| 197 |

2025-10-14 |

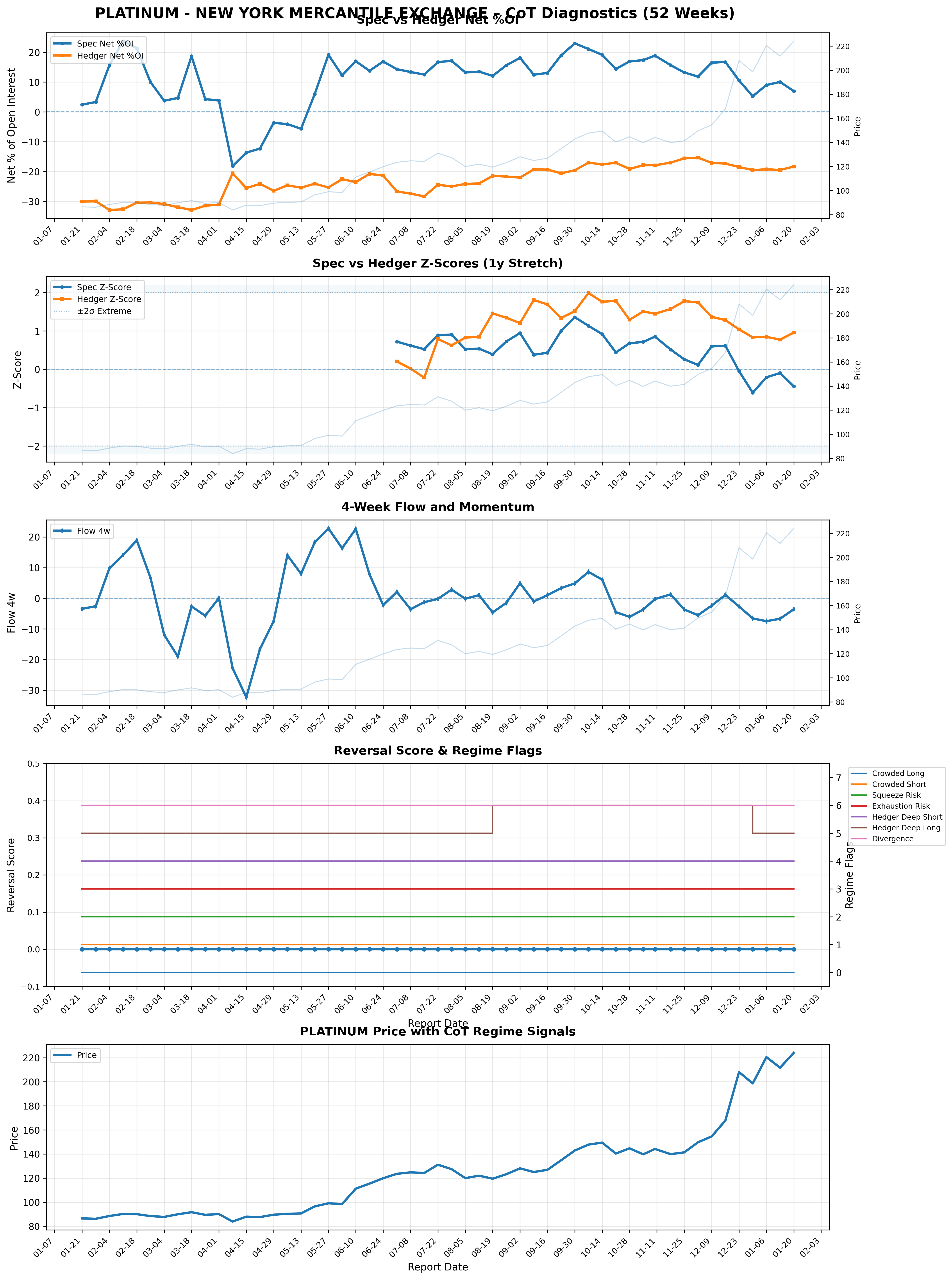

PLATINUM - NEW YORK MERCANTILE EXCHANGE |

19.120733 |

-17.594368 |

0.915772 |

1.757328 |

6.072442 |

Balanced |

1.526364 |

False |

False |

False |

None |

Long_Build |

6.072442 |

False |

False |

False |

False |

Hedgers_Deep_Long |

False |

False |

No_Clear_Reversal |

Balanced_Long_Bias |

0.841555 |

0 |

Normal |

076651 |

NYME |

1.0 |

76.0 |

Other |

Unknown |

Other / Unknown |

89.095017 |

16949 |

-15596 |

False |

False |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

True |

0 |

149.449997 |

| 198 |

2025-10-21 |

PLATINUM - NEW YORK MERCANTILE EXCHANGE |

14.404405 |

-17.051767 |

0.437679 |

1.782187 |

-4.532499 |

Balanced |

-2.647362 |

False |

False |

False |

None |

Long_Reduction |

-4.532499 |

False |

False |

False |

False |

Hedgers_Deep_Long |

False |

False |

No_Clear_Reversal |

Balanced_Short_Bias |

1.344508 |

0 |

Normal |

076651 |

NYME |

1.0 |

76.0 |

Other |

Unknown |

Other / Unknown |

77.817928 |

11720 |

-13874 |

False |

False |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

True |

0 |

140.360001 |

| 199 |

2025-10-28 |

PLATINUM - NEW YORK MERCANTILE EXCHANGE |

16.888872 |

-19.133911 |

0.676835 |

1.290110 |

-6.069488 |

Balanced |

-2.245039 |

False |

False |

False |

None |

Long_Reduction |

-6.069488 |

False |

False |

False |

False |

Hedgers_Deep_Long |

False |

False |

No_Clear_Reversal |

Balanced_Short_Bias |

0.613275 |

0 |

Normal |

076651 |

NYME |

1.0 |

76.0 |

Other |

Unknown |

Other / Unknown |

83.758472 |

13225 |

-14983 |

False |

False |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

True |

0 |

144.679993 |

| 200 |

2025-11-04 |

PLATINUM - NEW YORK MERCANTILE EXCHANGE |

17.358495 |

-17.856916 |

0.712050 |

1.504739 |

-3.706358 |

Balanced |

-0.498421 |

False |

False |

False |

None |

Long_Reduction |

-3.706358 |

False |

False |

False |

False |

Hedgers_Deep_Long |

False |

False |

No_Clear_Reversal |

Balanced_Short_Bias |

0.792689 |

0 |

Normal |

076651 |

NYME |

1.0 |

76.0 |

Other |

Unknown |

Other / Unknown |

84.881377 |

13687 |

-14080 |

False |

False |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

True |

0 |

139.710007 |

| 201 |

2025-11-10 |

PLATINUM - NEW YORK MERCANTILE EXCHANGE |

18.862748 |

-17.881929 |

0.849074 |

1.446997 |

-0.257985 |

Balanced |

0.980818 |

False |

False |

False |

None |

Long_Reduction |

-0.257985 |

False |

False |

False |

False |

Hedgers_Deep_Long |

False |

False |

No_Clear_Reversal |

Balanced_Short_Bias |

0.597923 |

0 |

Normal |

076651 |

NYME |

1.0 |

76.0 |

Other |

Unknown |

Other / Unknown |

88.478155 |

15193 |

-14403 |

False |

False |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

