Credit Conditions Signal

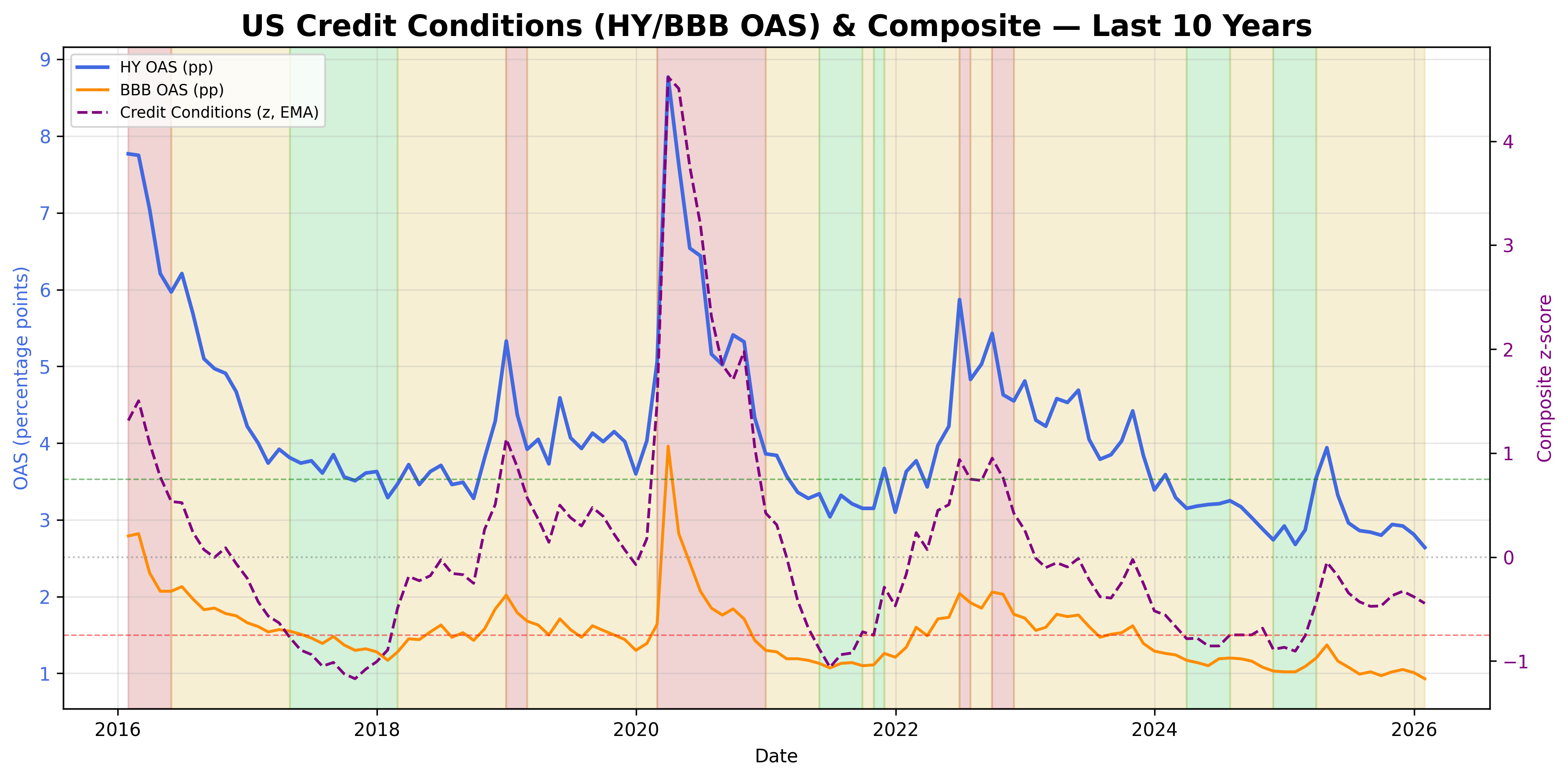

Credit conditions composite: HY/BBB spreads and equity volatility.

Gemini Summary

Signal Summary:

- The Credit Conditions signal is currently in a Neutral regime as of 2026-01-31, suggesting benign funding conditions (1). The composite value is -0.444807, comfortably within the neutral band (-0.75 to 0.75) (1).

- Conviction Band: Medium | Interpretation Confidence: High Confidence | Internal Conflict Flag: No.

Key Dynamics:

- The latest values show HY Option-Adjusted Spread (OAS) at 2.64, BBB OAS at 0.93, and VIX at 15.64 as of 2026-01-31.

- The robust z-scores for HY OAS (-0.719033) and BBB OAS (-0.674491) indicate an easing trend in corporate credit spreads, but the VIX z-score (-0.130080) is closer to neutral, showing less equity-implied stress.

- The composite reflects a stabilisation within the Neutral regime, not indicating a clear direction towards tightening or further easing.

- Conditional Invalidation: A sustained increase in the `Credit_Conditions` composite above +0.75 would reverse the interpretation to a Tightening regime (1).

Scenario Balance:

- Base case dominant: Credit conditions remain Neutral, supported by the composite's current positioning within the band.

- Upside secondary: Further narrowing of corporate spreads and/or a notable drop in VIX could drive the composite into an Easing regime.

- Downside residual: A significant widening of corporate spreads and/or a sharp rise in VIX could push conditions into a Tightening regime.

Time Horizon & Aggregation:

- Time Horizon: Cyclical (months), reflecting the use of robust z-scores over 36-month windows and a 3-month exponential moving average (1).

- Aggregation Weight Hint: High, given the signal's robust methodology and its clear, well-defined regime classification.

Macro Relevance:

- Macro dimension informed: This signal directly assesses US Credit Conditions (2), providing insights into financial stress, risk appetite, and funding conditions (1).

- Cycle position: A neutral credit environment is typical of a mid-cycle expansion.

- Typical interaction with other macro signals: Often correlates inversely with growth signals and positively with financial stress indicators. It provides a key input for liquidity and monetary conditions assessments (3).

Data & References:

- ICE BofA US High Yield Option-Adjusted Spread (HY_OAS), latest 2.64 as of 2026-01-31 (1).

- ICE BofA US BBB Option-Adjusted Spread (BBB_OAS), latest 0.93 as of 2026-01-31 (1).

- CBOE Volatility Index (VIXCLS), latest 15.64 as of 2026-01-31 (1).

- Additional public datasets: TED spread, commercial paper spreads would enhance depth by offering interbank and short-term corporate funding perspectives.

Credit Conditions Chart

Credit spreads and volatility combined into a single financial conditions index.