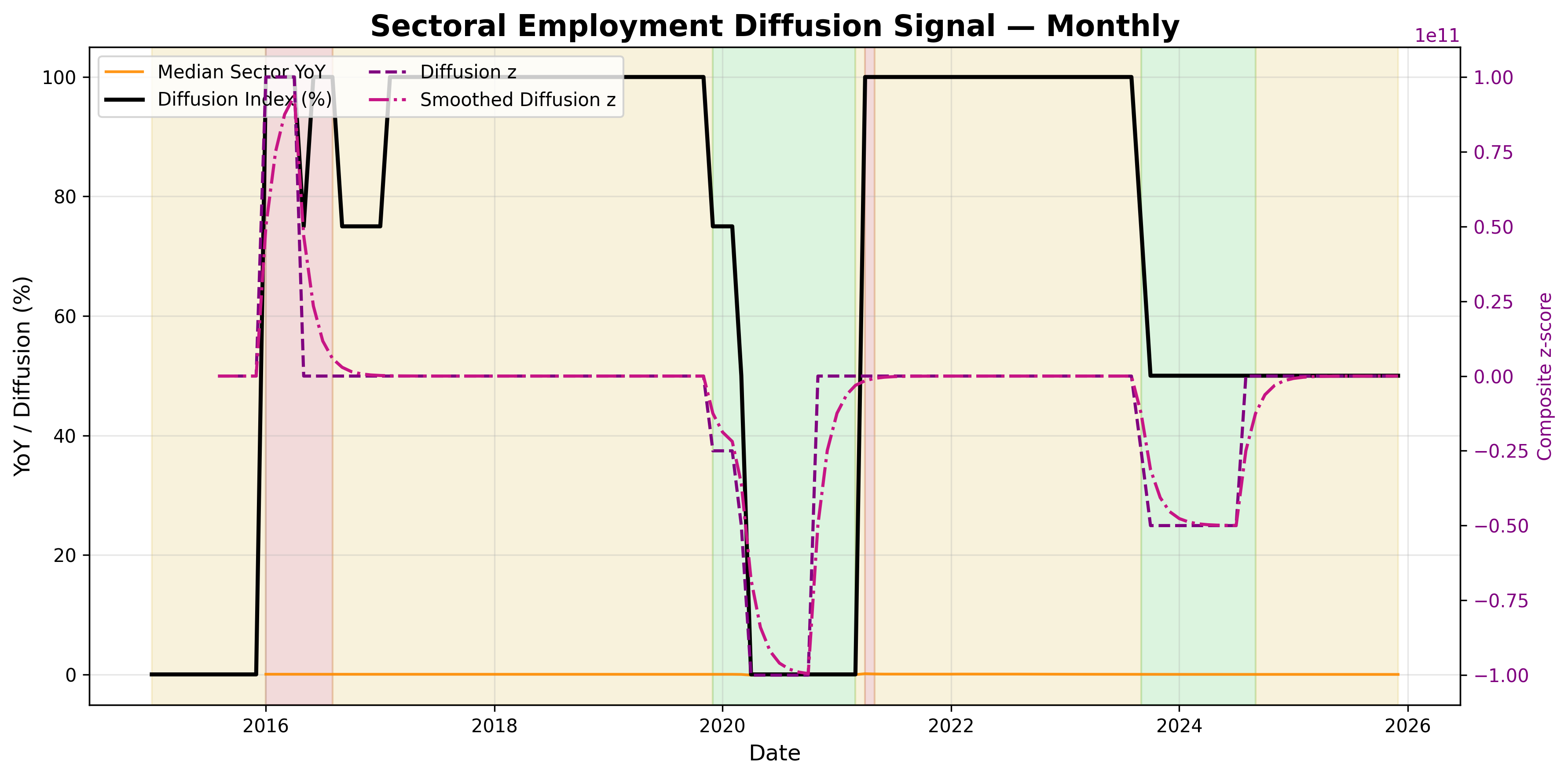

Sectoral Employment Diffusion Signal

Sectoral employment diffusion: assessing breadth and dispersion in labour market conditions.

Gemini Summary

Signal Summary:

- The Sectoral Employment Diffusion Signal (1) currently indicates a NEUTRAL regime for U.S. payroll growth breadth as of 2025-12-01.

- The diffusion index remains flat at 50%, signaling a stable state with an equal number of expanding and contracting sectors.

- This state is interpreted with Medium Conviction and High Confidence, with no internal conflicts observed.

Key Dynamics:

- The primary quantitative driver is the diffusion z-score, which is precisely 0.0, placing it within the defined NEUTRAL range of -0.75 to +0.75 (1).

- While overall diffusion is stable, median sector year-over-year growth is slightly negative (-0.001300), with negative 3-month momentum (-0.002580).

- Conditional Invalidation: A sustained move of the diffusion z-score above +0.75 (HOT) or below -0.75 (COOL) would invalidate this neutral interpretation.

Scenario Balance:

- Base case dominant: The prevailing NEUTRAL regime in sectoral employment diffusion is expected to continue, supported by the stable diffusion index and z-score.

- Upside secondary: Broad-based acceleration in employment growth across a majority of sectors, leading to a diffusion z-score above +0.75.

- Most plausible downside risk: A clear narrowing of employment breadth, with more sectors contracting than expanding, causing the diffusion z-score to fall below -0.75.

Time Horizon & Aggregation:

- This signal operates on a Cyclical (months) time horizon, as it tracks year-over-year growth and 3-month momentum in employment.

- It warrants a Medium Aggregation Weight hint due to its clear, confident reading and its importance as a breadth indicator for the labor market.

Macro Relevance:

- This signal primarily informs the Slack and Demand dimensions of the macro economy.

- It helps identify the cycle position by indicating whether the labor market is in a broad expansion (Hot), narrow/weak (Cool), or stable (Neutral) phase (1).

- A stable or broadening diffusion typically interacts positively with broader growth and consumption signals, while a narrowing diffusion often foreshadows slowdowns (1).

Data & References:

- CES3000000001 (Manufacturing), CES2000000001 (Construction), CES6000000001 (Professional & Business Services), CES7000000001 (Leisure & Hospitality) employment levels and year-over-year growth, latest observation 2025-12-01.

- The `Diffusion_Index`, `Diffusion_z`, `Diffusion_Regime`, `Median_Sector_YoY`, and `Median_Sector_YoY_mom_3m` were most influential for the current state.

- Additional public datasets that would improve depth or reliability include the full BLS CES database for a broader diffusion index, and the Job Openings and Labor Turnover Survey (JOLTS) for labor demand insights.

Sectoral Employment Diffusion Chart

Sectoral employment diffusion across major industries.