True |

0 |

144.190002 |

| 202 |

2025-11-18 |

PLATINUM - NEW YORK MERCANTILE EXCHANGE |

15.656772 |

-16.999568 |

0.513237 |

1.568281 |

1.252367 |

Balanced |

-1.342797 |

False |

False |

False |

None |

Long_Build |

1.252367 |

False |

False |

False |

False |

Hedgers_Deep_Long |

False |

False |

No_Clear_Reversal |

Balanced_Long_Bias |

1.055044 |

0 |

Normal |

076651 |

NYME |

1.0 |

76.0 |

Other |

Unknown |

Other / Unknown |

80.812429 |

13059 |

-14179 |

False |

False |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

True |

0 |

139.869995 |

| 203 |

2025-11-25 |

PLATINUM - NEW YORK MERCANTILE EXCHANGE |

13.211674 |

-15.585114 |

0.257594 |

1.774063 |

-3.677198 |

Balanced |

-2.373440 |

False |

False |

False |

None |

Long_Reduction |

-3.677198 |

False |

False |

False |

False |

Hedgers_Deep_Long |

False |

False |

No_Clear_Reversal |

Balanced_Short_Bias |

1.516469 |

0 |

Normal |

076651 |

NYME |

1.0 |

76.0 |

Other |

Unknown |

Other / Unknown |

74.966019 |

11055 |

-13041 |

False |

False |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

True |

0 |

141.350006 |

| 204 |

2025-12-02 |

PLATINUM - NEW YORK MERCANTILE EXCHANGE |

11.825369 |

-15.348110 |

0.111695 |

1.743108 |

-5.533127 |

Balanced |

-3.522742 |

False |

False |

False |

None |

Long_Reduction |

-5.533127 |

False |

False |

False |

False |

Hedgers_Deep_Long |

False |

False |

No_Clear_Reversal |

Balanced_Short_Bias |

1.631413 |

0 |

Normal |

076651 |

NYME |

1.0 |

76.0 |

Other |

Unknown |

Other / Unknown |

71.651261 |

10366 |

-13454 |

False |

False |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

True |

0 |

149.699997 |

| 205 |

2025-12-09 |

PLATINUM - NEW YORK MERCANTILE EXCHANGE |

16.483687 |

-17.063615 |

0.594621 |

1.366320 |

-2.379061 |

Balanced |

-0.579928 |

False |

False |

False |

None |

Long_Reduction |

-2.379061 |

False |

False |

False |

False |

Hedgers_Deep_Long |

False |

False |

No_Clear_Reversal |

Balanced_Short_Bias |

0.771699 |

0 |

Normal |

076651 |

NYME |

1.0 |

76.0 |

Other |

Unknown |

Other / Unknown |

82.789644 |

14894 |

-15418 |

False |

False |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

True |

0 |

154.589996 |

| 206 |

2025-12-16 |

PLATINUM - NEW YORK MERCANTILE EXCHANGE |

16.731037 |

-17.330450 |

0.612286 |

1.279568 |

1.074265 |

Balanced |

-0.599413 |

False |

False |

False |

None |

Long_Build |

1.074265 |

False |

False |

False |

False |

Hedgers_Deep_Long |

False |

False |

No_Clear_Reversal |

Balanced_Long_Bias |

0.667283 |

0 |

Normal |

076651 |

NYME |

1.0 |

76.0 |

Other |

Unknown |

Other / Unknown |

83.381076 |

16245 |

-16827 |

False |

False |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

True |

0 |

167.770004 |

| 207 |

2025-12-23 |

PLATINUM - NEW YORK MERCANTILE EXCHANGE |

10.534706 |

-18.467840 |

-0.049218 |

1.039231 |

-2.676968 |

Hedgers |

-7.933134 |

False |

False |

False |

None |

Long_Reduction |

-2.676968 |

False |

False |

False |

False |

Hedgers_Deep_Long |

False |

False |

No_Clear_Reversal |

Hedger_Adding_Short |

1.088449 |

0 |

Normal |

076651 |

NYME |

1.0 |

76.0 |

Other |

Unknown |

Other / Unknown |

68.565191 |

9516 |

-16682 |

False |

False |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

True |

0 |

208.039993 |

| 208 |

2025-12-30 |

PLATINUM - NEW YORK MERCANTILE EXCHANGE |

5.234439 |

-19.486697 |

-0.612831 |

0.829911 |

-6.590930 |

Hedgers |

-14.252257 |

False |

False |

False |

None |

Long_Reduction |

-6.590930 |

False |

False |

False |

False |

Hedgers_Neutral |

False |

False |

No_Clear_Reversal |

Hedger_Adding_Short |

1.442741 |

0 |

Normal |

076651 |

NYME |

1.0 |

76.0 |

Other |

Unknown |

Other / Unknown |

55.891861 |

4336 |

-16142 |

False |

False |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

False |

0 |

198.610001 |

| 209 |

2026-01-06 |

PLATINUM - NEW YORK MERCANTILE EXCHANGE |

9.003163 |

-19.247312 |

-0.210744 |

0.843099 |

-7.480524 |

Hedgers |

-10.244149 |

False |

False |

False |

None |

Long_Reduction |

-7.480524 |

False |

False |

False |

False |

Hedgers_Neutral |

False |

False |

No_Clear_Reversal |

Hedger_Adding_Short |

1.053843 |

0 |

Normal |

076651 |

NYME |

1.0 |

76.0 |

Other |

Unknown |

Other / Unknown |

64.903157 |

7117 |

-15215 |

False |

False |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

False |

0 |

220.449997 |

| 210 |

2026-01-13 |

PLATINUM - NEW YORK MERCANTILE EXCHANGE |

10.039956 |

-19.445473 |

-0.098929 |

0.772919 |

-6.691081 |

Hedgers |

-9.405517 |

False |

False |

False |

None |

Long_Reduction |

-6.691081 |

False |

False |

False |

False |

Hedgers_Neutral |

False |

False |

No_Clear_Reversal |

Hedger_Adding_Short |

0.871849 |

0 |

Normal |

076651 |

NYME |

1.0 |

76.0 |

Other |

Unknown |

Other / Unknown |

67.382206 |

7865 |

-15233 |

False |

False |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

False |

0 |

211.649994 |

| 211 |

2026-01-20 |

PLATINUM - NEW YORK MERCANTILE EXCHANGE |

6.958701 |

-18.320698 |

-0.446622 |

0.954880 |

-3.576005 |

Hedgers |

-11.361997 |

False |

False |

False |

None |

Long_Reduction |

-3.576005 |

False |

False |

False |

False |

Hedgers_Neutral |

False |

False |

No_Clear_Reversal |

Hedger_Adding_Short |

1.401502 |

0 |

Normal |

076651 |

NYME |

1.0 |

76.0 |

Other |

Unknown |

Other / Unknown |

60.014698 |

5498 |

-14475 |

False |

False |

disaggregated |

NaN |

NaN |

NaN |

NaN |

False |

False |

0 |

224.070007 |